Berry Global (BERY) Q4 Earnings Beat Estimates, Revenues Miss

Berry Global Group, Inc. BERY reported fourth-quarter fiscal 2023 (ended September 2023) adjusted earnings (excluding 73 cents from non-recurring items) of $2.28 per share, which beat the Zacks Consensus Estimate of $2.13. The bottom line increased 4.1% year over year.

Net sales of $3,087 million missed the Zacks Consensus Estimate of $3,171 million. The top line decreased 9.8% year over year due to a 3% dip in volumes and lower selling prices, which declined $320 million due to the pass-through of lower resin costs. Reduced demand in the consumer and industrial markets led to the volume decline.

In the fiscal fourth quarter, Berry Global’s cost of goods sold decreased 12.5% to $2,481 million. Selling, general and administrative expenses increased 16.2% year over year to $215 million. The company reported an operating EBITDA of $547 million, up 1% year over year. Adjusted operating income in the quarter increased 1.5% year over year to $335 million.

Segmental Discussion

Consumer Packaging - International sales amounted to $1,000 million (accounting for 32.4% of total sales), down 6% from the year-ago quarter’s figure. Our estimate for segmental revenues was $984.3 million. The decline in sales was due to lower selling prices and volumes as a result of weakness in the industrial and consumer markets in Europe. Operating income of $84 million decreased 14.3% year over year.

Consumer Packaging - North America’s sales totaled $798 million (accounting for 25.5% of total sales) in the segment, down 13% year over year due to a 2% decline in volumes. Our estimate for segmental revenues was $786.0 million. Operating income declined 8.7% year over year to $94 million.

Revenues from the Health, Hygiene & Specialties segment amounted to $630 million (accounting for 20.4% of total sales), down 17% year over year due to a 4% decrease in volumes as a result of lower demand in specialty markets, such as filtration and building and construction. Our estimate for segmental revenues was $667.1 million. Operating income of $36 million declined 18.2% year over year.

Revenues from the Engineered Materials segment decreased 16% year over year to $671 million (accounting for 21.7% of total revenues) due to a 5% decline in volumes as a result of inventory destocking, weakness in the European industrial markets and decreased selling prices. Operating income of $87 million decreased 4.4% year over year.

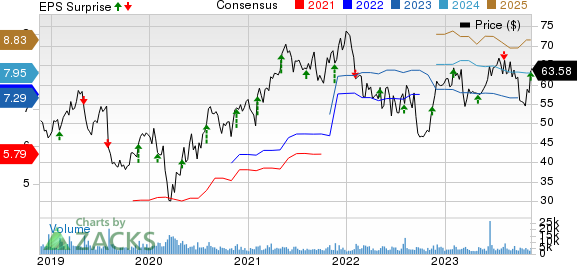

Berry Global Group, Inc. Price, Consensus and EPS Surprise

Berry Global Group, Inc. price-consensus-eps-surprise-chart | Berry Global Group, Inc. Quote

Balance Sheet and Cash Flow

At the end of the fourth quarter of fiscal 2023, Berry Global had cash and cash equivalents of $1,203 million compared with $1,410 million at the end of fiscal 2022. Current and long-term debt totaled $8,980 million compared with $9,255 million in the previous year.

At the end of the fiscal fourth quarter, Berry Global generated net cash of $1,615 million from operating activities compared with $1,563 million in the year-ago period. Capital expenditure totaled $689 million compared with $687 million in the prior-year quarter. Adjusted free cash flow at the end of the fiscal fourth quarter was $926 million compared with $876 million in the year-ago period.

In fiscal 2023, BERY repurchased 6.9 million shares for approximately $601 million. It also paid dividends worth $127 million in the same time frame.

Fiscal 2024 Guidance

Berry Global expects adjusted earnings to be in the range of $7.35-$7.85 per share in fiscal 2024. The Zacks Consensus Estimate for the same is pegged at $7.95.

BERY expects cash flow from operations to be in the band of $1.35-$1.45 billion in fiscal 2024. It anticipates free cash flow in the $800-$900 million range during the same time frame. The company remains committed to debt reduction along with returning capital to shareholders through share repurchases and dividends.

Zacks Rank & Stocks to Consider

Berry Global currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector have been discussed below.

Graco Inc. GGG presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GGG delivered a trailing four-quarter average earnings surprise of 7.2%. In the past 60 days, the consensus estimate for Graco’s 2023 earnings has increased 1.7%. The stock has risen 13.9% in the past year.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 13.9%.

The consensus estimate for AIT’s fiscal 2024 earnings has increased 3.7% in the past 60 days. Shares of Applied Industrial have risen 24.7% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 5%. The stock has risen 23.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report