Best Buy's (BBY) Omnichannel Moves Appear Encouraging

Best Buy Co., Inc’s. BBY omnichannel efforts to efficiently cater to consumers’ necessities are commendable. The company continuously focuses on improving its digital capabilities including boosting its services, such as buy online and pickup in store services.

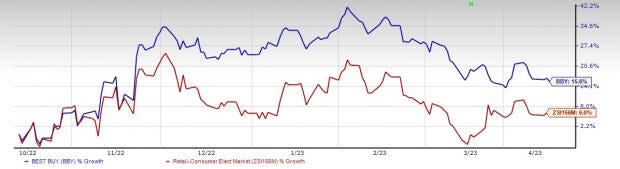

BBY is also deepening its customer engagement with more in-home consultations and in-home installations. Buoyed by the aforesaid tailwinds, shares of this electronics retailer have gained 15.6% in the past six months compared with the industry’s 6% rise.

For fiscal 2025, the Zacks Consensus Estimate for Best Buy’s sales and earnings per share (EPS) is currently pegged at $45.25 billion and $7.15, respectively. These estimates mirror corresponding growth of 1.2% and 14.5% year over year.

The company also looks favorable from an earnings point of view. Its earnings have outpaced the Zacks Consensus Estimate in three of the last four quarters, with a trailing four-quarter average earnings surprise of 20%. An expected long-term earnings growth rate of 8% coupled with a VGM Score of A further speaks volumes for this Zacks Rank #3 (Hold) stock.

Let’s delve deep.

What’s More?

Best Buy provides convenient pickup options like in-store pickup, curbside pickup, lockers and alternate pickup locations. Its consultation service, which supports customers with personalized tech needs, has been gaining traction. Additionally, management is focused on making significant investments in fundamental technology capabilities, such as data and analytics, as well as cloud migration to drive scale and effectiveness.

Image Source: Zacks Investment Research

Best Buy continues making investments in the stores and elevating the shopping experience. BBY is also constantly conducting various tests and pilots to become a more customer-centric, digitally focused and efficient company. It is focused on refreshing its U.S. store portfolio over the long term. For fiscal 2024, it intends to close 20-30 large format stores with eight experienced stores remodels and introduce ten additional stores. Also, it plans to conclude two remodels of medium core format.

The company is gradually progressing on its virtual store format, where customers interact with experts via chat, audio, video and screen sharing. Moreover, the company has been making investments in the distribution center network to improve productivity. Best Buy has invested in store-based fulfillment, which includes ship-from-store customer fulfillment centers.

In addition, the company is making significant headway in the health and beauty category. To this end, management had launched a skincare technology product across the company’s stores and online. In the health business category, over-the-counter hearing aids were launched across the stores and online, with a new online hearing assessment tool.

Best Buy is also focused on Care at Home solution, which leverages current health, the company’s major technology platform bringing together remote patient monitoring, telehealth, complete support model and patient engagement into one solution for health care providers and pharmaceutical organizations.

Furthermore, BBY’s annual membership program, Best Buy Totaltech, provides customers with tech support from Geek Squad agents, exclusive member prices on merchandise, up to 24 months of product protection on most purchases and free delivery and installation.

In fiscal 2024, management expects the membership program changes, including My Best Buy changes, to boost the enterprise operating margin expansion by nearly 25 basis points, mainly in the back half of the year.

All in all, Best Buy seems well-poised to tap growth opportunities, given its solid tech-agnostic drives.

Solid Picks in Retail

We have highlighted three top-ranked stocks, namely Urban Outfitters URBN, American Eagle Outfitters AEO and Stitch Fix SFIX.

Urban Outfitters, a leading apparel and accessories retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year sales and EPS suggests growth of 4.3% and 41.7%, respectively, from the year-ago reported figures. URBN delivered a negative earnings surprise of 7.1% in the trailing four quarters.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently carries a Zacks Rank #2 (Buy). AEO delivered an earnings surprise of 23.3% in the last reported quarter.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year sales and EPS suggests growth of 1.3% and 15.5%, respectively, from the year-ago reported figures.

Stitch Fix, an online personal styling retailer, currently carries a Zacks Rank of 2. The company has a trailing four-quarter negative earnings surprise of 10.6%, on average.

The Zacks Consensus Estimate for Stitch Fix’s current financial-year EPS suggests growth of 1.2% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Stitch Fix, Inc. (SFIX) : Free Stock Analysis Report