Beyond Meat Inc (BYND) Faces Steep Losses Amid Operational Challenges

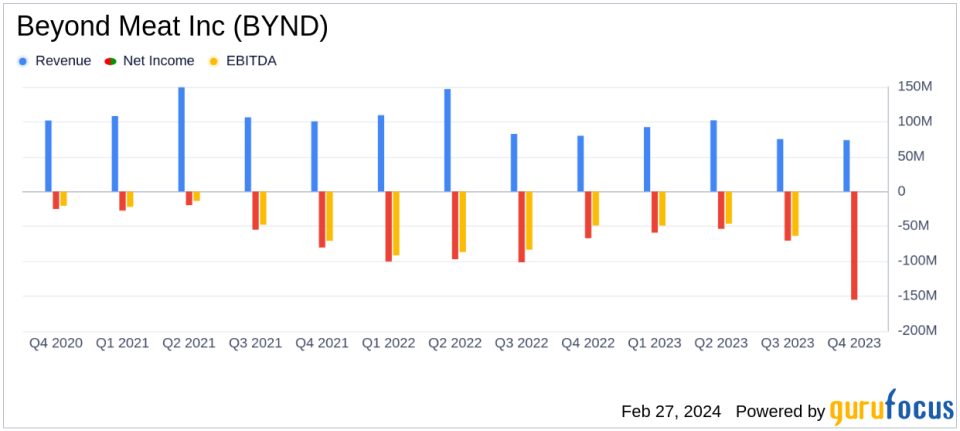

Net Revenues: Decreased by 7.8% in Q4 and 18.0% for the full year.

Gross Profit: Reported a loss with a gross margin of -113.8% in Q4 and -24.1% for the full year.

Net Loss: Increased to $155.1 million in Q4 and $338.1 million for the full year.

Adjusted EBITDA: Loss of $125.1 million in Q4 and $269.2 million for the full year.

Operational Review Impact: Non-cash charges of $95.6 million due to the Global Operations Review.

2024 Outlook: Net revenues expected to be between $315 million to $345 million.

On February 27, 2024, Beyond Meat Inc (NASDAQ:BYND) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its plant-based meat products, faced a challenging year with a significant decrease in net revenues and a steep net loss, exacerbated by non-cash charges related to its Global Operations Review.

Beyond Meat Inc (NASDAQ:BYND) is a pioneer in the plant-based meat industry, offering products designed to emulate the taste and texture of animal-based meat. The company's products are available in a variety of channels, including retail and foodservice, across the U.S. and internationally. Despite its innovative approach, Beyond Meat experienced a decline in demand and faced operational difficulties in 2023.

The company's performance in 2023 was marked by a decrease in net revenues by 7.8% to $73.7 million in Q4, and an 18.0% decrease to $343.4 million for the full year. This decline was attributed to a decrease in net revenue per pound and weak category demand, particularly in the U.S. retail and foodservice channels. International sales showed some resilience, with increases in both retail and foodservice channels.

Gross profit turned into a loss of $83.9 million in Q4, with a gross margin of -113.8%, and a loss of $82.7 million for the full year, with a gross margin of -24.1%. These losses were significantly impacted by non-cash charges totaling $78.0 million, primarily associated with the Global Operations Review. The net loss widened to $155.1 million, or $2.40 per common share, in Q4, and $338.1 million, or $5.26 per common share, for the full year.

Adjusted EBITDA also reflected losses, with a loss of $125.1 million in Q4 and $269.2 million for the full year. Beyond Meat's President and CEO, Ethan Brown, acknowledged the challenges and outlined a plan for 2024 focused on reducing operating expenses, cash use, and improving margins through pricing actions and production footprint optimization.

From a balance sheet perspective, Beyond Meat ended the year with $205.9 million in cash and cash equivalents, including restricted cash, and a total outstanding debt of $1.1 billion. The company managed to reduce its net cash used in operating activities to $107.8 million for the full year, compared to $320.2 million in the previous year. Capital expenditures were also reduced to $10.6 million from $70.5 million in the year-ago period.

Looking ahead to 2024, Beyond Meat expects net revenues to range from $315 million to $345 million, with gross margins anticipated to improve in the second half of the year. The company plans to continue its efforts to streamline operations and strengthen its financial position in the face of ongoing macroeconomic uncertainty.

Value investors and potential GuruFocus.com members should consider the company's strategic initiatives and the potential for a turnaround as Beyond Meat navigates through its current challenges. The full financial details and management's commentary can be found in the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Beyond Meat Inc for further details.

This article first appeared on GuruFocus.