Best Buy (BBY) Gains on Efforts to Enhance Customer Experience

Best Buy Company Inc. BBY emphasizes improving the customer experience across all touchpoints. This includes investments in improving the online shopping experience, in-store technology enhancements and a focus on personalized customer service. The company's efforts to improve delivery speeds and the efficiency of in-store pickup for online orders have contributed to a more seamless and convenient shopping experience for customers.

BBY continues to advance its digital transformation, leveraging data analytics and artificial intelligence to better understand customer preferences and behaviors. This enables Best Buy to offer more personalized marketing, product recommendations and services, leading to increased customer satisfaction and loyalty.

The company announced strategic partnerships with health systems and technology companies, enhancing its Best Buy Health services. These collaborations aim to expand the reach and capabilities of Best Buy's health technology solutions, further diversifying its revenue streams and leveraging its expertise in technology and consumer electronics.

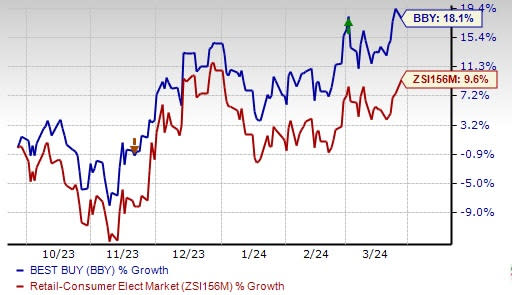

Image Source: Zacks Investment Research

Membership Program Bodes Well

The company has evolved its membership program to meet changing consumer needs and preferences. The program is structured into tiers, offering customers various benefits tailored to enhance their shopping and service experiences with Best Buy. As of fourth-quarter fiscal 2024, BBY reported having 7 million members across its paid membership tiers, indicating substantial growth and customer interest in the program.

This expansion not only showcases the company's capability to cultivate customer loyalty and improve the shopping journey but also markedly influences its financial results, adding about 45 basis points to the enterprise's operating margin growth on a year-over-year basis in the fiscal fourth quarter. This strategy aims to boost profitability and strengthen relationships with customers.

Soft Domestic & International Segment

Best Buy faced a significant downturn in its Domestic segment amid challenging consumer electronics market conditions, with revenues falling 0.9% year over year in the fiscal fourth quarter due to a 5.1% drop in comparable sales and a 4.8% decline in online revenues. The decrease was driven by lower sales in appliances, computing, home theater and mobile phones, slightly offset by gains in gaming.

Although the company’s International segment faced an increase in revenues in the fiscal fourth quarter, the segment’s comparable sales declined 1.4%. The results were hurt by the adverse effects of foreign currency exchange rates.

However, Best Buy's focus on digital innovation and personalized service, along with its expansion into health tech through strategic partnerships, diversifies revenues and enhances customer engagement.

This Zacks Rank #3 (Hold) company’s shares have gained 18.1% in the past six months compared with the industry’s growth of 9.6%.

Key Picks

A few better-ranked stocks in the same space are Deckers Outdoor Corporation DECK, American Eagle Outfitters Inc. AEO and Abercrombie & Fitch Co. ANF.

Deckers is a leading designer, producer and brand manager of innovative, niche footwear and accessories. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 38.7% and 15.8% from the year-ago period’s reported figures. DECK has a trailing four-quarter average earnings surprise of 32.1%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear. The company flaunts a Zacks Rank #1 at present.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 12.5% and 3.3% from the year-ago period’s reported figures. AEO has a trailing four-quarter average earnings surprise of 22.7%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently sports a Zacks Rank #1. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year earnings and sales indicates growth of 19.1% and 5.6% from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report