Best Stock to Buy Right Now: Home Depot vs. Lowe's

The conversation around home improvement stores in America begins and ends with The Home Depot (NYSE: HD) and Lowe's Companies (NYSE: LOW). They are the country's two dominant home improvement retailers by a wide margin.

Consider that the home improvement store market was roughly $258 billion last year, and these two companies combined for $244 billion in trailing-12-month sales. Yeah, this is a clash between two top dogs.

But which stock is the better buy? I put each through the paces to determine which business is performing better, then compared their valuations to see which is the best bang for your buck. You're going to want to see the result.

Deciding which business is better managed

Generally speaking, Home Depot and Lowe's are very similar companies. They each operate a network of stores where they sell materials, tools, appliances, and services to homeowners and professional contractors. E-commerce also hasn't been the existential threat it's been for other retailers. Each company has utilized its store network for distribution, successfully bringing its business online.

However, the complexity of the supply chain and the challenge to manage costs could be where one pulls ahead of the other. So, to examine this, investors can look at what each company is generating as a return on invested capital (ROIC). In other words, how efficiently do these companies make money?

Interestingly, Home Depot has long held an advantage here. The companies are virtually tied today, but investors may want Lowe's to sustain it longer.

A high ROIC is excellent, but what a company pays for its capital, called the weighted average cost of capital, or WAAC, is just as important. Each company's estimated WAAC is:

Home Depot: 9.31%

Lowe's: 8.06%

It's not a huge difference, but one can argue that Lowe's is currently generating a similar ROIC on capital while paying 14% less than Home Depot. That can add up over time. Lowe's gets a slight edge for now, but since Home Depot has done it for longer, this is splitting hairs more than anything.

Can one company return more money to shareholders?

As companies mature, they shift from reinvesting every dollar back into the business for growth to returning profits to shareholders, often by repurchasing shares or paying dividends. Home Depot and Lowe's are mature businesses, so this is important for long-term investors.

Both companies repurchase shares to lower their share count, which helps boost earnings-per-share (EPS) growth because profits are spread across fewer shares. Over the past 10 years, Home Depot has reduced its shares by 28%, while Lowe's has lowered it by 44%.

Home Depot and Lowe's also both pay dividends, and coincidentally, their dividend payout ratios are virtually identical at 46% and 47% of their respective cash flows. They also have similar dividend yields (2% versus 2.3%), close enough to a tie.

Lowe's has repurchased more shares, but Home Depot could have more financial flexibility moving forward because it has a healthier balance sheet. Lowe's has $36 billion in long-term debt, roughly 2.6 times its earnings before interest, taxes, depreciation, and amortization (EBITDA). That's beyond the 2.5 ratio I generally look for, which could become a concern if it keeps rising. Meanwhile, Home Depot is comfortably lower at just 1.6 times its EBITDA on $42 billion in long-term debt.

Too much debt can paint a company in a corner, so it's something long-term investors should follow.

Can Home Depot or Lowe's stretch your investment dollars further?

Both companies are fantastic stocks. As you can see, both have stellar fundamentals with minor differences. Ultimately, this battle came down to valuation, where a winner emerged.

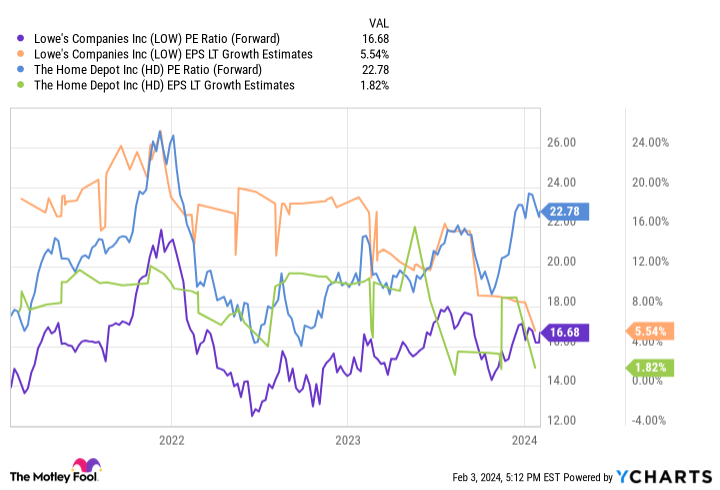

Despite having similar businesses and fundamentals, Home Depot trades at a premium to Lowe's. Their respective forward P/E ratios are just under 23 and 17, respectively. Both companies benefited a couple of years ago when pandemic stimulus checks boosted consumer spending.

Today, each is giving back some of that growth, and analysts have each company posting slow earnings growth until spending picks up again. That's understandable, but analysts are more optimistic about earnings growth at Lowe's (the far-cheaper stock) than at Home Depot.

This race would be too close to call, but the sizable gap between what the market commands for each stock makes Lowe's the winner and better buy right now.

Should you invest $1,000 in Lowe's Companies right now?

Before you buy stock in Lowe's Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lowe's Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Lowe's Companies. The Motley Fool has a disclosure policy.

Best Stock to Buy Right Now: Home Depot vs. Lowe's was originally published by The Motley Fool