BHP Group (BHP) Iron Ore Production in Q1 Falls 3% Y/Y

BHP Group’s BHP iron ore production declined 3% year over year to 63.2 Mt in the first quarter of fiscal 2024 (ended Sep 30, 2023). The company witnessed a 3% fall in iron ore output at Western Australia Iron Ore (WAIO). This was due to tie-in activity for the Rail Technology Program, the ongoing ramp-up and maintenance at the Central Pilbara hub (South Flank and Mining Area C) and the timing of the track renewal maintenance.

Copper Output Up 11%: Total copper production in the first quarter of fiscal 2024 rose 11% year over year to 457 kt. Production at Escondida increased 8% year over year due to higher concentrator feed grade.

Copper output at Pampa Norte was up 11%, reflecting a record quarterly output of 69 kt at Spence. This was mainly driven by improved concentrator performance and recoveries. Production at Cerro Colorado was down 26% as it transitions toward closure by the end of December 2023

Production from Copper South Australia surged 44% to 72 kt driven by additional contributions from Prominent Hill and Carrapateena.

Antamina copper production dipped 12%, hurt by planned lower copper feed grades.

Nickel Production Dips 2%: Nickel production declined 2% year over year to 20.2 kt during first-quarter fiscal 2024. Production decreased in line with higher stripping activity at Mt Keith mining operations.

Energy Coal Up, Metallurgical Coal Plunges: Energy coal production surged 38% year over year to 3.6 Mt in the first quarter of fiscal 2024. Production benefited from favorable weather conditions and the easing of labor constraints. This was partially offset by planned wash plant maintenance completed in August.

Metallurgical coal production was 5.6 Mt, down 16% compared with the prior-year quarter. Lower production was attributed to planned wash plant maintenance at Goonyella, mining in higher strip ratio areas, an extended longwall move at Broadmeadow and a stoppage at Peak Downs. This was partially offset by strong underlying truck productivity and favorable weather conditions.

Prices Decline: Average realized prices for copper, iron ore, and nickel were down 4%, 2% and 14% year over year, respectively, in the period under review. Prices for metallurgical coal and energy coal products were down 13% and 20% respectively.

FY24 Production Guidance

BHP’s iron ore production guidance for fiscal 2024 is 254-264.5 Mt. WAIO's production is expected to be between 250 Mt and 260 Mt (282 Mt and 294 Mt on a 100% basis).

BHP expects copper production within 1,720-1,910 kt in fiscal 2024. Production guidance for metallurgical coal is 28 -31 Mt. The production guidance for energy coal is 13-15 Mt. Nickel production is expected to be between 77 kt and 87 kt.

Cost Guidance for FY24

Unit cost guidance for WAIO is $17.40-$18.90 per ton. Escondida unit cost is estimated to be $1.40-$1.70 per pound. Spence unit costs are expected to range between $2.00 per pound and $2.30 per pound. BMA unit cost is expected to be between $95 per ton and $105 per ton.

Other Updates

BHP and Mitsubishi Development Pty Ltd., a wholly-owned subsidiary of Mitsubishi Corporation, have signed Asset Sale Agreements to divest the Blackwater and Daunia mines, which are part of the BHP Mitsubishi Alliance (BMA) metallurgical coal joint venture in Queensland. Both BHP and Mitsubishi Development hold a 50% interest in BMA.

The deal has been fixed for a cash consideration of around $4.1 billion. The purchase price comprises $2.1 billion cash on completion, $1.1 billion in cash over three years after completion and the potential for up to $0.9 billion in a price-linked earnout payable over three years. Net proceeds will be used to reduce the Group’s net debt.

The sale is subject to the satisfaction of certain conditions, including competition and regulatory approvals. Completion is expected to occur in the June 2024 quarter. BMA will continue to operate the assets until completion.

Peer Performance

Vale S.A. VALE reported iron ore production of 86.2 Mt for the third quarter of 2023, which was down 4% year over year. This was mainly due to lower run-of-mine production from the Paraopeba complex, a temporary stoppage at the Viga operations due to one-off maintenance of the tailings pipeline and lower output from Serra Norte.

Vale’s iron ore production guidance for 2023 is 310-320 Mt. The company had produced around 308 Mt of iron ore in 2022.

Rio Tinto Group RIO recently reported a 1% year-over-year drop in third-quarter 2023 iron ore production to 83.5 Mt (on a 100% basis). Rio Tinto’s share was 70.9 Mt. Iron ore shipments, however, rose 1% to 83.9 Mt, from the year-ago quarter’s shipment. RIO has witnessed a 4% improvement in iron in the first nine-month period of 2023.

Iron ore shipments have improved 5% year over year to 245.5 Mt in the first nine months of 2023, reflecting improved performance across the Pilbara system, ramp-up of the Gudai-Darri mine and improved productivity as a result of the implementation of the Safe Production System. Backed by this performance, the company expects Pilbara iron ore shipments (100% basis) to be at the upper end of its stated range of 320 Mt to 335 Mt in 2023. Shipments in 2022 were reported at 322 Mt.

Price Performance

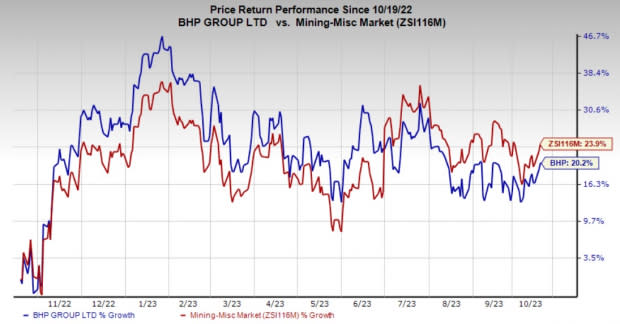

BHP’s shares have gained 20.2% in a year compared with the industry’s 23.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Another Key Pick

BHP currently carries a Zacks Rank #2 (Buy).

Another top-ranked stock in the basic materials space is Ecolab ECL, which currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate ECL’s earnings for the current fiscal year is pegged at $5.09 per share, implying year-over-year growth of 13.4%. The estimate has moved up 2% over the past 90 days. Ecolab has a trailing four-quarter earnings surprise of roughly 1.04%, on average. The ECL stock has gained around 12% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report