Best Undervalued Energy Stocks in May

Energy stocks, such as Matachewan Consolidated Mines and High Arctic Energy Services, are trading at a value below what they may actually be worth. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. If you’re looking for capital gains in your next investment, I suggest you take a look at my list of potentially undervalued stocks.

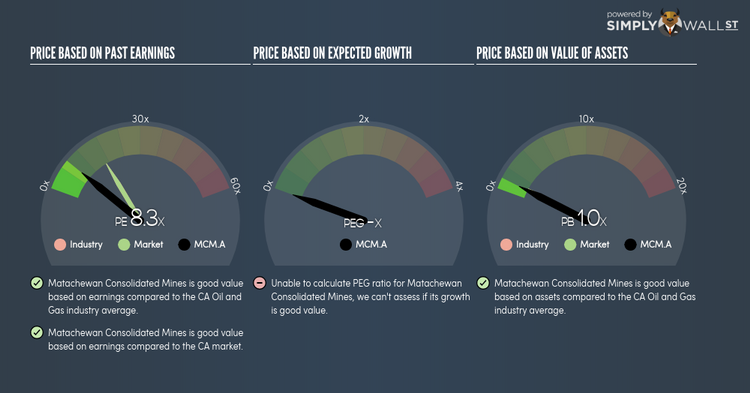

Matachewan Consolidated Mines, Limited (TSXV:MCM.A)

Matachewan Consolidated Mines, Limited, a natural resource company, invests in various petroleum interests and mineral resource properties in Canada. Matachewan Consolidated Mines is headed by CEO Richard McCloskey. With a current market cap of CAD CA$3.55M, we can put MCM.A in the small-cap group

MCM.A’s stock is currently hovering at around -51% lower than its actual level of $0.58, at the market price of CA$0.28, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy MCM.A shares at a low price. In addition to this, MCM.A’s PE ratio is trading at around 8.28x compared to its Oil and Gas peer level of, 16.78x suggesting that relative to its comparable set of companies, MCM.A’s stock can be bought at a cheaper price. MCM.A is also robust in terms of financial health, as short-term assets amply cover upcoming and long-term liabilities. It’s debt-to-equity ratio of 26.24% has been declining for the past few years signifying MCM.A’s capability to reduce its debt obligations year on year. Interested in Matachewan Consolidated Mines? Find out more here.

High Arctic Energy Services Inc (TSX:HWO)

High Arctic Energy Services Inc. provides oilfield services in Canada and Papua New Guinea. Formed in 1993, and currently headed by CEO J. Bailey, the company provides employment to 711 people and with the market cap of CAD CA$211.35M, it falls under the small-cap group.

HWO’s shares are now floating at around -41% below its real value of $6.81, at a price of CA$3.99, based on my discounted cash flow model. The difference between value and price signals a potential opportunity to buy HWO shares at a discount. What’s even more appeal is that HWO’s PE ratio stands at around 10.47x against its its Energy Services peer level of, 24.36x indicating that relative to other stocks in the industry, we can purchase HWO’s shares for cheaper. HWO is also in great financial shape, with near-term assets able to cover upcoming and long-term liabilities. HWO also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. More detail on High Arctic Energy Services here.

Tidewater Midstream and Infrastructure Ltd. (TSX:TWM)

Tidewater Midstream and Infrastructure Ltd. The company was established in 2015 and has a market cap of CAD CA$424.53M, putting it in the small-cap group.

TWM’s shares are now floating at around -49% under its actual value of $2.57, at a price tag of CA$1.30, based on my discounted cash flow model. The discrepancy signals an opportunity to buy low.

TWM is also a financially healthy company, as short-term assets amply cover upcoming and long-term liabilities.

More on Tidewater Midstream and Infrastructure here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.