The Biggest Banks Reported Earnings Today: This One is the Clear Leader

A slew of bank earnings from the largest financial institutions in the world were released this morning, providing insight into their Q4 and 2023 performance.

Although the financial sector underperformed the broad market during 2023, returning just 12% vs the S&P’s 24%, XLF managed to outperform in the fourth quarter. As markets began pricing in the coming interest rate cuts, banks, which hold large fixed income portfolios benefitted significantly.

Image Source: TradingView

Earnings Results

JP Morgan Chase & Co. JPM clearly came out on top, and although it missed quarterly earnings estimates, recorded its most profitable year on record. The country’s largest bank booked $49.6 billion in profits for the year, a 32% increase from 2022.

JPM CEO Jamie Dimon had some rather grim remarks about the state of the economy sharing that he thinks rampant deficit spending risks another inflationary spike and that he remains cautious about expectations this year.

Looking back a few quarters, while large swaths of the industry were in panic during the Silicon Valley Bank crisis, JP Morgan Chase & Co. sat comfortably, drawing in new depositors, and buying up distressed firms on the cheap.

Part of what limited the Q4 profits were charges to cover special government fees related to the failures of Silicon Valley Bank and Signature Bank. The $3 billion charge will refill a government FDIC fund.

JPM reported Q4 EPS of $3.04 below estimates of $3.35. However, before the one-time fee, earnings were $3.97 per share.

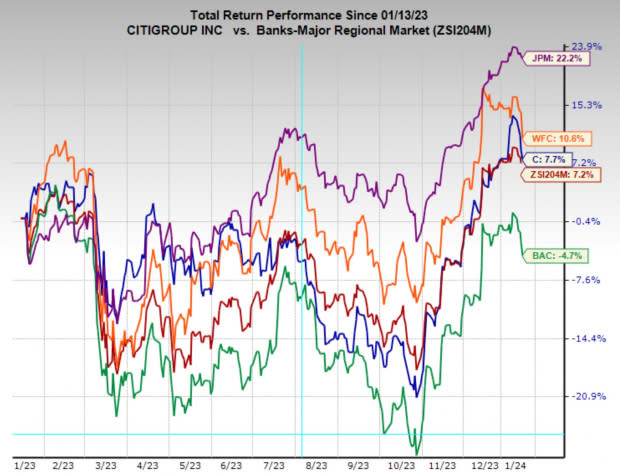

JP Morgan Chase & Co. is the best performing large bank stock of the group over the last 1, 5 and 10-year period.

Image Source: Zacks Investment Research

Wells Fargo & Company WFC had a commendable Q4 performance as well, beating analysts’ expectations on both the top and bottom line. Q4 EPS of $1.29 came in above estimates of $1.09 and sales of $20.48 billion were just above estimates of $20.4 billion.

Wells Fargo & Company currently has a forward earnings multiple of 10.1x, which is just below the industry average and below its 10-year median of 12.5x. The company also pays a dividend yield of 2.85%.

Image Source: Zacks Investment Research

Citigroup C, the bank stock with the highest Zacks rank, posted mixed earnings this morning. The company currently has a Zacks Rank #2 (Buy) rating, but reported a major earnings miss. However, like the other big banks was largely affected by the FDIC charges related to last year's banking crisis. Before the charges, Citigroup had earnings of $0.84 per share vs. expectations of $0.81.

Revenue also came up short, reporting $17.44 billion, below estimates of $18.74 billion.

Citibank CEO Jane Fraser stated that the company’s performance was disappointing and announced plans for a sweeping reorganization. She said that the company plans to cut up to 20,000 employees over the next two years.

Bank of America BAC also posted rather dismal earnings after the one-time FDIC charge. Net income fell some 50% YoY and the stock is down (-5%) over the last 12 months.

Sales for the nation’s second-largest bank missed analysts’ estimates for the first time in two years and were down 10% from the year ago quarter.

Bank of America CEO Brian Moynihan was upbeat nonetheless, saying that the company has achieved record client activity and that disciplined budgeting and a strong capital base should allow the company to deliver strong growth in the year ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report