Best Buy (BBY) Rides High on Growth Strategies: Apt to Hold

Best Buy Co., Inc. BBY is doing well, thanks to its robust omnichannel efforts to efficiently cater to consumers. Management continuously focuses on improving its digital capabilities including boosting its services, such as buy online and pickup in store services.

The company is also deepening its customer engagement with more in-home consultations and in-home installations. It is making significant headway in the health and beauty category.

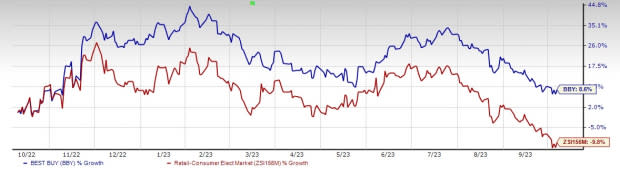

Buoyed by the aforesaid tailwinds, shares of this electronics retailer have gained 8.6% over the course of a year against the industry’s 9.8% decline.

Let’s Delve Deeper

Best Buy is focused on making significant investments in fundamental technology capabilities, such as data and analytics. The company provides convenient pickup options like in-store pickup, curbside pickup, lockers and alternate pickup locations.

The company’s consultation service, which supports customers with personalized tech needs, has been gaining traction. It has also been offering free next day delivery on several items along with convenience store and curbside pickup options. In fiscal 2023, digital sales accounted for 33% of the domestic revenues versus 19% in fiscal 2020.

Image Source: Zacks Investment Research

The company also continues making investment in the stores and elevating unique experiences. Best Buy has been testing various store formats and operating models. It is on track to deliver the fiscal 2024 store plans, including closing 20-30 large format stores and implementing eight Experience store remodels. Moreover, the company has made investments in the distribution center network to improve productivity.

Additionally, Best Buy’s annual membership program, Best Buy Totaltech, appears encouraging. The program provides customers tech support from Geek Squad agents, exclusive member prices on merchandise, up to 24 months of product protection on most purchases, and free delivery and installation.

The membership program offers three tiers, which are My Best Buy, My Best Buy Plus, and My Best Buy Total. My Best Buy is the company’s free tier plan for customers looking for convenience, including free shipping with no minimum purchase and gains connected with a member account, such as online access to purchase history, order tracking, and fast checkout.

My Best Buy Plus is the latest membership plan for customers wanting value and access. For $49.99 per year, customers get everything including with the My Best Buy offering with exciting prices and access to product releases. Free two-day shipping with an expanded 60-day return and exchange window on majority of the products can also be availed.

My Best Buy Total is a membership plan for customers looking for protection and support. This tier is an evolution of the company’s Totaltech offer at $179.99 per year. It consists of the entire benefits from the Plus tier, along with the Geek Squad 24/7 tech support via in-store, remote, phone, or chat on all the electronics. This tier also includes up to two years of product protection with AppleCare+ on many new Best Buy purchases. The membership program is likely to contribute nearly 25 basis points of year-over-year operating income rate expansion in fiscal 2024.

To wrap up, Best Buy seems well-poised to tap growth opportunities, given its solid tech-agnostic drives. A VGM Score of A further speaks volumes for this Zacks Rank #3 (Hold) company. For fiscal 2025, the Zacks Consensus Estimate for Best Buy’s earnings per share (EPS) is currently pegged at $6.83, mirroring growth of 9.7% year over year.

Solid Picks in Retail

We have highlighted three better-ranked stocks, namely American Eagle Outfitters AEO, Abercrombie & Fitch ANF and Boot Barn BOOT.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year EPS suggests growth of 33% from the year-ago reported figure. AEO delivered an average trailing four-quarter earnings surprise of 43.2%.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank of 1. ANF has delivered an earnings surprise of 724.8% in the last four quarters.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10% from the year-ago reported figures.

Boot Barn, a leading apparel and footwear retailer, currently carries a Zacks Rank #2 (Buy). BOOT delivered an average trailing four-quarter earnings surprise of 13.5%.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 7.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report