Best Value Stocks to Buy for March 3rd

Here are three stocks with buy rank and strong value characteristics for investors to consider today, March 3rd:

FS Bancorp FSBW: This company operates as a bank holding company for 1st Security Bank of Washington that provides banking and financial services to local families, local and regional businesses, and industry niches, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.7% over the last 60 days.

FS Bancorp, Inc. Price and Consensus

FS Bancorp, Inc. price-consensus-chart | FS Bancorp, Inc. Quote

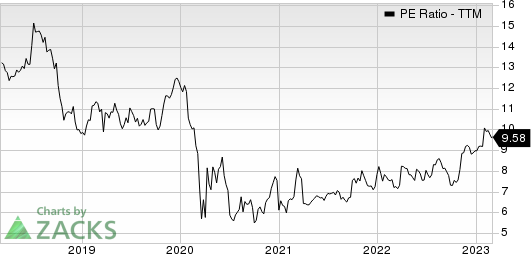

FS Bancorp has a price-to-earnings ratio (P/E) of 7.40 compared with 10.00 for the industry. The company possesses a Value Score of A.

FS Bancorp, Inc. PE Ratio (TTM)

FS Bancorp, Inc. pe-ratio-ttm | FS Bancorp, Inc. Quote

Centrais Eltricas Brasileiras EBR: This company which is involved in the generation and distribution of electric power through its subsidiaries to the whole of Brazil, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.6% over the last 60 days.

Centrais Eltricas Brasileiras SA Price and Consensus

Centrais Eltricas Brasileiras SA price-consensus-chart | Centrais Eltricas Brasileiras SA Quote

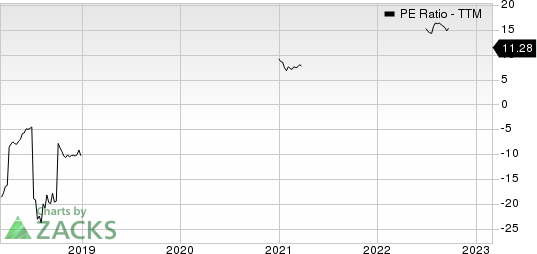

Centrais Eltricas Brasileiras has a price-to-earnings ratio (P/E) of 6.56 compared with 9.70 for the industry. The company possesses a Value Score of A.

Centrais Eltricas Brasileiras SA PE Ratio (TTM)

Centrais Eltricas Brasileiras SA pe-ratio-ttm | Centrais Eltricas Brasileiras SA Quote

Betterware de Mexico SAPI de C BWMX: This direct-to-consumer company in Mexico with a product portfolio which includes home solutions, kitchen and food preservation, technology and mobility, bedroom, bathroom, laundry and cleaning, and other categories, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.4% over the last 60 days.

Betterware de Mexico SAPI de C Price and Consensus

Betterware de Mexico SAPI de C price-consensus-chart | Betterware de Mexico SAPI de C Quote

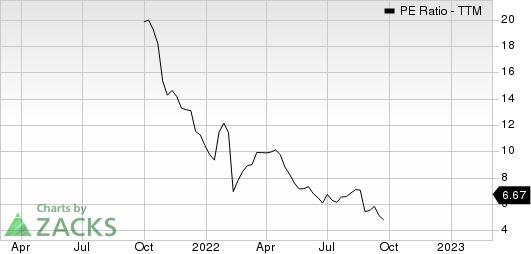

Betterware de Mexico SAPI de C has a price-to-earnings ratio (P/E) of 6.85 compared with 14.20 for the industry. The company possesses a Value Score of A.

Betterware de Mexico SAPI de C PE Ratio (TTM)

Betterware de Mexico SAPI de C pe-ratio-ttm | Betterware de Mexico SAPI de C Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Centrais El?tricas Brasileiras SA (EBR) : Free Stock Analysis Report

FS Bancorp, Inc. (FSBW) : Free Stock Analysis Report

Betterware de Mexico SAPI de C (BWMX) : Free Stock Analysis Report