Best Dividend Stocks In NYSE

Tupperware Brands is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. Here are other similar dividend stocks that could be valuable additions to your current holdings.

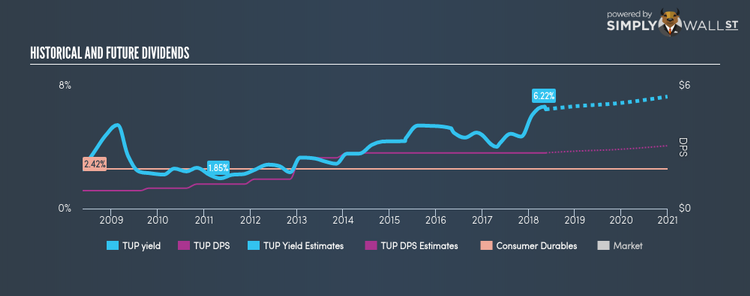

Tupperware Brands Corporation (NYSE:TUP)

Tupperware Brands Corporation operates as a direct-to-consumer marketer of various products across a range of brands and categories in Europe, Africa, the Middle East, the Asia Pacific, North America, and South America. Started in 1996, and currently headed by CEO Patricia Stitzel, the company currently employs 12,000 people and with the company’s market capitalisation at USD $2.25B, we can put it in the mid-cap group.

TUP has a large dividend yield of 6.05% and their payout ratio stands at -49.98% , with analysts expecting a 58.23% payout in the next three years. Over the past 10 years, TUP has increased its dividends from US$0.88 to US$2.72. Much to the delight of shareholders, the company has not missed a payment during this time. More on Tupperware Brands here.

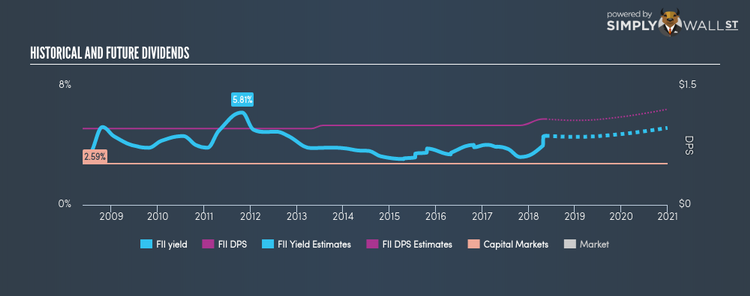

Federated Investors, Inc. (NYSE:FII)

Federated Investors, Inc. is a publicly owned asset management holding company. Formed in 1955, and headed by CEO John Donahue, the company currently employs 1,441 people and with the market cap of USD $2.51B, it falls under the mid-cap category.

FII has an alluring dividend yield of 4.35% and distributes 33.51% of its earnings to shareholders as dividends , and analysts are expecting a 44.78% payout ratio in the next three years. FII’s DPS have risen to US$1.08 from US$0.96 over a 10 year period. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Federated Investors’s earnings per share growth of 41.32% over the past 12 months outpaced the us capital markets industry’s average growth rate of 15.84%. Interested in Federated Investors? Find out more here.

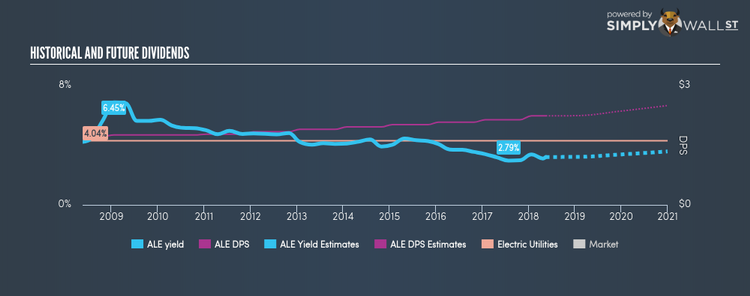

ALLETE, Inc. (NYSE:ALE)

ALLETE, Inc. operates as an energy company. Established in 1906, and now run by Alan Hodnik, the company now has 2,002 employees and has a market cap of USD $3.85B, putting it in the mid-cap stocks category.

ALE has a nice dividend yield of 3.01% and has a payout ratio of 63.45% . ALE’s dividends have increased in the last 10 years, with DPS increasing from US$1.72 to US$2.24. The company has been a reliable payer too, not missing a payment during this time. Interested in ALLETE? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.