Is This The Best Way To Play The $700 Billion EV Boom?

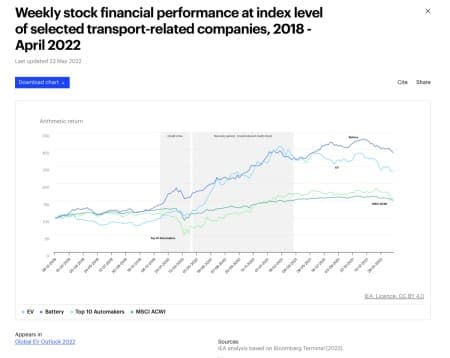

Electric vehicle sales are set for a 35% year-on-year increase in 2023, with national policies and incentives providing further impetus for producers and consumers. So far, overall, this has been rewarding for investors.

While the top 14 EV stocks had a market capitalization representing only 13% of that of the Top 10 vehicle manufacturers as of the end of 2019, they still managed to outperform them. That trend continued through last year, both with EV and battery stocks.

Electric car sales exceeded 10 million units in 2022, with their market share steadily climbing, from less than 5% of new cars sold in 2020 to 14% in 2022. In the first quarter of this year, we already saw a 25% jump in sales, year-on-year.

But this space has become extremely crowded, resulting in a price war that is making investors uneasy.

It’s time to find a new niche in the EV segment where first-movers have a very clear advantage: electric boating, where innovators hope to take the EV revolution off-road.

The waterways are going electric, too.

That’s why the next big thing in racing is all-electric, with NFL superstar Tom Brady joining the UIM E1 World Championship with ownership of an electric boat racing team. The inaugural season of the EV boating world championship is set to launch in early 2024.

The electric boat playing field is far less chaotic and crowded, and the first-mover advantage goes to Vision Marine Technologies (NASDAQ:VMAR), which offers a proprietary PowerTrain outboard motor that is being used in the launch of the fastest electric speedboat in its class on the market.

The newly unveiled H2e Bowrider speed boat took the Paris Boat Show by storm in December, and made its official debut in February in Miami, with deliveries expected to start this summer.

The boat, developed in partnership with Four Winns, is special because it showcases VMAR’s E- Motion 180 HP electric outboard motor.

That motor, with proprietary PowerTrain technology, makes the H2e Bowrider the first all-electric series production bowrider on the market.

The company is expecting first revenues from PowerTrain this year and is aggressively pursuing an electric disruption to the boat rental market, with franchise plans well underway. While it’s been all about build-out and launch over the past couple of years, VMAR is positioned to be free-cash-flow positive next year, and it’s not burning cash like its road warrior brethren.

The Sound of Silence Opportunity

The global electric boat market was valued at $5 billion in 2021, and is projected to reach $16.6 billion by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

Narrowing that down by type, the 40-foot electric boat market alone is worth $1.9 billion as of 2023, and is set to hit $4.93 billion by 2030 for a growth rate of 14.6% during that time period.

As we speak, the multi-billion-dollar boat battery market is undergoing its biggest transition since the invention of the boat motor itself. Not only is the marine battery market forecast to grow by 18.6% to 2030, but it represents a $2-billion opportunity for investors over the next five years.

And while climate change is a key element propping up the electric boating industry, it’s not the only ‘attraction’:

Electric boats are quiet. They completely change the boating aesthetic by removing the sound of the loud outdoor motor, which overwhelms all other sound at sea.

They’re safe, too. There’s no risk of gasoline leaks or carbon monoxide poisoning common with internal combustion engines.

The consensus seems to be that electric boat motors, by design, are more robust than their loud and dirty predecessors, and they also require a lot less frequent maintenance than a gasoline engine. They’re cheaper to operate over the long-run: No oil changes, no filters or tune-ups, and while combustion engines require maintenance every 100 hours, electric motors (on average) can go up to 3,000 hours

The World’s Most Powerful Electric PowerTrain

Vision Marine’s E-Motion is the first fully electric, production-ready, high-performance 180 HP outboard motor on the market.

The 180E Electric Powertrain can provide a consistent 180 HP of pure electric power, with cutting-edge high voltage power when you need it most, and a completely scalable powerbank.

The proprietary technology is end-to-end: It includes the batteries, the engine and the software, making it the only turn-key solution for boat manufacturers in its class.

The E-Motion outboard motor can fully charge overnight with no additional infrastructure and boasts the highest horsepower engine in its class. And from a cost perspective, it out-competes everyone else, which should help it to capture new market share.

Vision Marine’s (NASDAQ:VMAR), E-Motion motor isn’t confined to speedboats, either; they’re turning pontoon boats into faster, better and cleaner versions of themselves.

VMAR is in the process of equipping a pontoon with electric propulsion and solar panels for the longest known electric boat run in America (and possibly in the world). VMAR’s Zenith pontoon will set off in Virginia on a 1,050-nautical-mile journey to Miami, Florida, to showcase the capabilities of sustainable electric power.

How they plan to market the E-Motion Powertrain is the part that should sound more attractive to investors who may or may not have been taken for a wild ride with EV investments. VMAR isn’t trying to manufacturer its own boats, which would mean burning through cash at an untenable rate (just like all the smaller EV companies right now). Instead, it’s marketing E-Motion to OEMs (original equipment manufacturers), and they’ve already received an impressive volume of orders.

Last September, right out of the gate, VMAR received and initial purchase order from the North America’s Limestone Boat Company for $2 million worth (25 units) of E-Motion 180E outboard motors and Powertrain systems. Limestone is now moving into scheduled production, with delivery target to dealers set to begin in 2024.

But the bigger picture is this: VMAR’s proprietary electric motor and powertrain system turns any boat into an electric boat, which makes its strategy to sell motors (not boats) to OEMs an incredibly savvy one in a market flooded with EV makers who are spending more money than they might ever make.

A Second, Disruptive Revenue Chain

VMAR also plans to plug in the boat rental market.

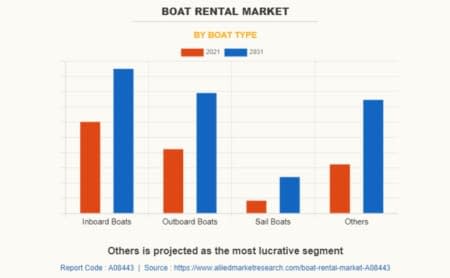

The global boat rental market (across all boat types) was valued at $18.2 billion in 2021, and is projected to reach $31.2 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031. It’s a huge market that is about to go electric.

And, again, VMAR has first-mover advantage.

VMAR’s flagship Newport business managed to serve 300,000 clients in the first three years, annualizing $4 million in revenues with a 35% profit margin.

For 2023, Vision Marine will be rolling out two more fully-owned electric boat rental locations and launching their franchise model.

By 2024, it’s expected to be full speed ahead with scaling.

The company’s proprietary technology gives it the opportunity to become one of the NASDAQ’s most exciting EV plays.

By the end of 2024, Vision Marine (NASDAQ:VMAR), expects to be free-cash-flow positive, and by 2025, it expects to have two profitable and growing divisions, after which the scaling is expected to gain further momentum.

Other companies to keep an eye on:

Applied Materials (NASDAQ: AMAT) is a prominent player in the chip manufacturing and research sector. As the leading chip fabrication equipment maker, the company supplies advanced machinery to semiconductor production factories. Despite being overshadowed by other tech stocks, Applied Materials' significance in the industry cannot be ignored. The company's recent announcement about investing up to $4 billion in the EPIC Center demonstrates its commitment to testing new semiconductor technology and fostering industry collaboration.

Notable partners, including Nvidia, Taiwan Semiconductor Manufacturing, AMD, and Intel, have expressed excitement about this initiative. The company's adaptability to focus on high-growth segments, such as chip fabs for electric vehicles and industrial technology, has contributed to a 6% increase in revenue and 7% rise in EPS in its most recent quarter. With shares trading at an appealing valuation, Applied Materials is an attractive prospect for investors looking for exposure to the chip sector's potential.

Alphabet Inc. (NASDAQ: GOOGL) remains a powerhouse in the tech industry despite a recent slowdown in revenue growth. With a dominant 92.8% share of the search market and a growing presence in the cloud market through Google Cloud Platform (GCP), Alphabet demonstrates its strong position. The company's diverse revenue streams, including digital advertising, cloud infrastructure, and streaming services, provide a solid foundation for future growth.

Additionally, Alphabet's commitment to innovation, integrating AI into various products and ventures like Waymo's autonomous driving, keeps the company at the forefront of technological advancements. Trading at approximately 17 times projected earnings in 2024 and with a projected annual increase of over 16% in per-share profits over the next five years, Alphabet offers an attractive investment opportunity for those seeking long-term growth prospects.

Apple (NASDAQ: AAPL), with a market capitalization of $2.8 trillion, stands as one of the most significant tech giants. The company's services segment, including Apple Music, Apple Pay, and Apple TV+, has witnessed remarkable growth and contributes to both financials and customer loyalty. Seamless integration between Apple's hardware and software ecosystem, combined with a vast user base of over 2 billion active Apple devices, fosters strong customer stickiness.

Apple's pricing power is evident, as it successfully raises prices for flagship products like the iPhone without significant demand impact. The company generates substantial free cash flow, enabling it to return capital to shareholders through share repurchases and dividends. With proven resilience and a history of sustained growth, Apple remains an appealing choice for investors looking for a compelling long-term holding in the tech industry.

Amazon (NASDAQ: AMZN) continues to dominate the e-commerce space with a commanding 38% share of online retail shopping in the U.S. The company's logistics and distribution capabilities further solidify its position as an industry leader. Additionally, Amazon's cloud infrastructure arm, Amazon Web Services (AWS), holds a substantial 32% share of the cloud market, benefitting from the growing demand for on-demand cloud services. AWS's impressive operating margin of 28% contributes significantly to Amazon's overall profitability. The company's digital advertising business is also thriving, with a 23% increase in sales in the first quarter, making Amazon a strong player in the advertising space. With strategic investments in AI, exemplified by the launch of Bedrock within AWS, Amazon is well-prepared to leverage emerging technologies and maintain its market dominance. Trading at an attractive valuation and with multiple growth drivers, Amazon presents an enticing opportunity for investors looking for a market leader with a focus on AI initiatives.

Meta Platforms (NASDAQ: META), formerly known as Facebook, has witnessed soaring stock prices, gaining nearly 120% in 2023. Despite already being a dominant player, the company continues to experience impressive growth, with 3.81 billion monthly active users across its Family of Apps. Meta's potential to monetize users outside the U.S. and Canada provides room for further revenue expansion. Reports suggest the company may be developing a decentralized alternative to Twitter, showcasing its commitment to innovation. Moreover, Meta's strong focus on leveraging artificial intelligence to enhance content recommendations and boost monetization positions it well for upcoming technological shifts. With a solid financial position, maintaining an average operating margin of 36.2% over the past five years and generating substantial free cash flow, Meta has the resources to drive further growth. These factors make Meta an appealing option for investors seeking a strong and forward-looking player in the social media and AI landscape.

IBM (NYSE: IBM), a tech giant with a history of resilience, has demonstrated consistent sales growth despite challenging market conditions. Its recent strategic restructuring efforts, including divestments and simplification of business segments, aim to streamline operations and fuel future growth. IBM's cloud business, especially through its subsidiary Red Hat, has been expanding, benefiting from a hybrid cloud approach that capitalizes on open-source software.

Leveraging its portfolio of AI services, IBM is well-positioned to tap into the growing AI market. Improving margins and rising cash flows, driven by cost-cutting measures and strategic initiatives, provide the company with ample resources to invest in hybrid cloud and AI sectors. With a focus on key growth areas and a solid financial footing, IBM is a potential candidate for investors seeking a resilient and innovative tech company.

Please note that the information presented here is not financial advice and should not be considered as such. Investing in the stock market carries inherent risks, and it's essential to conduct thorough research and seek advice from a qualified financial professional before making any investment decisions.

Microsoft (NASDAQ: MSFT) stands as a diverse tech powerhouse with renowned brands like Windows, Office, Xbox, and LinkedIn. Its leadership across various tech sectors has translated into remarkable stock growth, making it an attractive investment option. Microsoft's strategic foray into artificial intelligence (AI) has further strengthened its investment appeal. The company's early investments in OpenAI, totaling $11 billion, have positioned it as a leader in the burgeoning AI market.

By integrating OpenAI's technologies across its platforms, Microsoft has become a go-to provider of AI services. Collaborations with Advanced Micro Devices (AMD) in AI chip development demonstrate the company's dedication to optimizing AI offerings and performance. Furthermore, Microsoft's success in the gaming industry with Xbox Game Pass, a subscription-based service with access to a vast library of games, has attracted millions of subscribers and transformed the Xbox console into a cost-effective option. With Microsoft's track record of growth and continuous innovation, it remains a compelling choice for investors seeking stability and long-term potential in the tech sector.

Cisco Systems Inc (NASDAQ: CSCO) is a networking giant specializing in networking hardware, telecoms equipment, and IT services and products. The company's strong financial position, with $23.3 billion in cash and equivalents plus short-term investments, provides opportunities for potential acquisitions and growth.

Cisco's focus on artificial intelligence software and a shift towards subscription-based software and services contribute to its long-term growth prospects. The company has shown decent performance in 2023, with a year-to-date rise of approximately 10%, driven by growth in its core networking business and improved supply chain conditions.

Cisco's recent revision of full-year guidance, anticipating higher sales growth, indicates strong demand, particularly in the commercial and enterprise sectors. With a solid 3% dividend yield, Cisco is considered by many investors as a strong long-term hold with limited downside risk.

Shopify (NYSE: SHOP), a notable player in the e-commerce software industry, has exhibited signs of recovery and is poised for brighter days ahead. The company reported impressive financial figures in the first quarter of 2023, with revenue and monthly recurring revenue (MRR) increasing significantly year-over-year. MRR provides Shopify with a stable and predictable revenue stream, essential for subscription-based businesses.

With a strategic decision to focus on its core e-commerce software offerings, Shopify aims to enhance its gross profit margin and allocate resources efficiently. This renewed focus on e-commerce software, coupled with its solid track record, makes Shopify a potential candidate to deliver substantial value to investors in the long run.

Advanced Micro Devices, Inc. (NASDAQ: AMD) presents a compelling case for investors seeking exposure to the semiconductor industry. While competing against industry giants like Nvidia, AMD offers significant upside potential and a less risky investment option. The company's continuous efforts to capture market share from Intel in the CPU markets for computers and servers, as well as challenging Nvidia in the AI space, position it well for future growth. AMD's partnership with Microsoft in AI chip development and subsequent launch of the MI300 accelerator processing unit demonstrate its commitment to driving performance and data center growth. The company's potential for market share gains, positive demand catalysts, and AI-related partnerships make it an enticing investment opportunity in the semiconductor sector.

As always, it's important for investors to conduct thorough research and consult with financial professionals before making any investment decisions. The stock market carries inherent risks, and individual circumstances and risk tolerance should be taken into consideration when making investment choices.

By. Josh Owens

IMPORTANT NOTICE AND DISCLAIMER

This communication is a paid advertisement. Oilprice.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is occasionally paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Vision Marine Technologies Inc (NASDAQ:VMAR) to conduct investor awareness advertising and marketing. Vision Marine paid the owner of Oilprice.com an out-of-the-money Common Share Purchase Warrant entitling the owner of Oilprice to purchase 250,000 shares of common stock between August 21, 2023 and February 21, 2026 at a price of USD $4.21 per share. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in such articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured company and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http:// Oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http:// Oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.