Best Income Stocks to Buy for September 13th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, September 13th:

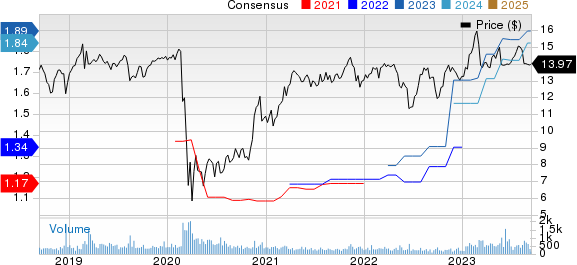

Stellus Capital Investment SCM: This closed-end, non-diversified investment management company with investment objective to maximize the total return to its stockholders in the form of current income and capital appreciation by investing primarily in private middle-market companies, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 3.3% over the last 60 days.

Stellus Capital Investment Corporation Price and Consensus

Stellus Capital Investment Corporation price-consensus-chart | Stellus Capital Investment Corporation Quote

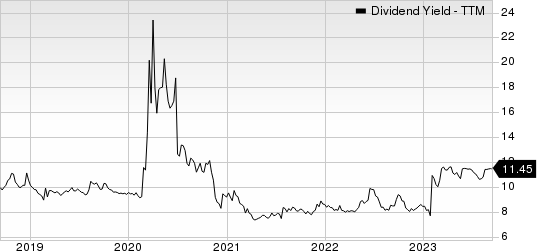

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 11.5%, compared with the industry average of 10.1%.

Stellus Capital Investment Corporation Dividend Yield (TTM)

Stellus Capital Investment Corporation dividend-yield-ttm | Stellus Capital Investment Corporation Quote

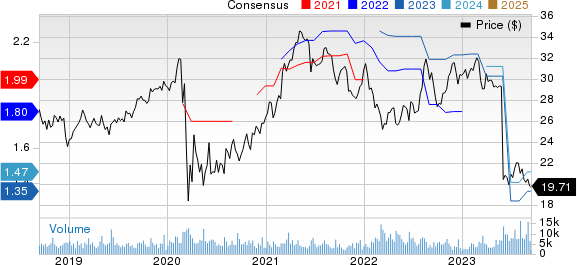

Sierra Bancorp BSRR: This bank holding company which operates branch offices as well as real estate centers, agricultural credit centers and a bank card center in the South Valley, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.7% over the last 60 days.

Sierra Bancorp Price and Consensus

Sierra Bancorp price-consensus-chart | Sierra Bancorp Quote

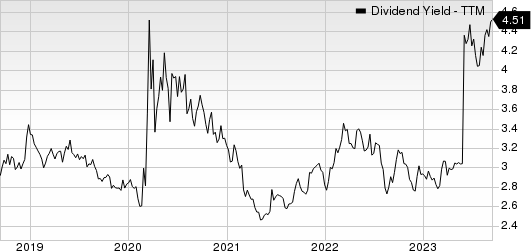

This Zacks Rank #1 company has a dividend yield of 4.7%, compared with the industry average of 3.4%.

Sierra Bancorp Dividend Yield (TTM)

Sierra Bancorp dividend-yield-ttm | Sierra Bancorp Quote

MDU Resources Group MDU: This utility natural gas distribution company which provides value-added natural resource products and related services that are essential for energy transportation and regulated energy delivery services to its customers, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.6% over the last 60 days.

MDU Resources Group, Inc. Price and Consensus

MDU Resources Group, Inc. price-consensus-chart | MDU Resources Group, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 4.5%, compared with the industry average of 3.8%.

MDU Resources Group, Inc. Dividend Yield (TTM)

MDU Resources Group, Inc. dividend-yield-ttm | MDU Resources Group, Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

Sierra Bancorp (BSRR) : Free Stock Analysis Report

Stellus Capital Investment Corporation (SCM) : Free Stock Analysis Report