Best Dividend Paying Stock in May

Stanrose Mafatlal Investments and Finance is one of companies that can help grow your investment income by paying large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

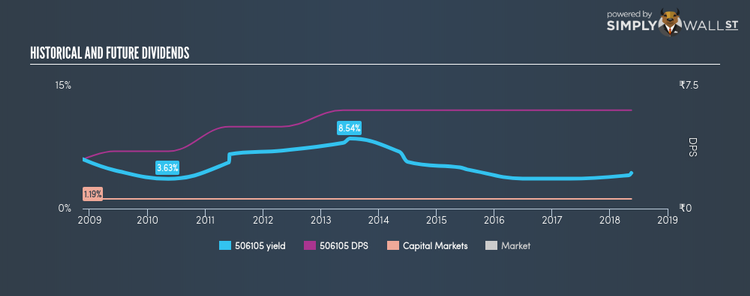

Stanrose Mafatlal Investments and Finance Limited (BSE:506105)

Stanrose Mafatlal Investments and Finance Limited, a non-banking financial company, engages in inter-corporate investment, financing, and capital market related activities. Started in 1980, and currently headed by CEO Madhusudan Mehta, the company now has 17 employees and with the stock’s market cap sitting at INR ₹547.77M, it comes under the small-cap stocks category.

506105 has a sumptuous dividend yield of 4.35% and has a payout ratio of 70.51% . In the last 10 years, shareholders would have been happy to see the company increase its dividend from ₹3.00 to ₹6.00. They have been consistent too, not missing a payment during this 10 year period. It should comfort potential investors that the company isn’t expensive when we look at its PE ratio compared to the IN Capital Markets industry. Stanrose Mafatlal Investments and Finance’s PE ratio is 16.2 while its industry average is 24.4. Interested in Stanrose Mafatlal Investments and Finance? Find out more here.

DCM Shriram Limited (BSE:523367)

DCM Shriram Limited engages in chloro-vinyl, sugar, agri-input, and other businesses in India. DCM Shriram was founded in 1989 and with the company’s market capitalisation at INR ₹39.74B, we can put it in the large-cap group.

523367 has a good dividend yield of 3.35% and has a payout ratio of 19.89% , with analysts expecting this ratio to be 21.37% in the next three years. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from ₹3.40 to ₹8.20. The company has also had a strong past 12 months, reporting a double digit EPS growth of 21.35%. Dig deeper into DCM Shriram here.

Vedanta Limited (NSEI:VEDL)

Vedanta Limited, a diversified natural resources company, engages in exploring, extracting, and processing minerals, and oil and gas in India. Founded in 1965, and run by CEO Rajagopal Kumar, the company provides employment to 60,197 people and with the company’s market capitalisation at INR ₹1.04T, we can put it in the large-cap category.

VEDL has a large dividend yield of 7.60% and pays 74.91% of its earnings as dividends . Despite there being some hiccups, dividends per share have increased during the past 10 years. Analysts are enthusiastic about the company’s future growth, estimating a 65.67% earnings per share increase in the next three years. Interested in Vedanta? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.