BGC Group Inc Reports Record Fourth Quarter Revenues and Adjusted Earnings

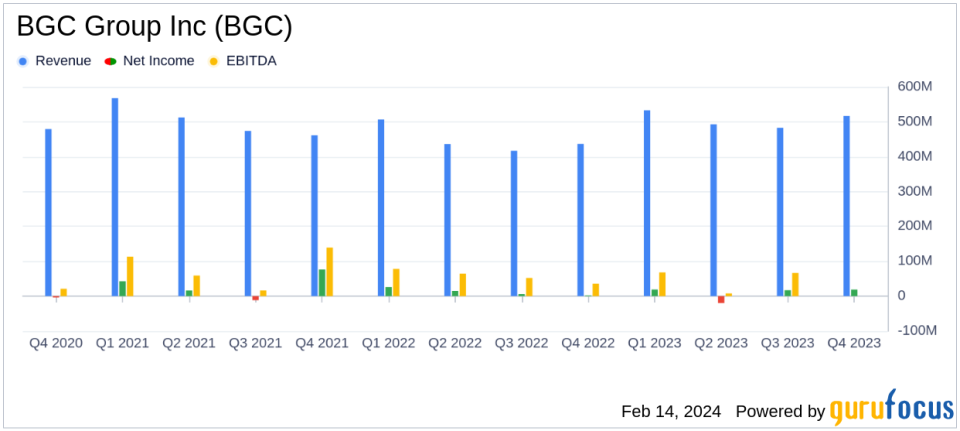

Revenue: Q4 revenue surged 18.4% to $516.8 million; FY23 revenue up 12.8% to $2,025.4 million.

Adjusted Earnings: Q4 Adjusted Earnings before taxes rose 27.3% to $110.8 million; Post-tax Adjusted Earnings per share increased by 31.3% to $0.21.

GAAP Net Income: Q4 GAAP net income for fully diluted shares jumped 582.3% to $18.8 million; FY23 saw a decrease of 46.5% to $33.9 million.

Adjusted EBITDA: Q4 Adjusted EBITDA climbed 22.3% to $151.6 million.

Dividend: Announced quarterly cash dividend of $0.01 per share, payable on March 19, 2024.

Share Count: Fully diluted weighted average share count for Adjusted Earnings was 490.7 million in Q4.

Future Outlook: BGC expects favorable macro trading conditions to persist through 2024.

On February 14, 2024, BGC Group Inc (NASDAQ:BGC) released its 8-K filing, announcing a record-breaking fourth quarter with significant year-over-year revenue growth. BGC, a brokerage and financial technology company, serves a diverse client base, including banks and hedge funds, offering services across various financial products and markets.

Financial Highlights and Performance Analysis

BGC's impressive fourth-quarter performance was marked by an 18.4% increase in revenues, reaching $516.8 million. This growth was attributed to the Americas and EMEA regions, which saw revenue increases of 21.9% and 20.5%, respectively. The company's Adjusted Earnings before taxes grew by 27.3% to $110.8 million, with margins improving by 149 basis points to 21.4%. Post-tax Adjusted Earnings per share saw a significant rise of 31.3%, reaching $0.21.

Despite the robust revenue and Adjusted Earnings growth, GAAP net income for fully diluted shares experienced a substantial year-over-year decrease of 46.5% for the full year, settling at $33.9 million. This contrast highlights the challenges BGC faces, including the need to manage expenses and navigate market volatility effectively.

Segment Performance and Future Prospects

Energy and Commodities were standout segments, with revenues growing by 42.3%, driven by strong volume growth. Rates revenues increased by 26.1%, reflecting broad-based growth across interest rate products. However, Credit and Equities revenues saw declines of 3.6% and 3.8%, respectively, due to lower volumes in certain areas.

Chairman and CEO Howard W. Lutnick commented on the company's strategic moves, including the CFTC's approval for FMX to operate an exchange for U.S. interest rate futures products. Lutnick anticipates launching the FMX Futures Exchange in the summer of 2024, which could further bolster BGC's market position.

"BGC had its best fourth quarter, with record revenues and Adjusted Earnings. Our revenues improved over 18 percent ending a strong year where we delivered accelerating year-over-year revenue growth each quarter. We expect favorable macro trading conditions to continue throughout 2024."

The company's outlook remains positive, with expectations of continued favorable macro trading conditions. The declared dividend reflects a commitment to shareholder returns, despite the fluctuating market environment.

Conclusion

BGC Group Inc's latest earnings report showcases a company capitalizing on market volatility and expanding its technological capabilities. With a strategic focus on high-growth areas and a positive outlook for 2024, BGC is positioned to continue its trajectory of revenue growth and market expansion.

For a detailed analysis of BGC's financials and future prospects, investors and interested parties can access the full earnings report and investor presentation at BGC's investor relations website.

Explore the complete 8-K earnings release (here) from BGC Group Inc for further details.

This article first appeared on GuruFocus.