BIGLARI CAPITAL CORP. Boosts Stake in El Pollo Loco Holdings Inc.

On August 4, 2023, BIGLARI CAPITAL CORP. (Trades, Portfolio), a renowned investment firm, significantly increased its stake in El Pollo Loco Holdings Inc. (NASDAQ:LOCO). This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the potential impact on the stock market.

Transaction Details

BIGLARI CAPITAL CORP. (Trades, Portfolio) added 722,936 shares of El Pollo Loco Holdings Inc. to its portfolio, representing a 22.06% change in shares. The transaction was executed at a price of $10.39 per share. As a result, the firm now holds a total of 4,000,000 shares in the company, accounting for 5.73% of its portfolio and 11.30% of El Pollo Loco's total shares. This transaction had a 1.03% impact on BIGLARI CAPITAL CORP. (Trades, Portfolio)'s portfolio.

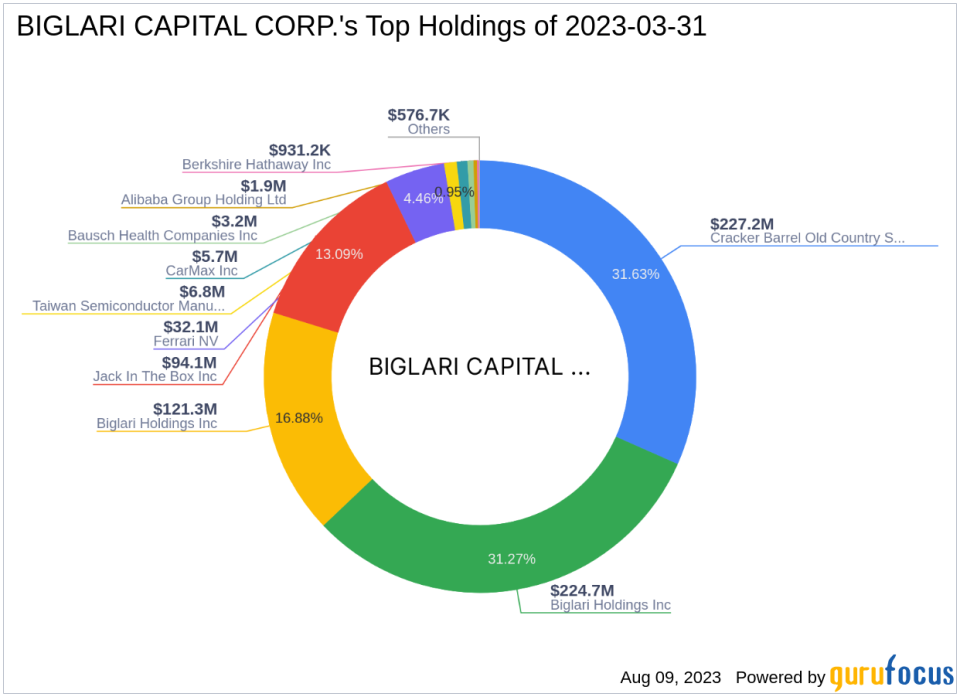

Profile of BIGLARI CAPITAL CORP. (Trades, Portfolio)

Based in San Antonio, Texas, BIGLARI CAPITAL CORP. (Trades, Portfolio) is a prominent investment firm with a portfolio of 12 stocks, valued at $718 million. The firm's top holdings include Cracker Barrel Old Country Store Inc (NASDAQ:CBRL), Jack In The Box Inc (NASDAQ:JACK), Biglari Holdings Inc (NYSE:BH), Ferrari NV (NYSE:RACE), and Biglari Holdings Inc (NYSE:BH.A). The firm primarily invests in the Consumer Cyclical and Technology sectors.

Overview of El Pollo Loco Holdings Inc.

El Pollo Loco Holdings Inc. is a leading fast-casual chicken restaurant chain in the United States. The company operates and franchises hundreds of restaurants, offering a variety of low-priced options. The company's market capitalization stands at $381.242 million, with a current stock price of $10.75. The stock's PE percentage is 16.54, indicating a modest undervaluation according to the GF Value Rank. The GF Value of the stock is $13.76, with a Price to GF Value ratio of 0.78.

Performance of El Pollo Loco Holdings Inc. Stock

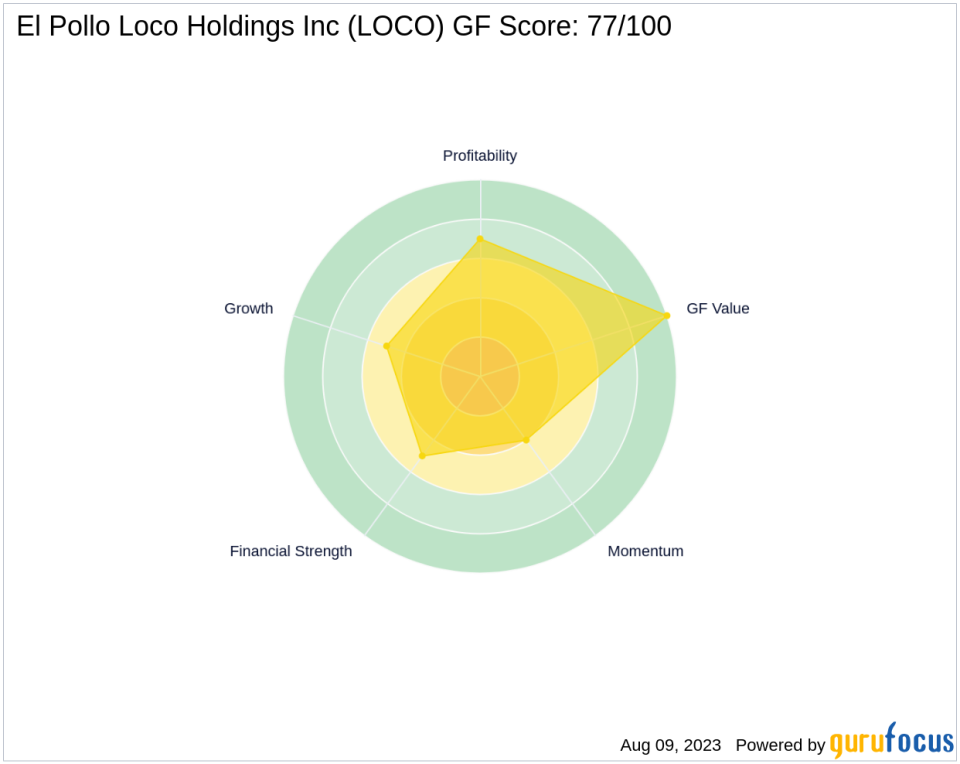

Since the transaction, the stock has gained 3.46%, but it has declined by 43.42% since its IPO in 2014. The stock has a year-to-date price change ratio of 10.03%. The GF Score of the stock is 77/100, indicating a good outperformance potential.

Financial Health of El Pollo Loco Holdings Inc.

El Pollo Loco Holdings Inc. has a Financial Strength Rank of 5/10, a Profitability Rank of 7/10, and a Growth Rank of 5/10. The company's cash to debt ratio is 0.04, and its interest coverage is 12.22. The company's ROE and ROA are 7.88 and 3.91, respectively.

El Pollo Loco Holdings Inc.'s Position in the Market

El Pollo Loco Holdings Inc. operates in the restaurant industry. The company's revenue, EBITDA, and earning growth over the past 3 years are 2.80%, -6.40%, and -5.20%, respectively. The stock's RSI 14 Day is 62.58, and its Momentum Index 6 - 1 Month is -26.07.

Largest Guru Holding El Pollo Loco Holdings Inc.

The largest guru holding El Pollo Loco Holdings Inc. is Hotchkis & Wiley Capital Management LLC. However, the exact percentage of the traded stock held by this guru is not available.

In conclusion, BIGLARI CAPITAL CORP. (Trades, Portfolio)'s recent acquisition of El Pollo Loco Holdings Inc. shares could potentially influence the stock's performance and the firm's portfolio. Investors should keep a close eye on future developments.

This article first appeared on GuruFocus.