Best Value Stocks to Buy for August 9th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, August 9th:

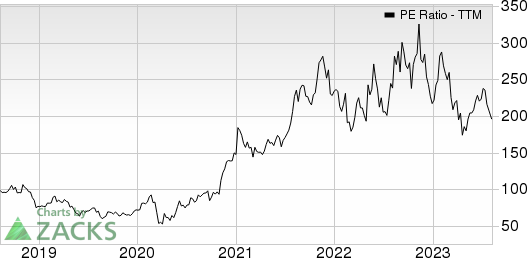

Albemarle ALB: This company which is a premier specialty chemicals company with leading positions in attractive end markets globally, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.5% over the last 60 days.

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Albemarle has a price-to-earnings ratio (P/E) of 7.76 compared with 15.60 for the industry. The company possesses a Value Score of A.

Albemarle Corporation PE Ratio (TTM)

Albemarle Corporation pe-ratio-ttm | Albemarle Corporation Quote

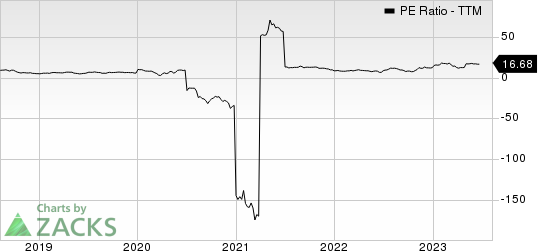

Commercial Vehicle Group CVGI: This company which is a supplies interior system, vision safety solutions and other cab-related products for the global commercial vehicle market, including the heavy-duty (Class 8) truck market, the construction market and other specialized transportation markets, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.4% over the last 60 days.

Commercial Vehicle Group, Inc. Price and Consensus

Commercial Vehicle Group, Inc. price-consensus-chart | Commercial Vehicle Group, Inc. Quote

Commercial Vehicle Group has a price-to-earnings ratio (P/E) of 10.11 compared with 11.10 for the industry. The company possesses a Value Score of A.

Commercial Vehicle Group, Inc. PE Ratio (TTM)

Commercial Vehicle Group, Inc. pe-ratio-ttm | Commercial Vehicle Group, Inc. Quote

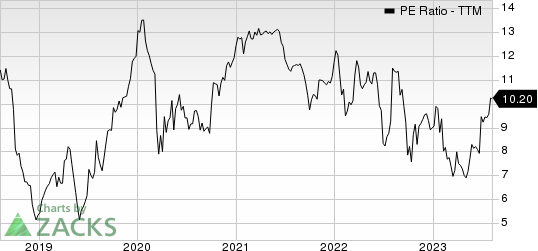

TTM Technologies TTMI: This company which is a leading global printed circuit board manufacturer, focusing on quick-turn and volume production of technologically advanced PCBs, backplane assemblies and electro-mechanical solutions, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.7% over the last 60 days.

TTM Technologies, Inc. Price and Consensus

TTM Technologies, Inc. price-consensus-chart | TTM Technologies, Inc. Quote

TTM Technologies has a price-to-earnings ratio (P/E) of 13.89 compared with 21.10 for the industry. The company possesses a Value Score of A.

TTM Technologies, Inc. PE Ratio (TTM)

TTM Technologies, Inc. pe-ratio-ttm | TTM Technologies, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

TTM Technologies, Inc. (TTMI) : Free Stock Analysis Report

Commercial Vehicle Group, Inc. (CVGI) : Free Stock Analysis Report