Big Lots, Big Trouble: Can It Survive?

Big Lots (NYSE:BIG) has been the subject of negative news and publicity over the past few years, resulting in the stock imploding from record highs of $70 a share to lows of $3 a share recently.

While 90% of the market cap has already been wiped out, have investors overreacted, and is the stock undervalued?

The embattled discount retailer is not new to significant price movements in the market. Over the past few years, the stock has exploded, only to implode thereafter.

For instance, in 2007, it rallied from $16 to $30 a share, only to fall back to $16 before year-end.

The Rollercoaster Journey of a Discount Retailer's Stock Amidst Turnaround Turmoil

Likewise, between 2017 and 2019, the stock dropped from $60 a share to $15 a share, only to rally again to $63 a share at the height of the pandemic in 2020. The big question now is whether the stock has what it takes to bounce back after imploding to record $3 per share lows.

The steep sell-off in recent days comes even with the discount retailer insisting its fourth-quarter same-store sales and gross margin will meet guidance. The company also says it generated substantial cash flow in the fourth quarter that it used to pay down a $900 million asset-based lending facility.

Going by the company's statement, it is progressing in its turnaround efforts. However, the market is hearing none of it going by deep sell-off with every bounce back. While the stock is trading at about $4.40 a share, its outlook remains gloomy, all technical indicators have turned bearish.

Loop Capital analyst downgrading the stock to a sell from a hold with a share price target of $1 underscores the growing concern about the discount retailer's long-term prospects. Reports that the company has hired a consulting firm as it looks to explore new turnaround plans signal things could be better.

The weak financial performance of the underlying business has been the catalyst behind the stock going down by over 90% over the past three years. The discount retailer has struggled to deliver consistent profitability as high inflation is hurting the spending power of its customers. Customers could no longer afford the pricey items they bought at the discount retailer when interest rates in the US were near zero.

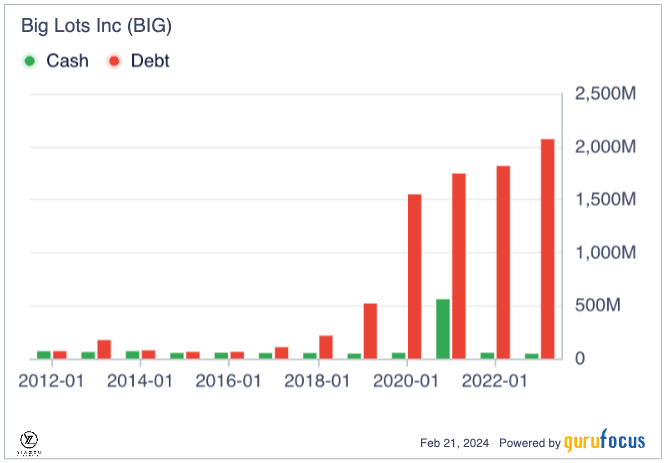

While customers no longer have extra cash to spend on furniture or home decor, Big Lots' revenue base has come under pressure. Consequently, a widening net loss has poked a big hole in the company's financials, with the debt-to-equity ratio plunging to lows of 7.8, meaning the company needs new finances.

While the company has been working on a turnaround plan to lower freight costs, reduce markdown, and strengthen inventory, its financial position has deteriorated. The immediate concern among the investment community is that the company is facing significant liquidity problems that could threaten its future.

Reports indicating that the company has been engaging banks and other institutions as it looks to raise much-needed capital to strengthen liquidity levels have only gone to fuel a ferocious sell-off of the stock. Thus, the retailer reportedly has over $3.33 billion in liabilities, comprising $533 million in long-term debt and $1.6 billion in leases.

Therefore, concerns that the embattled retailer is facing bankruptcy risks amid liquidity issues and soaring debt levels continue to dent the stock's sentiments in the market.

Navigating a Sea of Losses Amidst Soaring Debt and Stiff Competition

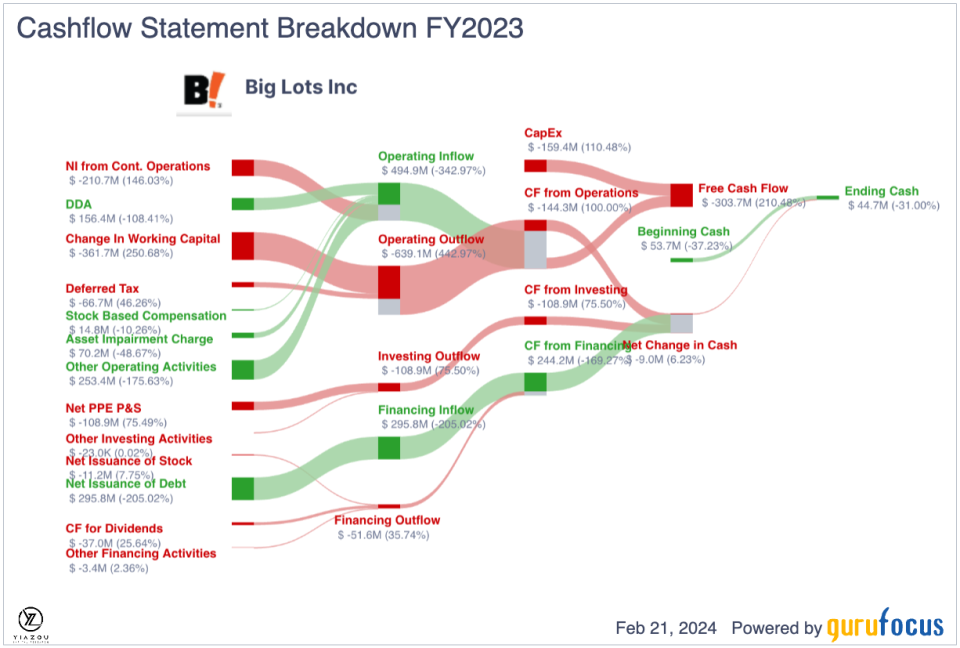

Big Lots is in a precarious position after posting a net loss in five straight quarters. Over the period, its net loss has skyrocketed to $550 million, leaving it unable to settle its debt, let alone bolster its liquidity standing.

Compounding the deteriorating financial position is the high-interest rate environment, which has seen a significant uptick in interest rate expense. Due to the current high-interest rate environment, the discount retailer must contend with over $11.3 million in costs needed to service its debt. Soaring debt levels come when the company is no longer generating as much revenue as it used to.

In Q3 2023, Big Lots delivered a 14.7% year-over-year revenue decline to $1.026 billion. Same-store sales were down by 13.2% on a year-over-year basis. Even though Big Lots posted a 240 basis point improvement in gross margins, it still reported a wider-than-expected net loss of $4.38 compared to $2.99 per share delivered the same year ago.

Furniture and home decor sales at Big Lots peaked during the pandemic as people began working from home. But that was no longer the case since normalcy had crept in, and spending was no longer the frenzy it used to be. The company cannot attract those big sales, and earnings will always be under pressure.

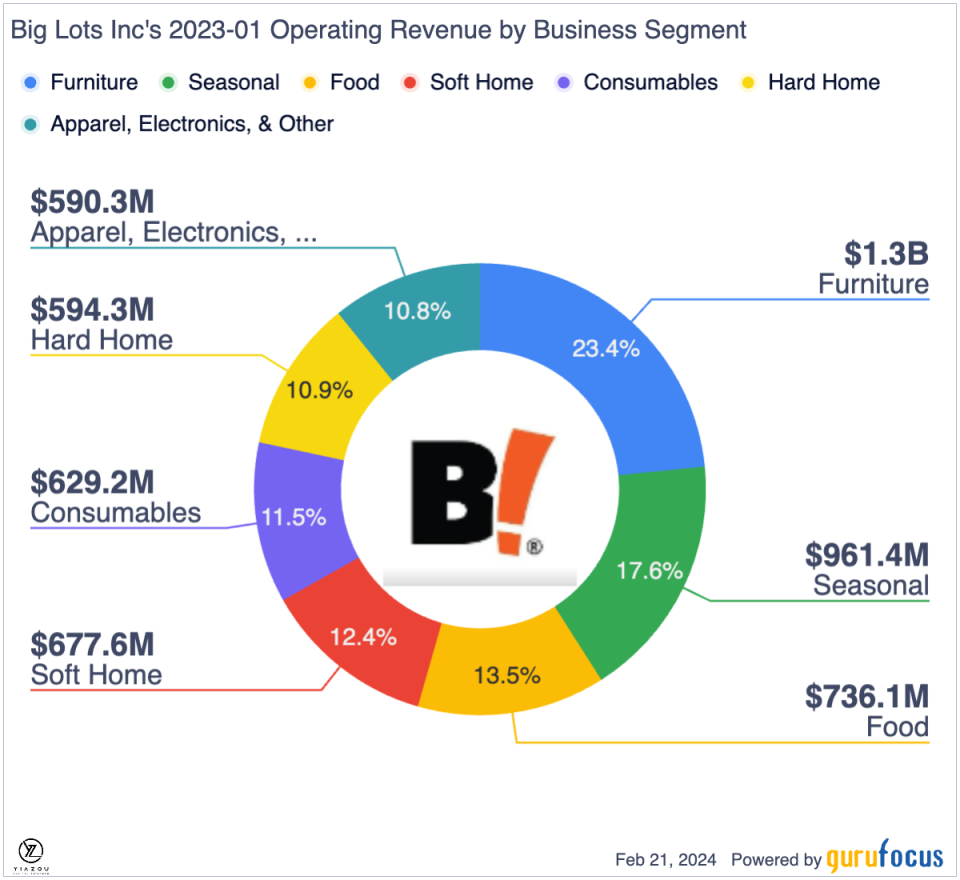

Apart from this, the disappointing results come from the stiff competition faced by the company in the industry. The embattled discount retailer is under immense pressure from TJX Companies (NYSE:TJX), Dollar Tree (NASDAQ:DLTR), and Walmart (NYSE:WMT) as they delivered solid revenue increases with strong consumer sentiment recently.Food and consumables, meanwhile, make up about 16% and 14% of Big Lots' sales, but the retailer needs to do more to outcompete other discount chains with far greater scales, such as Dollar Tree and Walmart.

The high-interest rate environment and runaway inflation have made consumers more cautious about high ticket purchases at Big Lots. Unlike in the pandemic's peak, when there was a lot of money out there because of the stimulus packages, people are less inclined now to spend big on things such as furniture, a key part (23.4%) of the company's revenues.

After five consecutive quarters of net losses, Big Lots is only left with $258 million in liquidity behind a long-term debt worth $533 million. With the company having just $46.5 million in cash and cash equivalents, it remains in a precarious position to meet its financial obligations. This might explain reports that the company has started engaging financial institutions to raise additional cash.

The situation is compounded by growing concerns that the company might generate negative EBITDA over the next two years even as management works on a turnaround plan. While the company entered into a sale and leaseback transaction late last year, resulting in asset monetization of $306 million, the transaction will likely impact the liquidity position significantly.

As long as the company continues to generate negative free cash from its operating activities, its financial position should continue to rattle investors. A high debt burden complicates the issue and could make it difficult for the company to navigate a challenging economic environment with interest rates at 22-year highs.

Big Lots' Turnaround Efforts in Inventory Management and Cost-Cutting Amid Post-Pandemic Challenges

During the booming COVID sales period, Big Lots increased its inventory and distribution facilities. However, in the aftermath of the pandemic, it was left with too much inventory, leaving it overextended while investing in the distribution strategy. Amid the soaring inventory pressure and liquidity concerns, the company has yet to pursue a turnaround plan.

Faced with a challenging microenvironment, management has set out to enhance inventory management as one of the ways of bolstering its margins. It's also targeting improvements in merchandising, focusing on treasure and closeouts as it looks to grow sales.

According to the chief executive officer, Brue Thorn, they are also making significant progress in lowering freight costs, which is crucial to taming the widening net loss in recent quarters. Also, reduced markdowns at the back of improved inventory positions are driving sales in slow moving inventory.

Big Lots has also embarked on a cost-cutting drive, targeting capital expenditures. The efforts in place have already set it on a trajectory to achieve over $100 million in SG&A cost savings. Its protracted project springboard is also expected to give rise to $200 million in new opportunities.

Additionally, the company is also looking for ways to monetize its assets as one way of strengthening its balance sheet. The monetization of assets for $306 million helped improve the company's balance sheet, which had shrunk significantly.

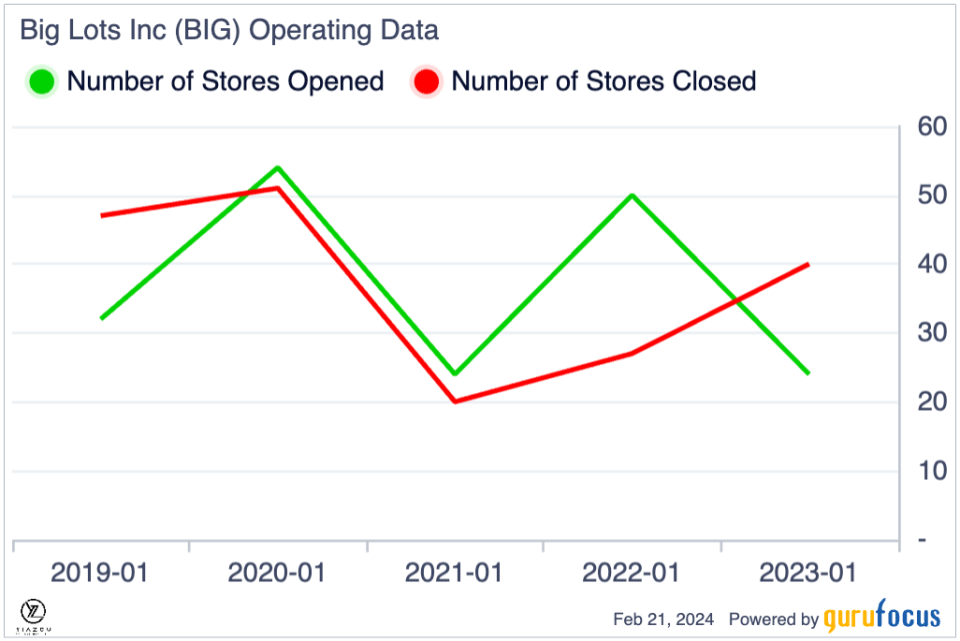

Finally, the turnaround plan also includes shutting down some locations that have underperformed in recent quarters. Last year, the company closed 50 stores and plans to close additional stores in New York, North Carolina, and Illinois to target $100 million in structural SG&A cost savings.

Bottom Line

The spending of consumers is also affected by inflation in terms of the discretionary products that a company produces, which in turn determines the selling price of the company. Besides, competition from other discounters and internet sales makes access to sales growth a challenge for the company.

However, although the turnaround plan set by the company is reasonable, the expected results can still be a long way away from reality. The financial condition has plunged as a result of plunging revenues and a widening net loss. Analysts predict that this discount home essentials retailer will not report positive EBITDA for some time, so the company's prospects are not very promising.

The company venturing into the debt market in pursuit of new financing underlines the worsening situation compounded by reports it has engaged the services of a turnaround consulting firm. Loop Capital Analyst Anthony Chukumba's downgrading the stock to sell implies further downside action as the turnaround plan has yet to have the desired impact. For this reason, it would be ideal to avoid BIG until the company addresses its debt and liquidity issues, with solid signs of operational improvement.

This article first appeared on GuruFocus.