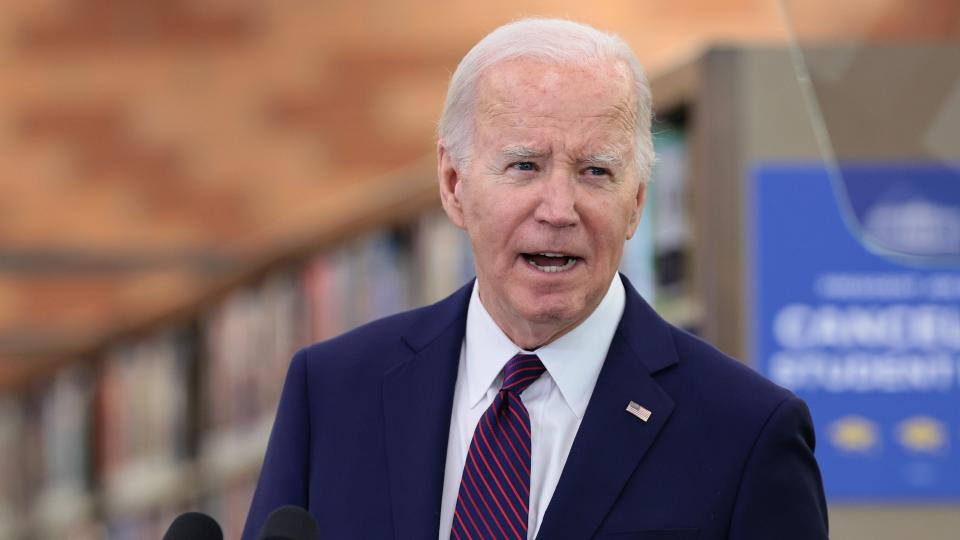

Biden Cancels Student Loan Debt for 150,000 Borrowers — How Much Will It Cost Taxpayers?

President Joe Biden continues to pursue federal student loan forgiveness options, announcing on Wednesday, Feb. 21, that his administration will eliminate debt for more than 150,000 borrowers.

Find Out: What Would a Biden Win in 2024 Mean for Student Loan Debt?

Trending Now:: 6 Unusual Ways To Make Extra Money (That Actually Work)

The move cancels about $1.2 billion in debt, CNN reported, and advances the Biden administration’s student loan forgiveness program after a much more ambitious plan to cancel up to $20,000 in debt per borrower was struck down by the Supreme Court last summer. As it stands, Biden has now canceled about $138 billion for 3.9 million borrowers since taking office, The New York Times reported.

The latest round of debt relief will impact certain borrowers who are enrolled in a new income-driven repayment (IDR) program called the Saving on a Valuable Education (SAVE) Plan. SAVE aims to eliminate monthly payments for low-income borrowers, save other borrowers at least $1,000 per year on payments and ensure borrowers don’t see their balances grow from unpaid interest.

Explore More: How Student Loan Debt Payments Are Cutting Into Employee 401(k)s

Eligible SAVE borrowers were expected to receive emails on Feb. 21 informing them of the canceled debt, according to CNN.

“From day one of my Administration, I vowed to fix student loan programs so higher education can be a ticket to the middle class — not a barrier to opportunity,” the email reportedly said.

Debt relief under the SAVE plan was not scheduled to begin until July 2024, but last month the Biden administration said it would start forgiving the loans well ahead of schedule.

Although loan forgiveness might be happy news for borrowers, not everyone likes it. Critics of Biden’s loan cancellation policies say they are unfair to borrowers who have already repaid their loans and also unfair to taxpayers who might have to foot the bill.

A February 2023 report from the U.S. House Committee on Education & the Workforce said the Biden administration’s $400 billion forgiveness plan, originally announced in August 2022, would simply move the loan debt “onto the backs of American taxpayers.” According to that report, the Biden plan would cost every taxpayer about $2,500 — even those who never went to college.

It’s uncertain how much the SAVE plan will cost individual taxpayers. However, an analysis released last summer by the Penn Wharton Budget Model (PWBM) estimated that SAVE will “incur a net cost of $475 billion over the 10-year budget window.”

About $200 billion of that will come from payment reduction for the $1.64 trillion in loans already outstanding in 2023. The PWBM estimates that roughly 53% of the current loan volume will move to SAVE after it goes active, implying that about $869 billion will be “subject to enhanced subsidies” under SAVE.

Despite the pushback from critics, the Biden administration has been quick to tout its various student loan forgiveness programs. In a Feb. 21 press release, the U.S. Department of Education mentioned the following programs approved by the administration since Biden took office:

Public Service Loan Forgiveness: Fixes to this program have resulted in $56.7 billion in loan forgiveness for more than 793,000 borrowers.

Income-Driven Repayment Plans: Improvements to IDR plans have resulted in $45.6 billion in debt relief for 930,500 borrowers.

Borrowers with disabilities: $11.7 billion in loan forgiveness has been approved for 513,000 borrowers with a total and permanent disability. This includes providing automatic discharges off a data match with the Social Security Administration.

Legal settlements and related relief: The Education Department said that $22.5 billion in canceled loans have been approved for 1.3 million borrowers through closed school discharges, borrower defense and related court settlements. For example, in June 2022 the Biden administration said it would cancel the federal student loan debts of about 200,000 borrowers who claimed to be defrauded by their schools. The announcement followed a class-action lawsuit settlement filed in federal court. A couple of months later, the Education Department said it would discharge all remaining federal student loans borrowers received to attend ITT Technical Institute from January 1, 2005 through ITT’s closure in September 2016.

More From GOBankingRates

What Makes a Good Bank in 2024, According to a Banking Expert

I'm a Personal Finance Writer: These Are the Worst Money Mistakes I Made in 2023

This article originally appeared on GOBankingRates.com: Biden Cancels Student Loan Debt for 150,000 Borrowers — How Much Will It Cost Taxpayers?