BGSF Inc (BGSF) Reports Mixed Full Year and Q4 2023 Results Amid Strategic Shifts

Full Year Revenue: Increased by 4.9% to $313.2 million.

Operating Cash Flow: Generated $20.4 million in 2023.

Net Loss: Reported a net loss from continuing operations of $10.2 million due to non-cash impairment.

Adjusted EBITDA: Grew 15.9% year over year to $25.1 million.

Adjusted EPS: Declined to $1.19 in 2023 from $1.26 in 2022.

New Credit Facility: Closed with a maturity date of March 12, 2028.

Strategic Acquisitions: Arroyo Consulting acquisition contributed $14.8 million in new revenues.

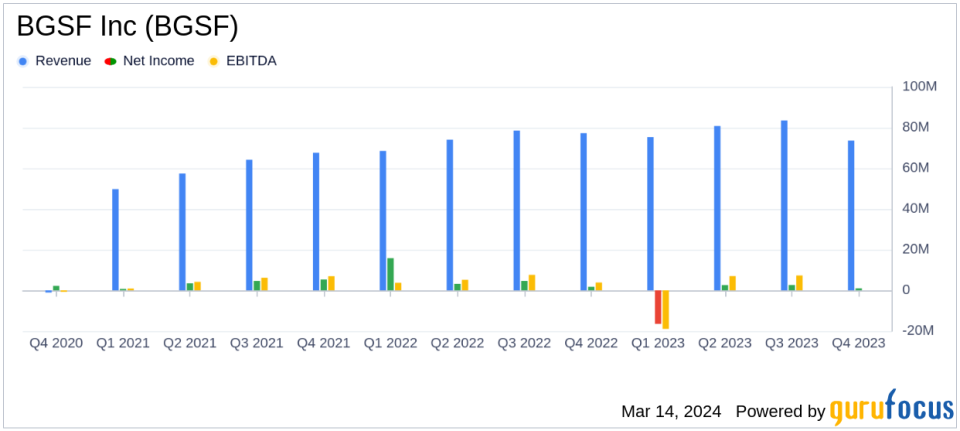

On March 13, 2024, BGSF Inc (NYSE:BGSF), a prominent provider of workforce solutions, released its 8-K filing, detailing its financial results for the fiscal year and fourth quarter ended December 31, 2023. The company, which specializes in staffing and recruiting across IT, Finance & Accounting, Managed Solutions, and Property Management, reported a full year revenue increase of 4.9% to $313.2 million, with the Professional segment showing a 6.1% growth, bolstered by the Arroyo Consulting acquisition.

Despite the revenue growth, BGSF faced challenges, including a non-cash impairment of $22.5 million related to trade name intangible assets from rebranding, which significantly impacted net income. The net loss from continuing operations stood at $10.2 million, or $0.95 per diluted share, compared to a net income of $11.3 million in the previous year. Adjusted EBITDA from continuing operations, however, increased by 15.9% to $25.1 million, reflecting the company's ability to maintain profitability in core operations.

Financial Highlights and Challenges

BGSF's gross profit margin improved by 100 basis points to 35.7%, indicating better cost management and higher-margin business mix. The operating cash flow was robust at $20.4 million, showing the company's operational efficiency. However, the net loss underscores the impact of strategic decisions, such as rebranding and acquisition-related amortization and interest expenses, which are important for long-term growth but have short-term financial implications.

The balance sheet reflects a mixed picture, with total assets decreasing to $178.5 million from $194.7 million the previous year. The company's new credit facility, closed on March 12, 2024, with a borrowing capacity of up to $40 million, provides financial flexibility for future growth initiatives.

"Fiscal 2023 was a significant year for BGSF. We successfully executed our long-term strategic plans through an accretive acquisition, rebranding all our businesses, and building stronger relationships with world-class ERP technologies," said Beth A. Garvey, Chair, President, and CEO of BGSF.

Looking Ahead

Garvey's commentary highlights the strategic moves made by BGSF, including acquisitions and rebranding, which are expected to strengthen the company's market position. Despite the current challenges, such as project delays and macroeconomic headwinds, BGSF's leadership remains confident in the company's strategy and its ability to deliver shareholder value through consistent dividends.

Value investors may find BGSF's revenue growth and operational cash flow generation appealing, as these indicate the company's underlying business strength. However, the non-cash impairment and net loss suggest the need for careful evaluation of the company's long-term profitability and the effectiveness of its strategic initiatives.

For a more detailed analysis of BGSF Inc's financial performance and future prospects, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive research and tools.

Explore the complete 8-K earnings release (here) from BGSF Inc for further details.

This article first appeared on GuruFocus.