What Are the Best Marijuana Stocks?

Marijuana is much more than just a commodity. In fact, despite all the hype surrounding the cannabis industry, the profit potential of this plant is still oft underestimated.

Cannabis companies can of course profit from growing and selling dried marijuana flower, but consumer goods products that use marijuana as an ingredient may be an even bigger opportunity. Marijuana foods, beverages, and cosmetics could expand the total addressable marijuana market significantly beyond its current $150 billion value. Further, the pricing power for these value-added products could provide companies with the best profit margins. Do you know which stocks are best positioned for marijuana going Main Street?

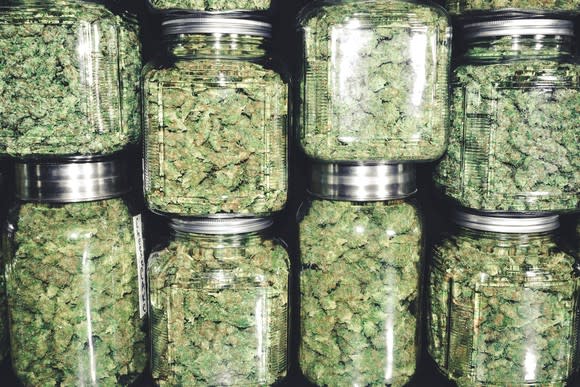

Image Source: Getty Images

What is marijuana?

Marijuana is the dried flower of the female cannabis sativa plant. It contains over 100 chemical cannabinoids, but the most common cannabinoids are tetrahydrocannabinol (THC), a psychoactive chemical that's found in the resin -- a gooey sap-like substance -- produced by the leaves and buds of the female cannabis plant, and cannabidiol (CBD), a nonpsychoactive chemical.

Marijuana's psychoactive and non-psychoactive effects are caused by cannabinoids interacting with our body's natural endocannabinoid system, which regulates various physiological and cognitive functions including appetite, pain, and mood. There are two primary receptors in this system: CB1 and CB2. CB1 is found primarily in the central nervous system and CB2 is expressed mostly in the immune system. THC's interaction with CB1 is behind marijuana's "high" while CBD is thought to indirectly block CB1, CB2, as well as other receptors in the body.

CBD's mechanism of action isn't fully understood, but its interaction with receptors in the endocannabinoid system can counteract some of THC's effects, depending on the type of marijuana, or marijuana strain, and the actual percentage of CBD and THC present.

The plant Cannabis Sativa has a long history of cultivation and use. Marijuana consumption stretches back at least 1,000 years and the use of hemp, a variety with lower THC amount, has been used for industrial purposes, such as making rope, as far back as 10,000 B.C. in China, based on archaeological discoveries. In addition to rope, hemp was also commonly used to make clothing, sail, and paper. In fact, wood was the only material used more in shipbuilding than hemp during the colonial era and the Chinese used hemp to make the first paper in approximately 150 B.C. Hemp's industrial importance is evidenced by the fact that colonists arrived in North America with cannabis seeds in tow, and the English crown mandated that every farmer use part of their land to grow hemp.

In the Middle East, a purified form of cannabis called hashish has been smoked in the since at least 800 A.D. and in India, where it's called ganja (a Hindi word from Sanskrit meaning hemp or hemp resin). It appears in the Hindu texts, Vedas, as one of five sacred plants. In the middle ages, Sikh warriors would drink a marijuana-beverage called bhang before going into battle because of it's ability to elicit joy and reduce fear.

Medicinal use of cannabis stretches far back in time, as well. There's evidence of its popularity in ancient China, India, Greece, the Middle East, and elsewhere for various maladies, including insomnia, headaches, gastrointestinal disorders, and pain. In the West, it was used to relieve stomach pain until the 1800s.

Outside of medicinal use, marijuana has a recreational use in which ingesting it can help a person attain a high, or euphoric feeling. Recreational use is the new frontier for marijuana, as more countries like Canada are legalizing adult recreational use.

How did marijuana become illegal?

During the early 20th century, the U.S. was suffering a drug epidemic because of widespread use of opium, a highly addictive drug from the juice of the opium poppy. Opium was often prescribed as a pain reliever by doctors in the 1800's, particularly during and after the Civil War and its recreational use expanded significantly alongside immigration from China, where it was grown and recreational use was more common.

Opium addiction affected an estimated 1 in 200 Americans by 1895, prompting regulations to limit its use, including the passage of the Harrison Narcotics Tax Act, which criminalized opium and cocaine use in 1914.

Momentum to curb marijuana use was building concurrently. While hemp was widely cultivated in the U.S. for industrial and medicinal purposes, marijuana's recreational use didn't increase significantly until the early 1900s, when the Mexican revolution resulted in a boom of immigration from Mexico, where recreational marijuana use was more common.

Concerns that marijuana use would turn into an epidemic rivaling that of opium abuse, individual states began passing marijuana prohibition laws and by 1931, 29 states had outlawed marijuana. In 1937, marijuana became federally illegal in the U.S. when Congress passed the Marijuana Tax Act.

Marijuana's prohibition expanded globally after 73 countries got together in 1961 to create the Single Convention on Narcotic Drugs, a United Nations treaty that included the requirement that participating countries restrict marijuana production, possession and distribution of marijuana.

In 1970, the U.S. passed the Controlled Substances Act, creating a ranking system that classifies drugs into one of five tiers, called a schedule, depending on their potential for risk and their medical use. Marijuana was determined not to have any scientifically proven medical use at the time, so it was placed in the Act's most stringent tier, schedule 1, alongside heroin, a highly addictive drug derived from morphine, an opium-based drug

Shortly thereafter, President Nixon waged "war on drugs", a major policy initiative that included the formation of the Drug Enforcement Administration (DEA) in 1973. Since then, the DEA has led enforcement of marijuana prohibition and overseen the licensing of growers for medical research. More than 7 million Americans were arrested for pot possession from 2001 to 2010, according to the ACLU, and the DEA has licensed only one grower, the University of Mississippi, despite requests to access more marijuana for medical research.

IMAGE SOURCE: GETTY IMAGES.

Marijuana legalization efforts grow

In the U.S., the reemergence of public support for marijuana began in earnest in 1996 when California created a medical marijuana market. As California's market has matured, more states have followed its lead and today, 33 states, plus the District of Columbia, have legalized medical marijuana and 10 states have legalized marijuana for recreational purposes, or adult-use. Overall, legal retail marijuana sales in the U.S. totaled over $8 billion in 2017, up from $6.5 billion in 2016, according to Matt Karnes of GreenWave Advisors.

So far, marijuana legalization has increased tax revenue and decreased incarceration rates in states that have adopted pro-pot laws. It may also be reducing the use of opiates. For instance, Colorado became one of the first states to pass recreational laws in 2012 and sales of about $1.5 billion there generate over $250 million in annual tax revenue for the state. Colorado saw an 80% decline in marijuana-related drug charges and a 23% decline in all-drug charges between 2010 and 2014, and in 2018, a University of Georgia study found that opiate use rates were lower in states like Colorado with pro-marijuana laws.

Federal laws still prohibit marijuana in the U.S, but that's not the case in Canada. A vibrant medical marijuana market has been up-and-running nationwide there since rule changes in 2014 created a licensing system. In 2018, Canada became the first of the G7 countries to break from the Single Convention on Narcotic Drugs treaty when it opened a national, regulated, recreational marijuana market.

It remains to be seen if other countries, including the U.S., will follow Canada's lead, but polls suggest efforts would be supported by the population. A record 66% of Americans favor legalization, up from about 50% in 2012 and 12% in 1969, according to Gallup. The groundswell of voter support for legalization suggests most, if not all, of the $50 billion spent in the U.S. on marijuana will eventually make its way out of the shadows and into regulated marketplaces, providing a boon for marijuana stocks.

IMAGE SOURCE: GETTY IMAGES.

How to invest in marijuana stocks

U.S. investors interested in cannabis stocks had limited options until 2018 because federal prohibition forced U.S. marijuana stocks to list their shares on the lightly regulated over-the-counter market (OTC) and Canadian marijuana stocks only traded on Canada's stock exchanges, not major U.S. exchanges.

Because OTC stocks don't trade on a physical exchange, stock prices that are quoted bet.ween OTC participants vary significantly, creating transparency risks. A buyer might not know the exact price they're signing up to pay. The difference between quotes prices by buyers and sellers of OTC stocks, or the spread, are usually wider than they are on the major exchanges too, increasing costs. Additionally, since OTC stocks don't have to meet minimum listing requirements, including per share price levels and filing financials according to Securities and Exchange Commission (SEC) rules, stocks trading on OTC markets have a higher risk of being fraudulent.

Some investors avoided the risks associated with OTC stocks by buying stocks listed on foreign exchanges, such as Canada's Toronto Stock Exchange, but many institutional investors, including mutual funds, weren't able to do the same, because mandates prevent them from owning foreign issues.

Fortunately, investing in marijuana stocks became easier when five of Canada's biggest cannabis companies won the OK to list shares on the NYSE and NASDAQ exchanges in 2018.

Cronos Group (NASDAQ: CRON) began trading on the NASDAQ in February.

Canopy Growth (NYSE: CGC) began trading on the NYSE in May.

Tilray (NASDAQ: TLRY) held its initial public offering on the NASDAQ exchange in July.

Aurora Cannabis (NYSE: ABC) listed on the NYSE in October.

And, Aphria Inc. (NYSE: APHA) listed on the NYSE in November.

Buying shares in those cannabis companies is now as simple as opening a brokerage account with a discount brokerage firm, such as E*Trade. However, Canadian listed companies are still prevented from doing business in countries where marijuana remains illegal federally, so investing in them doesn't give investors exposure to growing demand for marijuana and its ancillary products in America.

What kinds of marijuana stocks are there?

Before we discuss the best cannabis-related stocks, it's important to know all the different kinds of companies operating within the marijuana sector.

Growers:

Companies that cultivate cannabis as a commodity, like wheat, on farms, indoors, or in greenhouses. For example, Canopy Growth, Aurora Cannabis, and Aphria are three of Canada's largest cannabis cultivation companies.

Extraction:

Companies, including growers, that further process the dried cannabis they cultivate to create value-added products such as cannabis oils. Extracted marijuana products can command higher prices and thus, they offer better margins than dried marijuana flower.

Packagers:

Companies that sell packing products or provide packaging services to the industry, including KushCo Holdings (NASDAQOTH: KSHB), a maker of tamper proof packaging for the cannabis industry.

Dispensaries:

Companies retail marijuana products directly to consumers online or in physical stores, including MedMen (NASDAQOTH: MMNFF), an operator of 16 marijuana retail stores.

Distribution:

Companies that facilitate the movement of products through the supply chain to end. For instance, Great North Distributors, a Canadian subsidiary of Southern Glazer's Wine & Spirits provides distribution services to Aphria in Canada.

eCommerce:

Companies help marijuana companies market products using the Internet. For instance, Shopify (NYSE: SHOP), a cloud-based provider of marketing and payment solutions to cannabis retailers.

Financing:

Companies providing services to marijuana market participants, including Bank of Montreal (NYSE: BMO), which issued a $200 million debt facility to Aurora Cannabis in 2018.

Food & Beverages:

Companies incorporating marijuana as an ingredient into consumer goods, like Molson Coors Brewing (NYSE: TAP), which has a licensing deal with HEXO Corp to create cannabis-infused beverages in Canada.

Pharmaceuticals:

Companies developing marijuana products for use as medicine, including GW Pharmaceuticals (NASDAQ: GWPH), which recently won FDA-approval of Epidiolex, a purified CBD for use in patients with rare forms of epilepsy.

IMAGE SOURCE: GETTY IMAGES.

Best medical marijuana stocks

If a crackdown in recreational marijuana by the U.S. Government has you nervous, then investing in companies developing FDA-approved medications based on marijuana's cannabinoids or Canadian cannabis companies with a medical focus may be the best bet.

Of the various companies working on medical marijuana drugs that can pass regulatory muster, GW Pharmaceuticals, CannTrust, and Novartis, via a collaboration with Tilray, are among the leaders.

Company | Symbol | Market Cap | TTM Sales |

GW Pharmaceuticals | (NASDAQ: GWPH) | $3.9 billion | $12.74 million |

CannTrust | (NASDAQOTH: CNTTF) | $552 million | $27.41 million |

Tilray | (NASDAQ: TLRY) | $7 billion | $32.7 million |

Novartis | (NYSE: NVS) | $198.2 billion | $52.6 billion |

TTM = Trailing 12 months. Data source: Yahoo!Finance as of 12/14/2018. Author's table.

In June 2018, the U.S. Food and Drug Administration (FDA) approved GW Pharmaceuticals' purified CBD medicine Epidiolex after trials proved it can reduce seizures in patients with rare types of treatment-resistant epilepsy. In September, the company got a second win when the DEA scheduled Epidiolex as a schedule V drug, which is it's least-restrictive classification. As a result, doctor's can prescribe and refill Epidiolex as easily as they do cough medicines containing codeine, such as Robitussin AC.

Epidiolex reduced seizures from baseline in trials by between 40% to 50% per month in patients with Dravet syndrome and Lennox-Gastaut syndrome, two rare and debilitating forms of childhood-onset epilepsy. Patients with those forms of epilepsy fail to respond to existing antiepileptic medications, so Epidiolex could become a top-selling medication; especially since it's available by prescription throughout the U.S. regardless of whether marijuana is legal in the patient's state.

GW Pharmaceuticals is the only marijuana company to secure an FDA green light for purified CBD, but CannTrust and Tilray, with Novartis' help, could win regulatory approvals for marijuana medications in the U.S. and elsewhere, too.

In August, Canadian medical marijuana company CannTrust announced it's conducting clinical-stage trials of marijuana for the treatment of pain in collaboration with Hamilton Health Sciences and McMaster University. A randomized trial evaluating cannabis oil for chronic non-cancer pain was targeted to begin in 2018 and additional studies are under consideration. CannTrust also has a venture with Apotex, a global generic drug maker, to develop marijuana medicine for use in up to 85 countries where Apotex already operates. If these efforts succeed, it could not only validate medical marijuana's use in a variety of indications, but drive CannTrust's revenue significantly higher. CannTrust sells marijuana to over 50,000 Canadian medical marijuana patients and sales to those patients totaled CA$12.6 million as of the quarter ending September 2018.

Tilray, a CannTrust competitor, is also conducting trials to prove medical marijuana's safe and effective.

In March, 2018, it signed an agreement with Novartis' Canadian generic drug subsidiary, Sandoz Canada, to leverage Sandoz existing relationships with pharmacists and physicians to market Tilray's medical marijuana products, develop "new and innovative medical cannabis products that offer an alternative to smokable/ combustible products", and "subject to future regulatory changes, Sandoz Canada, known for its supply reliability, will wholesale and distribute non-smokable/non-combustible Tilray products to Canadian hospitals and pharmacies."

In December 2018, that agreement was expanded into a worldwide deal with Sandoz AG, Novartis' global generic drug business.

IMAGE SOURCE: GETTY IMAGES.

Best marijuana growers

If you want to invest in companies that are the biggest growers and distributors of marijuana, you'll want to focus your attention on the biggest Canadian cannabis companies. Because of favorable laws, they've been able to build the scale and experience necessary to serve not only Canada, but also other countries that create marijuana markets, like Germany, where medical marijuana was legalized in 2017.

Company | Symbol | Market Cap | TTM Sales |

Canopy Growth | (NYSE: CGC) | $10.8 billion | $70.5 million |

Aurora Cannabis | (NYSE: ACB) | $5.8 billion | $57.6 million |

Aphria, Inc. | (NYSE: APHA) | $1.4 billion | $33.1 million |

Cronos Group | (NASDAQ: CRON) | $2.1 billion | $8.8 million |

TTM = Trailing 12 months. Data source: Yahoo!Finance as of 12/14/2018. Author's table.

Canada's leading market-share grower, distributor, and retailer is Canopy Growth Corporation. Its Canadian medical marijuana market share exceeds 30% and investments that are boosting its grow capacity position it to capture a similarly large share of the Canada's adult-use market, particularly following drink maker Constellation Brands decision to pay $4 billion for a 38% equity ownership stake in the company in 2018.

Canopy Growth can't participate in the U.S. recreational market until marijuana's legal federally, but it has shipped medical marijuana for use in medical research to the U.S. and it's actively pursuing sales in other countries, including Australia and Germany.

In Australia, Canopy's Spectrum Australia subsidiary is working with the Victoria State Government to cultivate marijuana domestically for medical use. The company and the Victorian State Government's plans include programs focusing on cannabis as medicine, including the development of new types of marijuana. Australia's government legalized medical marijuana in 2016, but only about 350 people had been given the green light to use it as of February 2018, so this market isn't moving the needle yet.

The situation is different in Germany, where the medical marijuana market has grown more quickly. Canopy Growth's Spektrum Cannabis GmbH is approved to import medical marijuana in Germany and it's distributing it to over 1,200 pharmacies. As a result, Germany accounts for 10% of Canopy Growth's sales as of Q3, 2018, up from 1% the prior year. Since Germany's population is double that of Canada, the opportunity there could be much bigger than Canada over time.

Canopy Growth's top competitor is Aurora Cannabis, a company that's been actively issuing shares to acquire competitors, including MedReleaf.

Like Canopy Growth, Aurora Cannabis wants to operate globally. It's targeting Australia and Germany and in 2018, it acquired ICC Labs, a South American marijuana company with a 70% market share in Uruguay. ICC Labs annualized quarterly sales in Uruguay -- the only country besides Canada where recreational marijuana is legal -- totaled less than a half million dollars in early 2018, but the deal is still important to investors because it gives Aurora Cannabis production capacity and expertise in the region and that could be valuable if South American countries pass pro-pot laws.

Eventually, Aurora Cannabis thinks it will be able to produce marijuana at below $1 per gram and if so, then it could become one of the industry's lowest cost producers. However, it remains to be seen how quickly falling costs can translate into meaningful profits per share because Aurora's share-based acquisitions have substantially increased its share count.

Two other top growers to consider are Aphria and Cronos Group. They're smaller than Canopy Growth and Aurora Cannabis, but their sales should still benefit from Canada's recreational market and global legalization.

The third-largest Canadian marijuana grower, Aphria started to expand internationally in 2018, but it drew criticism from short sellers who argue it overpaid for assets in Jamaica, Europe, Columbia, and Argentina. The short-sellers imply their may have been self-dealing, but Aprhia claims executives with ties to the acquired companies, including its CEO, recused themselves from the acquisition decision. Aphria's Board of Directors has launched an independent investigation into the acquisition process to confirm there wasn't any wrong doing, so investors will want to keep tabs on how that proceeds.

Nevertheless, Aphria's large-scale greenhouses and historically, low-cost production still puts it in contention as a top-grower to consider, particularly if those international purchases help it establish a global footprint.

Cronos Group is the smallest of these growers, but it may not be for too much longer because it secured a major investment from tobacco-giant Altria Group (NYSE: MO) in December 2018 that gives it the financial flexibility to invest in production, products, distribution, and international expansion.

Specifically, Altria paid Cronos Group $1.8 billion for a 45% equity stake and an option to increase its ownership by an additional 10% within four years. In addition to the cash, Cronos Group gets valuable regulatory, distribution, and marketing expertise from Altria that could come in handy in the U.S. if marijuana eventually becomes legal federally.

Since Canopy Growth and Cronos Group have already secured investments from global consumer goods companies, investors may want to keep an eye out to see if anyone comes knocking on the door of Aurora Cannabis and Aphria.

IMAGE SOURCE: GETTY IMAGES.

Top marijuana dispensary stocks

There's a lot of overlap between marijuana growers and marijuana retailers because most of the big growers, including Aurora Cannabis and Canopy Growth, are investing in physical and online retail stores to market their marijuana in Canada.

Company | Symbol | Market Cap | TTM Sales |

MedMen Enterprises | (NASDAQOTH: MMNFF) | $1.48 billion | $59.44 million |

Green Thumb Industries | (NASDAQOTH: GTBIF) | $1.47 billion | $48.9 million |

Liberty Health Sciences | (NASDAQOTH: LHSIF) | $259 million | $6.5 million |

TTM = Trailing 12 months. Data source: Yahoo! Finance as of 12/14/2018. Liberty's sales are year-to-date 2018. Author's table.

Those players, however, aren't involved in the U.S. market yet, so the U.S. market is highly fragmented with many small operators. One exception is MedMen, a 16-store marijuana company that went public via a reverse merger in 2018. A reverse merger is when a private company acquires a public company to become public more quickly. MedMen operates 8 locations in California, and California accounted for 92% of the company's $20.6 million in fiscal fourth-quarter 2018 revenue.

California's likely to be a big driver of MedMen's revenue in the future, but it's also expanding into new states, like Florida. It operates a medical marijuana delivery service in Florida and it plans to open four dispensaries, including one in Miami, soon if regulators OK them. Over time, MedMen's targeting 66 stores in 12 states that will serve about half of U.S. residents and if it delivers on that goal, its revenue may increase dramatically because it estimates the retail marijuana opportunity could reach $75 billion someday.

Green Thumb Industries and Liberty Health Sciences are smaller dispensary operators than MedMen, but they're also intriguing investment options.

Green Thumb operates 13 dispensaries in eight states that limit the number of dispensary licenses they issue, which should limit competition. Its plans include opening 36 more stores that sell marijuana and cannabis products it grows and manufacturers.

Liberty Health is a 7-dispensary Florida operator that was previously intertwined with Aphria. Aphria sold its stake in the company this year, however, because of rules preventing Canadian listed stocks from investing in marijuana businesses where it's illegal federally. If licensing goes its way, Liberty hopes to have 14 stores by early 2019 and it plans to open a store in Ohio with a venture partner in 2019, too.

IMAGE SOURCE: GETTY IMAGES.

How to invest in marijuana without buying pure pot stocks

There's an old Wall Street maxim that those who made the most money during the Gold rush weren't the gold miners, but the vendors who sold them their picks and shovels. If you prefer this approach to investing in the marijuana Green Rush, then Shopify, Scott's Miracle-Gro and KushCo Holdings should be top of mind.

These companies could make sense because overly optimistic growers could wind up planting too much cannabis, causing prices to drop and some growers to fail. Furthermore, these companies are more insulated against the risk of marijuana's novelty wearing off and demand faltering, steps backward toward prohibition, or the failure of any one marijuana company.

Company | Symbol | Market Cap | TTM Sales |

Shopify, Inc. | (NYSE: SHOP) | $15.7 billion | $952 million |

Scott's Miracle-Gro | (NYSE: SMG) | $3.6 billion | $2.67 billion |

KushCo Holdings | (NASDAQOTH: KSHB) | $438 million | $52.1 million |

TTM= trailing 12 months. Data source: Yahoo!Finance as of 12/14/2018. Author's table.

An e-commerce cloud-platform that sells solutions to retailers that help them manage their digital and physical footprints, Shopify's sales come from recurring monthly subscription fees and transaction-based fees. Marijuana represents a tiny fraction of its revenue, but it could become a more meaningful contributor to this company's success in the future.

For instance, Canada's biggest marijuana market is Ontario and when the adult-use market went live there in October, Shopify's platform was the one that was managing the behind-the-scenes sales and inventory tracking. Shopify also has a deal to manage e-commerce sales for HEXO in Canada and The Green Organic Dutchman (TSX: TGOD) worldwide. As more dispensaries open in Ontario and e-commerce marijuana sales increase elsewhere, it could provide a nice boost to Shopify's financial performance.

Scott's Miracle-Gro is best known for grass seed and fertilizer, but it's been actively acquiring companies that sell products to marijuana growers, such as hydroponics. It's notable acquisitions include the greenhouse ventilation company Can-Filters, the hydroponics plant nutrients supplier, Botanicare, and the greenhouse lighting company, Gavita. These acquistiions have helped turn the company's Hawthorne division into one of the largest marijuana equipment and supplies vendors. Hawthorne isn't immune to the risk of individual growers failing, but annual revenue exceeding $250 million per year only accounts for less than 10% of Scott's Miracle-Gro's companywide revenue.

Unlike Scott's Miracle-Gro, KushCo Holdings trades on the over-the-counter market and it gets all of its revenue from the marijuana industry. KushCo sells marijuana packaging, including childproof bottles and tubes for rolled products, to over 5,000 marijuana growers, distributors, and retailers worldwide. Because of rising demand for packaging that adheres to regulatory guidelines and acquisitions, KushCo's revenue more than doubled in fiscal 2018 and sales are expected to double again in fiscal 2019.

To capitalize on recreational sales in Canada, KushCo's created a Canadian subsidiary and to capture sales in new markets on the East Coast, it opened a new facility in Massachusetts, where dispensaries opened for the first time in November 2018. KushCo has also moved into new markets including vaporizers and gas and solvents used to extract cannabis oils for concentrates. It also acquired a marijuana marketing company in 2018.

What is a marijuana ETF?

If individual stocks aren't right for your portfolio, there are also exchange-traded funds (ETF) that investors can buy to gain exposure to the emerging industry.

ETFs are pooled-investment funds that combine small investments from many individual investors together to gain broader exposure to a sector, industry, or specific investment theme. In this way, they're similar in this way to mutual funds, however, unlike mutual funds, ETFs can be bought or sold throughout the day like individual stocks.

The two largest marijuana ETFs are the Horizons Marijuana Life Sciences Index ETF (TSX: HMMJ) and the ETFMG Alternative Harvest ETF (NYSEMKT: MJ).

Horizon's ETF tracks Arcview's North American Marijuana Index and it trades on the Toronto Stock Exchange and on the over-the-counter market in the U.S. ETFMG's Alternative Harvest ETF tracks the Prime Alternative Harvest Index and it trades on the NYSE. A word of caution, though. The expense ratios for these funds are higher than many other ETFs and their holdings change regularly, so investors will want to research them carefully.

A risky market full of pops and drops

Make no mistake: Marijuana stock investing is risky. It's only early innings for this emerging market and valuations for many of these market participants have skyrocketed in recent years to levels where many industry watchers think they already reflect a lot of the industry's potential. As this market matures, many companies are likely that fall shy of forecasts or fail, resulting in big losses for investors.

Nevertheless, the potential for widespread adoption of pro-pot laws in the U.S., Europe, and elsewhere makes marijuana stocks compelling long-haul investments for risk-tolerant investors. In 15 years, Constellation Brands estimates legal marijuana sales could total more than $200 billion globally and if that forecast is anywhere near correct, it will mean some of these companies have a shot a valuations in excess of $100 billion. Picking the winners won't be easy, though, so investors are probably best off diversifying their exposure to the industry across several of these top marijuana stocks.

More From The Motley Fool

Todd Campbell owns shares of KushCo Holdings and Shopify. His clients may have positions in the companies mentioned. The Motley Fool owns shares of and recommends Shopify. The Motley Fool owns shares of Molson Coors Brewing. The Motley Fool recommends CannTrust Holdings Inc, Constellation Brands, Hexo., and KushCo Holdings. The Motley Fool has a disclosure policy.