Better Tech Stock: AMD vs. Microsoft

All eyes have been on tech stocks this year as advances in high-growth areas like artificial intelligence (AI) have made Wall Street particularly bullish. Despite macroeconomic headwinds last year, tech stocks have surged in 2023 and will likely continue trending up in the new year.

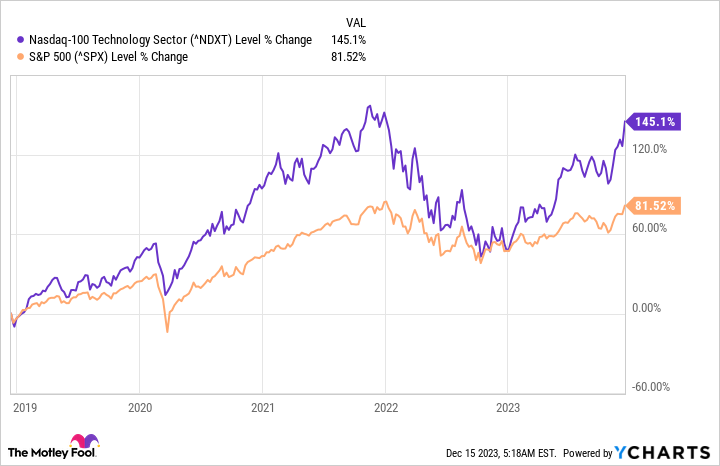

The tech market has a long history of delivering significant and consistent gains over the long term. The chart above illustrates this, with the Nasdaq-100 Technology Sector index rising far higher in the last five years than the S&P 500. As a result, it's not a bad idea to dedicate a portion of your portfolio to the lucrative sector.

Advanced Micro Devices (NASDAQ: AMD) and Microsoft (NASDAQ: MSFT) are two compelling options. These companies are expanding quickly in AI and have solid positions in various other areas of tech.

So, is AMD or Microsoft the better tech stock? Let's find out.

AMD

Chip stocks have soared alongside the boom in AI, with their hardware crucial for building and running AI models. Shares in AMD have risen about 115% year to date alongside the excitement.

The company is gearing up to challenge Nvidia's estimated 90% market share in AI chips in 2024 with the launch of a new graphics processing unit (GPU), the MI300X. It won't be easy to overcome Nvidia's dominance, but of the many companies venturing into chip development, AMD probably has the best chance at thriving in the industry.

AMD has held the second-largest market share in desktop GPUs for years, responsible for about 10% of the industry compared to Nvidia's 87%. Meanwhile, AMD has backing from Microsoft, which announced last month that its cloud platform Azure would become the first to begin using AMD's MI300X to expand its AI capabilities.

In addition to AI, AMD has a lucrative position in video games. Its chips are popular among PC gamers who use AMD's hardware to build high-powered gaming computers. The company is also the exclusive supplier of chips to Sony's PlayStation 5 and Microsoft's Xbox Series X|S, some of the world's best-selling consoles.

AMD is powering the tech market with its hardware and has a promising long-term outlook as demand for chips continues to rise.

Microsoft

As the world's second most valuable company with a market cap of $2.8 trillion, it's hard to go wrong with Microsoft. The company is a tech behemoth and a king of productivity with brands like Windows, Office, Azure, and LinkedIn. Millions of businesses rely on Microsoft's products, strengthening its prospects in high-growth industries like AI and cloud computing.

In its fiscal first quarter of 2024 (ending September 2023), the company posted revenue growth of 13% year over year and beat analysts' expectations by nearly $2 billion. The stellar growth was mainly thanks to a 13% rise in its productivity and business processes segment and a 19% increase in cloud revenue.

Like many tech companies, Microsoft has pivoted its business to AI this year. Heavy investments in the market have seen it achieve a 49% stake in ChatGPT developer OpenAI, granting it exclusive access to the start-up's most advanced technology.

Microsoft has used OpenAI's models to bring AI upgrades across its various services, including an AI assistant to Microsoft 365, which it calls Copilot. The company is charging an additional $30 on top of the subscription price to add the new assistant as it moves to monetize its AI expansion.

Microsoft's potent position in tech has given it the brand loyalty and vast financial resources to thrive long into the future.

Is AMD or Microsoft the better tech stock?

AMD and Microsoft have exciting prospects heading into 2024, with both likely to see big gains from AI and their positions in other markets. However, a company dominating a market doesn't necessarily mean it's trading at the right price.

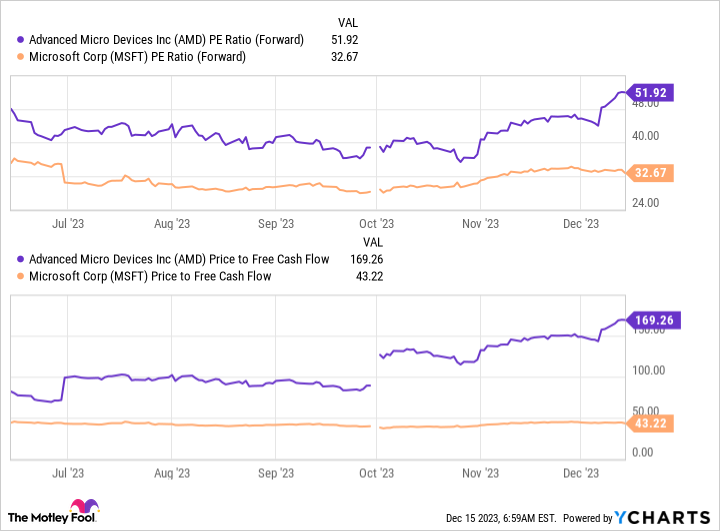

The tables above compare AMD's and Microsoft's forward price-to-earnings and price-to-free-cash-flow ratios, two helpful valuation metrics. While Microsoft's figures don't scream "bargain," they are significantly lower than AMD's and suggest the Windows company's stock currently offers far more value.

Moreover, Microsoft hit $63 billion in free cash flow this year compared to AMD's just over $1 billion. Microsoft is not only the cheaper stock, but the more reliable option, as it has the funds to overcome potential headwinds and continue investing in its business.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Advanced Micro Devices wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Better Tech Stock: AMD vs. Microsoft was originally published by The Motley Fool