Best Dividend Paying Stock in February

Xingda International Holdings, Sinopec Shanghai Petrochemical, and Guangdong Investment all share one thing in common. They are on our list of top paying dividend stocks which have helped grow my portfolio income over the past couple of months. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

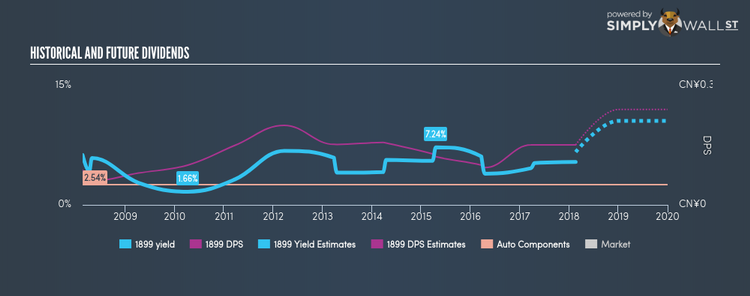

Xingda International Holdings Limited (SEHK:1899)

Xingda International Holdings Limited, an investment holding company, engages in the manufacturing and trading of radial tire cords, steel cords, bead wires, and other wires. The company currently employs 7000 people and has a market cap of HKD HK$4.16B, putting it in the mid-cap group.

1899 has a juicy dividend yield of 5.39% and the company currently pays out 47.45% of its profits as dividends , and analysts are expecting the payout ratio in three years to hit 70.59%. Interested in Xingda International Holdings? Find out more here.

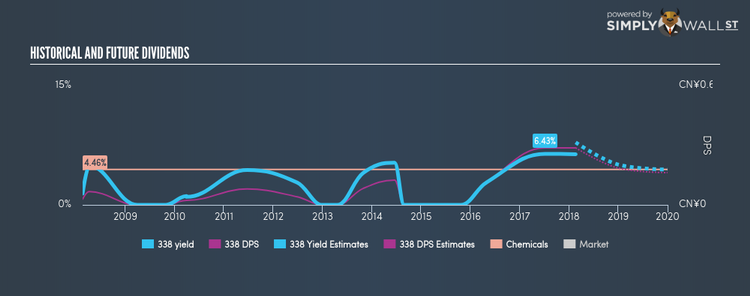

Sinopec Shanghai Petrochemical Company Limited (SEHK:338)

Sinopec Shanghai Petrochemical Company Limited, together with its subsidiaries, manufactures and sells petrochemical products in the People’s Republic of China. Founded in 1972, and currently run by , the company size now stands at 10,721 people and with the company’s market capitalisation at HKD HK$68.04B, we can put it in the large-cap stocks category.

338 has a enticing dividend yield of 6.38% and is paying out 45.41% of profits as dividends . Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. The company recorded earnings growth of 15.53% in the past year, comparing favorably with the hk chemicals industry average of -0.93%. Dig deeper into Sinopec Shanghai Petrochemical here.

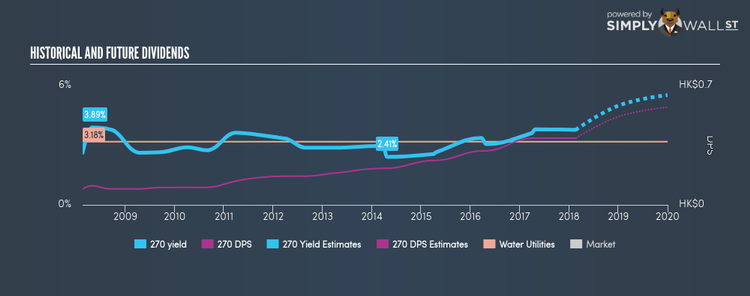

Guangdong Investment Limited (SEHK:270)

Guangdong Investment Limited engages in investment holding, water resources, property investment and development, department store operation, energy projects investment, road and bridge operation, and hotel operation and management businesses. Established in 1973, and now run by Yinheng Wen, the company currently employs 7,067 people and with the company’s market capitalisation at HKD HK$72.70B, we can put it in the large-cap stocks category.

270 has a sizeable dividend yield of 3.78% and distributes 50.45% of its earnings to shareholders as dividends , with an expected payout of 76.25% in three years. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. Guangdong Investment’s performance over the last 12 months beat the hk water utilities industry, with the company reporting 37.83% EPS growth compared to its industry’s figure of 24.74%. Continue research on Guangdong Investment here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.