Berry Global Group Inc: A High-Performing Stock with Strong Growth and Profitability

Berry Global Group Inc (NYSE:BERY), a leading player in the Packaging & Containers industry, is currently trading at $66.18 with a market cap of $7.89 billion. The stock has seen a gain of 4.68% today and a 1.41% increase over the past four weeks. In this article, we will delve into the company's GF Score and its implications for potential investors.

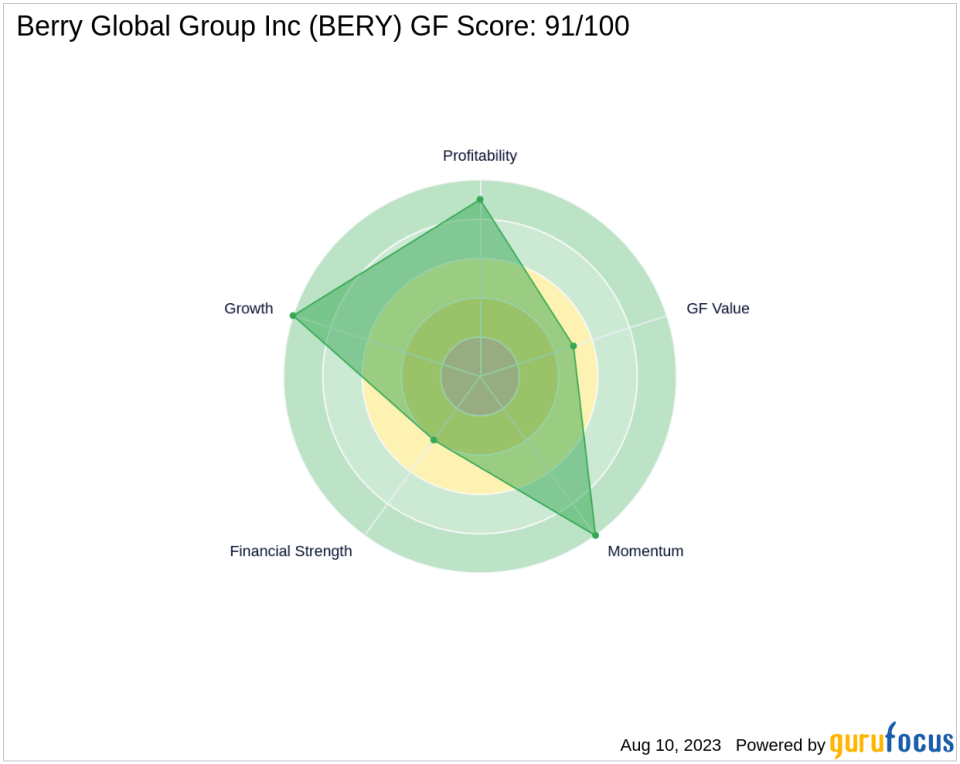

Understanding Berry Global Group's GF Score

Berry Global Group boasts a GF Score of 91 out of 100, placing it in the highest outperformance potential category. This score is a result of GuruFocus's comprehensive stock performance ranking system, which considers five key aspects of valuation: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. A high GF Score indicates a strong likelihood of generating higher returns than stocks with lower GF Scores. Let's delve into each of these aspects to understand Berry Global Group's performance better.

Financial Strength Analysis

The Financial Strength of a company is a measure of its financial situation, considering factors such as interest coverage and debt to revenue ratio. Berry Global Group's Financial Strength Rank stands at 4/10, indicating a moderate financial situation. The company's interest coverage is 4.19, and its debt to revenue ratio is 0.72. Its Altman Z-Score, another measure of financial health, is 1.73.

Profitability Rank Analysis

The Profitability Rank measures a company's profitability and its likelihood of maintaining it. Berry Global Group's Profitability Rank is an impressive 9/10, indicating high profitability and consistency. The company's operating margin stands at 9.13%, and its Piotroski F-Score, a measure of financial health, is 6. The company has also demonstrated consistent profitability over the past 10 years.

Growth Rank Analysis

The Growth Rank measures a company's growth in terms of revenue and profitability. Berry Global Group's Growth Rank is a perfect 10/10, indicating strong growth. The company's 5-year revenue growth rate is 16.90%, and its 3-year revenue growth rate is 18.30%. Its 5-year EBITDA growth rate is also impressive at 12.90%.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth. Berry Global Group's GF Value Rank is 5/10, indicating a moderate valuation.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. Berry Global Group's Momentum Rank is 10/10, indicating strong momentum.

Competitive Analysis

When compared to its competitors in the Packaging & Containers industry, Berry Global Group holds its own. Graphic Packaging Holding Co (NYSE:GPK) has a similar GF Score of 91, while Sealed Air Corp (NYSE:SEE) and Reynolds Consumer Products Inc (NASDAQ:REYN) have GF Scores of 82 and 79, respectively. This comparison further underscores Berry Global Group's strong performance and potential for outperformance.

In conclusion, Berry Global Group's high GF Score, strong growth, and high profitability make it a compelling choice for investors. However, as with any investment, potential investors should conduct their own due diligence before making a decision.

This article first appeared on GuruFocus.