Berry Global (BERY) Sets Net-Zero Emissions Target for 2050

Berry Global Group BERY recently announced its commitment to achieve net-zero emissions across its global operations and value chain by 2050. To this end, the company aims to reduce its total Scope 1, 2 and 3 emissions by more than 90% and neutralize the remaining 10% residual greenhouse gas (GHG) emissions by 2050. This is aligned with the Paris Agreement’s goal of limiting global warming to well-below 2°C.

In order to reduce GHG emissions, Berry Global will switch from virgin, fossil fuel-based plastic to using lighter weight, less carbon-intensive, circular materials, such as recycled plastics and bio-based plastics made from renewable resources (for example, used cooking oil).

Berry Global will work with customers to develop lower-carbon solutions and suppliers to provide lower-carbon materials and services. This will help in reducing value-chain emissions from purchased goods and services.

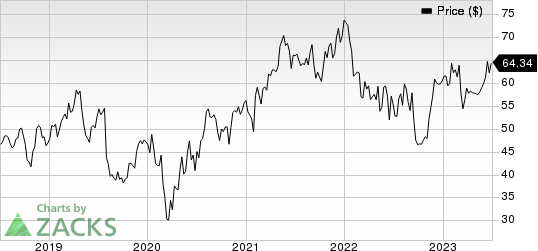

Berry Global Group, Inc. Price

Berry Global Group, Inc. price | Berry Global Group, Inc. Quote

BERY will focus on cleaner energy by increasing investment in renewable energy and decreasing the usage of fossil fuels. The company intends to electrify processes within operations that consume gas and fuel.

Compared to the 2019 baseline, Berry Global aims to reduce operational Scope 1 and 2 GHG emissions by 25% and absolute supply-chain Scope 3 GHG emissions by 25% by 2025. So far, BERY has reduced Scope 3 GHG emissions from its supply chain by 9% and Scope 1 and 2 GHG emissions by 21%.

Zacks Rank & Key Picks

Berry Global presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Ingersoll Rand IR presently sports a Zacks Rank #1 (Strong Buy). The company delivered a trailing four-quarter earnings surprise of 12.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingersoll Rand has an estimated earnings growth rate of 14.4% for the current year. Shares of the company have jumped 51% in a year.

Flowserve FLS presently flaunts a Zacks Rank #1. The company pulled off a trailing four-quarter earnings surprise of 2.5%, on average.

Flowserve has an estimated earnings growth rate of 64.5% for the current year. Shares of the company have gained 26.4% in a year.

Graco GGG currently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 7.9%, on average.

Graco has an estimated earnings growth rate of 16.4% for the current year. Shares of the company have rallied 43.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report