Best Value Stocks to Buy for August 3rd

Here are three stocks with buy rank and strong value characteristics for investors to consider today, August 3rd:

Regional Management Corp. RM: This diversified consumer finance company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.9% over the last 60 days.

Regional Management Corp. Price and Consensus

Regional Management Corp. price-consensus-chart | Regional Management Corp. Quote

Regional Management has a price-to-earnings ratio (P/E) of 7.74, compared with 10.40 for the industry. The company possesses a Value Score of A.

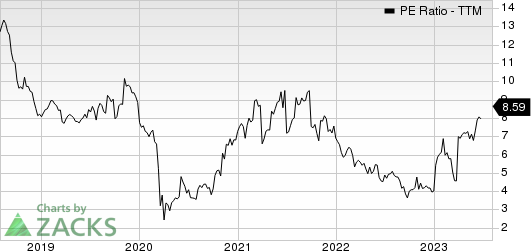

Regional Management Corp. PE Ratio (TTM)

Regional Management Corp. pe-ratio-ttm | Regional Management Corp. Quote

Heidrick & Struggles International, Inc. HSII: This executive search and management consulting company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.6% over the last 60 days.

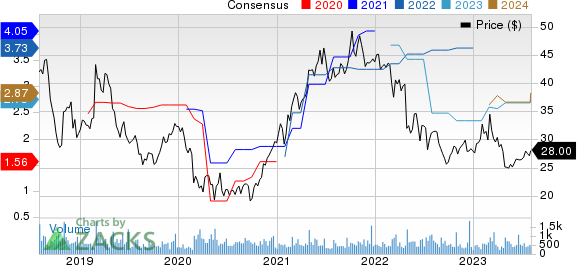

Heidrick & Struggles International, Inc. Price and Consensus

Heidrick & Struggles International, Inc. price-consensus-chart | Heidrick & Struggles International, Inc. Quote

Heidrick & Struggles has a price-to-earnings ratio (P/E) of 10.24, compared with 14.10 for the industry. The company possesses a Value Score of B.

Heidrick & Struggles International, Inc. PE Ratio (TTM)

Heidrick & Struggles International, Inc. pe-ratio-ttm | Heidrick & Struggles International, Inc. Quote

Alibaba Group Holding Limited BABA: This Chinese e-commerce giant carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2% over the last 60 days.

Alibaba Group Holding Limited Price and Consensus

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

Alibaba has a price-to-earnings ratio (P/E) of 12.39, compared with 21.36 for the industry. The company possesses a Value Score of B.

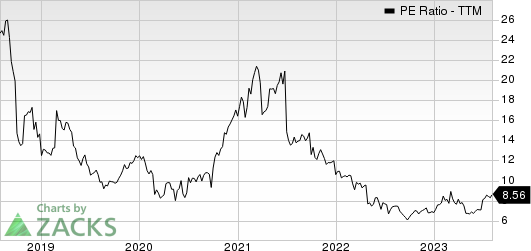

Alibaba Group Holding Limited PE Ratio (TTM)

Alibaba Group Holding Limited pe-ratio-ttm | Alibaba Group Holding Limited Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regional Management Corp. (RM) : Free Stock Analysis Report

Heidrick & Struggles International, Inc. (HSII) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report