Best NYSE Energy Dividend Paying Companies

Given the energy industry’s dependence on commodity prices, the sector tends to be cyclical and profitability can be highly variable. However, as oil prices recover from lows in 2014, energy stocks have benefited through increased profitability and cash flows. Subsequently, shareholders have growing expectations that dividend payments could increase as cash flow recovers at these companies. If you’re a buy-and-hold investor, these healthy dividend stocks in the energy industry can generously contribute to your monthly portfolio income.

Valero Energy Partners LP (NYSE:VLP)

VLP has a substantial dividend yield of 4.32% and the company has a payout ratio of 46.45% , and analysts are expecting a 84.07% payout ratio in the next three years. VLP’s dividend is not only above the low risk savings rate, but also amongst the top dividend payers in the market. Valero Energy Partners also reported a strong double digit earnings growth of 44.66% over the past 12 months.

Holly Energy Partners, L.P. (NYSE:HEP)

HEP has a enticing dividend yield of 7.94% and their payout ratio stands at 161.08% . The company’s DPS have increased from $1.43 to $2.58 over the last 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend.

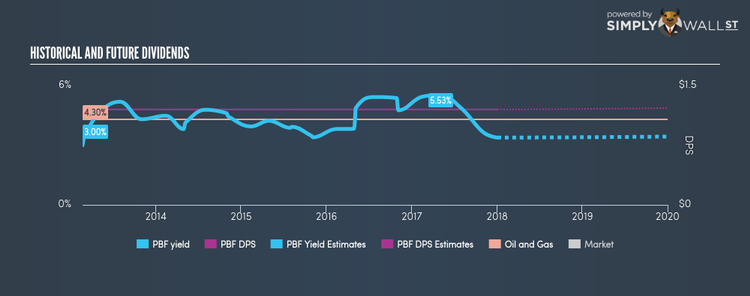

PBF Energy Inc. (NYSE:PBF)

PBF has a good-sized dividend yield of 3.38% and has a payout ratio of 56.57% . Besides the potential capital gains, PBF’s yield alone is better than the low risk savings rate. Plus, a 3.38% yield places it amidst the market’s top dividend payers.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.