Big 5 Sporting Losing Luster: Can Strategies Lift Stock?

Big 5 Sporting Goods Corporation BGFV is losing sheen due to its unimpressive sales surprise trend and soft comparable store-sales (comps) for a while now. Though management is taking strategic initiatives to revive its performance, it might take time.

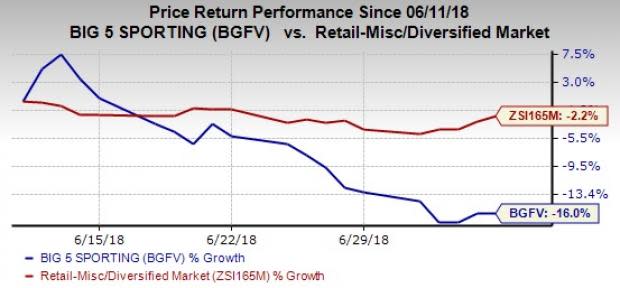

In the past month, shares of Big 5 Sporting have lost 16%, wider than the industry’s 2.2% decline. Moreover, the industry ranks among the bottom 29% (181 of 256) of all Zacks industries. Let’s delve deeper to find out the factors that are impacting the company’s performance and whether solid growth strategies can offset its hurdles.

Headwinds Pulling Stock Down

Big 5 Sporting has missed sales estimates in the trailing four quarters, including first-quarter 2018. Also, the company’s top line declined 7.3% year over year due to an extremely challenging environment. The downturn can be attributed to record warm as well as dry weather conditions in its markets, particularly during the first seven weeks of the first quarter.

Furthermore, comps dropped 7.5% compared to an increase of 7.9% in the year-ago quarter. Decline in sales at apparel, hard goods and footwear categories in the quarter led to weak comps. In addition, Big 5 Sporting is witnessing lower sales at its hard goods category for quite some time, which remains a headwind.

Lower sales have also been translating into soft margins and profitability. In the last reported quarter, the company incurred operating loss besides contraction in gross margin. Apparently, it recorded loss per share in the last two quarters.

Risks related to seasonal business and intense competition from well-established sporting goods players are additional headwinds for the company.

Growth Strategies Can Act as Catalysts

Nevertheless, Big 5 Sporting’s growth strategies look quite encouraging. Big 5 Sporting’s unique strategy of offering exclusive branded merchandise sourced from leading manufacturers provides it with a competitive edge.

Further, the company leverages its strong vendor relationships to source overstock and closeout merchandise at substantial discounts. This helps it achieve the dual objectives of boosting gross margin besides offering compelling value to customers. The company’s merchandise strategy also helps in retaining a solid inventory position.

Additionally, the company leverages an extensive network of stores to effectively penetrate into the target markets for generating increased sales and capturing market share. As part of this strategy, Big 5 Sporting expects to open nearly eight stores and close three in 2018. Also, the company’s shareholder-friendly moves via returns in the form of dividends and share buybacks remain noteworthy.

Though Big 5 Sporting incurred loss for two consecutive quarters, the company’s strategies have aided bottom line to improve sequentially, also marking its second straight bottom-line beat. Moreover, management expects earnings per share to be in the range of 4-12 cents for the second quarter of 2018. The Zacks Consensus Estimate which is largely stable is pegged at 11 cents for the impending quarter.

Per management, the improving sales trend towards the end of the first quarter continued in the second quarter as well. Further, it expects to gain from the key spring selling season in the second quarter. Comps are projected to be flat to up low-single digits. These, in turn, reflect Big 5 Sporting’s efforts to help rebound the stock.

We believe that the company’s strategic actions poise this Zacks Rank #3 (Hold) company well for growth.

Looking for Better-Ranked Retail Stocks? Check These

Dillard's, Inc. DDS has a long-term earnings growth rate of 10.2% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Five Below, Inc. FIVE has an impressive long-term earnings growth rate of 27.7% and a Zacks Rank #2 (Buy).

Burlington Stores, Inc. BURL is a Zacks #2 Ranked stock and has pulled off an average positive earnings surprise of 17.8% in the last four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Big 5 Sporting Goods Corporation (BGFV) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research