Better Electric Vehicle Stock: Tesla or Rivian?

The electric vehicle (EV) market has become crowded. As the industry has developed and attracted new competitors, two manufacturers have risen to become the most popular among investors: Tesla (NASDAQ: TSLA) and Rivian Automotive (NASDAQ: RIVN).

There are some similarities between them -- particularly, both are introducing cutting-edge vehicles. However, the differences between them are glaring. Here's why.

Let's cut to the chase

It's no secret that manufacturing vehicles is a tricky business, and electric vehicles are even more challenging. With intricate supply chains and the need for rare earth elements, mass-producing EVs is a daunting task.

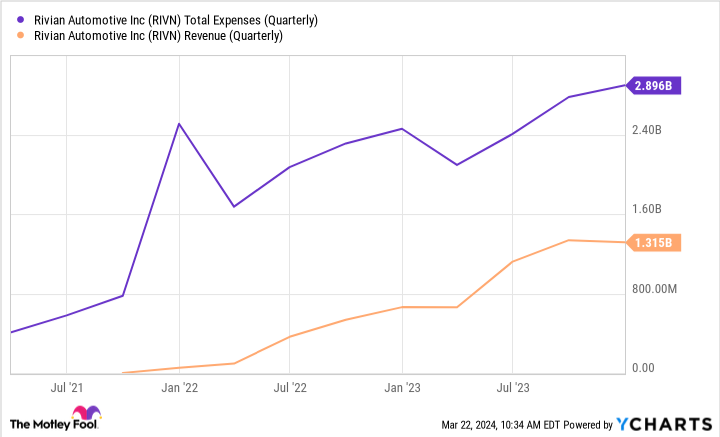

These difficulties make turning a profit in the EV business challenging, something Rivian is learning the hard way. Simply put, Rivian has never turned a profit, and the chances that it will reach profitability grow increasingly slim with each passing quarter.

While Rivian has increased production and narrowed its losses, its expenses continue to climb at a rate that outpaces its revenue growth. In Q4 2023, Rivian lost around $40,000 for every vehicle sold. That was unquestionably far better than its loss of more than $160,000 per vehicle in Q4 2022, but it still has far to go before it could hope to unseat Tesla, let alone become worthy of a spot in your portfolio.

Why Tesla stands tall

On the other hand, there's Tesla, the most profitable EV maker on the market. As of its last report, Tesla was raking in nearly $7,000 per vehicle sold. The next closest in terms of profits per vehicle is the Chinese-based BYD (OTC: BYDDY), with a profit of roughly $1,300 per vehicle.

Tesla's profits serve to highlight the considerable difference separating it from Rivian and the rest of its "competitors." After more than two decades in the EV business, Tesla has optimized its supply chain and production model to maximize efficiency and minimize costs.

This has given it formidable financial strength, which in turn, has allowed it to further separate itself from would-be competitors. With more than $29 billion in cash on its books, Tesla is not only able to invest in the construction of new factories and further refine its EV supply chain, but also to pursue other technological endeavors such as autonomous driving and robotics.

Here is where the differences between Tesla and Rivian become most apparent. An investment in Tesla is an investment in more than just an EV company. It's an investment in a company that holds the potential to transform transportation and beyond.

The bottom line

Rivian's lack of profits makes it an incredibly risky stock to own. It has burned through almost 60% of its cash reserves in roughly two-and-a-half years. At its current rate of spending, Rivian can likely only survive another two to three years at best before it will be forced to find new financing to stay afloat.

Given the cost-intensive nature of manufacturing EVs, reaching profitability can be a long and exhaustive journey for companies in the industry. Making matters worse for Rivian, there's much more competition to deal with now than there was for Tesla when it was at a similar stage of its story. Back then, it was virtually the only mass-market EV manufacturer.

For investors looking to ride the wave of EV adoption, Tesla remains the safest bet. Even better, though, an investment in Tesla is an investment in the technologies of the future.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of March 25, 2024

RJ Fulton has positions in Tesla. The Motley Fool has positions in and recommends BYD and Tesla. The Motley Fool has a disclosure policy.

Better Electric Vehicle Stock: Tesla or Rivian? was originally published by The Motley Fool