Best Income Stocks to Buy for March 22nd

Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 22nd:

Gladstone Commercial GOOD: This publicly traded real estate investment trust that focuses on investing in and owning triple-net leased industrial and commercial real estate properties and selectively making long-term mortgage loans, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.3% over the last 60 days.

Gladstone Commercial Corporation Price and Consensus

Gladstone Commercial Corporation price-consensus-chart | Gladstone Commercial Corporation Quote

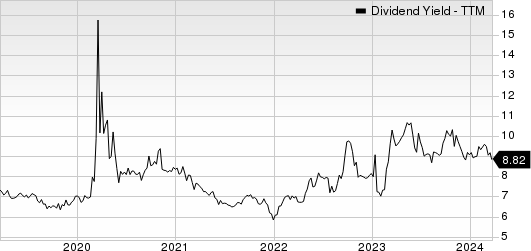

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 8.8%, compared with the industry average of 4.6%.

Gladstone Commercial Corporation Dividend Yield (TTM)

Gladstone Commercial Corporation dividend-yield-ttm | Gladstone Commercial Corporation Quote

Legal & General Group LGGNY: This leading UK risk, savings and investment group which provides life assurance and other financial protection products, annuities and long-term savings products including ISA's and pensions, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 4.6% over the last 60 days.

Legal & General Group PLC Price and Consensus

Legal & General Group PLC price-consensus-chart | Legal & General Group PLC Quote

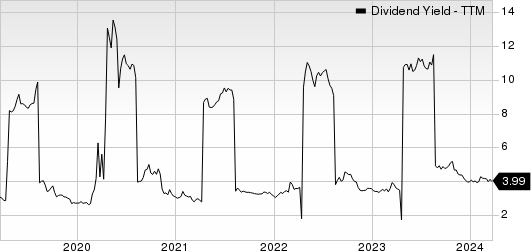

This Zacks Rank #1 company has a dividend yield of 4.0%, compared with the industry average of 1.9%.

Legal & General Group PLC Dividend Yield (TTM)

Legal & General Group PLC dividend-yield-ttm | Legal & General Group PLC Quote

Reynolds Consumer Products REYN: This consumer branded and private label products company which produces and sells branded and store-brand products which includes cooking products, waste & storage products and tableware, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 5.2% over the last 60 days.

Reynolds Consumer Products Inc. Price and Consensus

Reynolds Consumer Products Inc. price-consensus-chart | Reynolds Consumer Products Inc. Quote

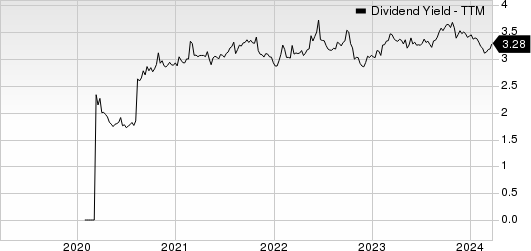

This Zacks Rank #1 company has a dividend yield of 3.3%, compared with the industry average of 0.0%.

Reynolds Consumer Products Inc. Dividend Yield (TTM)

Reynolds Consumer Products Inc. dividend-yield-ttm | Reynolds Consumer Products Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gladstone Commercial Corporation (GOOD) : Free Stock Analysis Report

Legal & General Group PLC (LGGNY) : Free Stock Analysis Report

Reynolds Consumer Products Inc. (REYN) : Free Stock Analysis Report