Best LSE Companies To Invest In

Fast-growing stocks may be appealing for some investors, whereas robust dividend-generating stocks may be more suitable for others. There are many different factors to deliberate on when deciding which investment best suits your needs. Below is a compilation of stocks that possess impressive aspects in two or more fundamentals, making them popular investments for every investor.

BlackRock Throgmorton Trust plc (LSE:THRG)

BlackRock Throgmorton Trust plc is a closed-ended equity mutual fund launched by BlackRock Fund Managers Limited. The company was established in 1962 and with the company’s market capitalisation at GBP £337.86M, we can put it in the small-cap category.

THRG’s earnings growth in the past year reaching triple-digits, producing an outstanding triple-digit return to shareholders, is an impressive feat for the company. THRG has ample cash coverage over its short term liabilities, and the business has no debt on its books, portraying its strong financial capacity. What’s more is, THRG is currently trading below its true value in terms of its discounted cash flows, and also on its price-to-equity metric, which gives investors an opportunity to accumulate the stock at a low price. Dig deeper into BlackRock Throgmorton Trust here.

Barratt Developments plc (LSE:BDEV)

Barratt Developments PLC engages in the housebuilding and commercial development businesses in Great Britain. Formed in 1958, and currently run by David Thomas, the company employs 6,193 people and has a market cap of GBP £5.57B, putting it in the mid-cap stocks category.

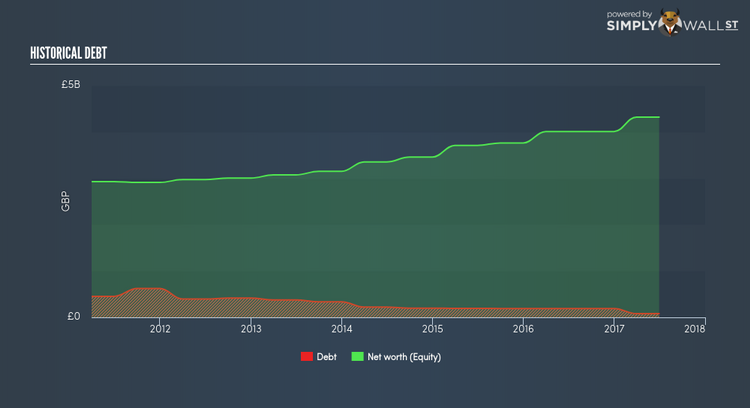

BDEV has ample cash coverage over its short term liabilities, and its total debt is well-covered by its cash flows, which indicates its strong financial position. BDEV’s share price is below its intrinsic value based on its discounted cash flows, and also on its price-to-equity metric, so potential investors can purchase the stock below its value. In addition, BDEV’s high dividend payments make it one of the best dividend stocks on the market, and it has also been able to maintain it at a level in which net income is able to cover dividend payments. Dig deeper into Barratt Developments here.

Eurocell plc (LSE:ECEL)

Eurocell plc manufactures, recycles, and distributes windows, doors, and roofline PVC building products in the United Kingdom. Established in 1974, and currently headed by CEO Mark Kelly, the company provides employment to 1,200 people and with the company’s market capitalisation at GBP £223.00M, we can put it in the small-cap group.

ECEL’s proven ability to generate high returns in the past of 56.38%, beating the industry return of 19.58%, gives us more conviction of the company’s capacity to drive bottom-line growth going forward. What’s more is, ECEL has ample cash coverage over its short term liabilities, and its debt is adequately covered by its operating cash, which indicates its strong financial position. More detail on Eurocell here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, use our free platform to explore our interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.