Bet on These 3 Juicy Dividend Yielding Energy Stocks

The price of West Texas Intermediate crude is trading above $85 per barrel. The favorable crude price is making the exploration and production business extremely profitable. This, in turn, will increase production volumes of crude oil. In the United States, crude production this year will be 12.78 million barrels per day (MMBbl/D), suggesting an increase from 11.91 MMBbl/D last year, projected by the U.S. Energy Information Administration.

Higher production will boost demand for midstream assets as more volumes of the commodities will get transported and stored. Also, the increasing consumption of motor gasoline and jet fuel this year is aiding refiners.

Given the backdrop, it is the ideal time for investors to allocate money to prospective energy stocks offering attractive dividend yields. We are employing our proprietary Stock Screener to zero in on three such names that are well-poised to gain. One of the stocks carries a Zacks Rank #2 (Buy), while the other two sport a Zacks Rank #1 (Strong Buy). All the stocks offer juicy dividend yields that are higher than the energy sector’s 3.6% yield.

3 Stocks in the Spotlight

Kinder Morgan, Inc. KMI generates stable and handsome fee-based revenues as it is the leading midstream service provider in North America. Its extensive pipeline network spans 82,000 miles and is used for transporting a variety of products, including natural gas, refined petroleum products, crude oil, and more.

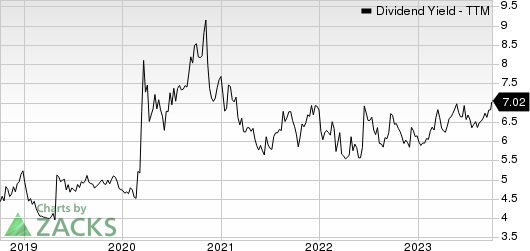

The dividend yield picture of the Zacks #2 Ranked stock looks bright, with its current yield being 7%. The metric has consistently been higher than the sector over the past year. (Check Kinder Morgan’s dividend history here).

Kinder Morgan, Inc. Dividend Yield (TTM)

Kinder Morgan, Inc. dividend-yield-ttm | Kinder Morgan, Inc. Quote

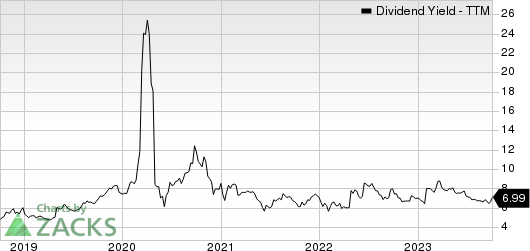

Plains GP Holdings, LP PAGP is a leading midstream energy services provider. Through its extensive pipeline network, Plains GP transports more than 7 million barrels per day of oil and natural gas liquids, thereby connecting key market hubs with prolific basins in North America. Currently, Plains GP Holdings sports a Zacks Rank of 1 and offers a dividend yield of almost 7%. You can see the complete list of today’s Zacks #1 Rank stocks here. (Check Plains GP Holdings’ distribution history here).

Plains Group Holdings, L.P. Dividend Yield (TTM)

Plains Group Holdings, L.P. dividend-yield-ttm | Plains Group Holdings, L.P. Quote

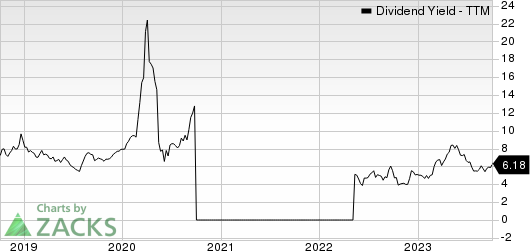

Having direct access to prolific crude oil fields in the Anadarko and Arkoma Basins, leading petroleum refiner CVR Energy Inc CVI is well-poised to grow. #1 Ranked CVI is leveraging its strong refining fundamentals, driving its cashflows and earnings momentum. Currently, the stock offers a dividend yield of 6.2%. Its dividends have mostly been higher than the sector over the past year. (Check CVR Energy’s dividend history here).

CVR Energy Inc. Dividend Yield (TTM)

CVR Energy Inc. dividend-yield-ttm | CVR Energy Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Plains Group Holdings, L.P. (PAGP) : Free Stock Analysis Report