Bill Ackman Is Betting on a Burger King Turnaround

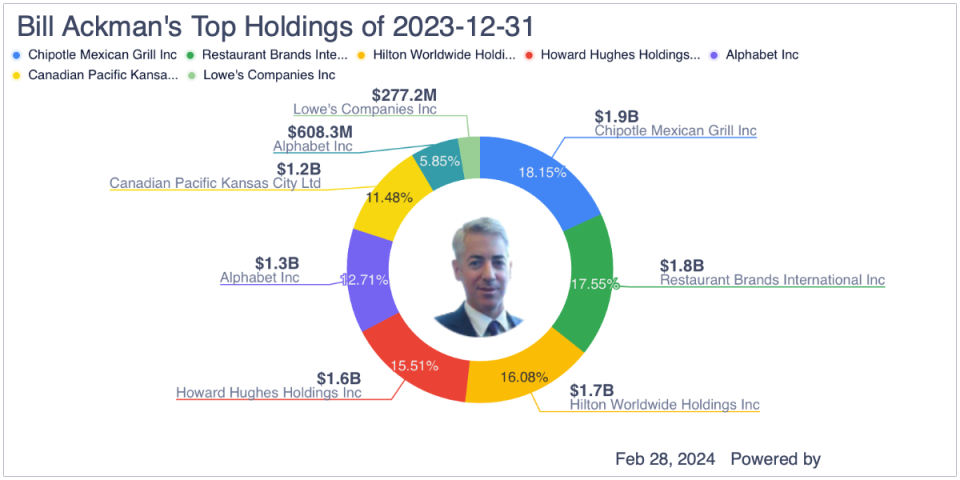

Bill Ackman (Trades, Portfolio) has made big bets on the quick-service industry with his top two holdings, Chipotle Mexican Grill Inc. (NYSE:CMG) and Restaurant Brands International Inc. (NYSE:QSR). Let's take a closer look at the latter, which is trying to turn around its largest brand.

Company profile

Restaurant Brands, or RBI as it is frequently called, primarily franchises quick-service restaurants in both North America and globally. Hamburger chain Burger King is its largest concept with over 19,300 global locations and $27 billion in global systemwide sales last year.

Coffee and donut chain Tim Horton is the company's second-largest brand with over 5,800 locations and over $7.8 billion in 2023 systemwide sales, followed by chicken restaurant Popeye's, which has over 4,500 locations and recorded $6.8 billion systemwide sales in 2023. Firehouse Subs is its smallest concept with over 1,200 locations and $1.2 billion in 2023 systemwide sales.

Opportunities and risks

Continued expansion of its franchised restaurants is Restaurant Brands' biggest growth opportunity. The company is looking to grow its number of locations from around 31,000 to over 40,000 over the next five years. Domestically, the company is looking to add 800 Popeye's and Firehouse Subs in North America by 2028. Meanwhile, it is looking to expand its Tim Horton's presence in the U.S., adding 400 locations of the popular Canadian chain.

Expanding its store base in international markets, however, is the bigger growth opportunity for Restaurant Brands, as it looks to add about 7,000 new locations over the next five years. While Burger King has over 12,000 international locations, that's half the number of international restaurants as rival McDonald's Corp. (NYSE:MCD). The other three brands, meanwhile, are all still unperpetrated internationally with plenty of runway. While Burger King is in over 120 markets, Popeye's is in only 35 markets. Restaurant Brands will look to enter new markets, as well as expand in existing ones.

Another growth opportunity the company is pursuing is remodeling and modernizing Burger King. Restaurant Brands says remodeled restaurants at the chain see a 20% uplift in sales once completed. To accelerate its remodeling program, the company is in the process of acquiring its largest franchisee owner, Carrols Restaurant Group (NASDAQ:TAST), which owns over 1,000 Burger Kings and 60 Popeye's across 23 states, for $1 billion.

It will look to remodel 600 of the Carrols locations over the next five years, which will bump up its planned remodels from 45 locations a year to 120. The company then plans to refranchise the restaurants over the next several years. In total, Restaurant Brands is looking to remodel a total of 400 Burger Kings this year, with 80% of them being full remodels.

The company has also been making a big marketing push with Burger King to help increase sales as well as invest in digital. This includes investing in its app as well in-store kiosks, which are currently being piloted. Kiosks have been very successful with other quick-service chains, increasing speed of service while lowering wage costs, so this has some potential to boost sales and strengthen its franchisees.

When it comes to risks, given that it primarily franchises its locations, Restaurant Brands does not face the same direct headwinds from rising minimum wages and food inflation that its less-franchised peers face. However, its franchisees can experience pain from these issues, which can lead to reduced margins and lower four-wall Ebitda. This pressure, in turn, has caused a number of Burger King franchisee bankruptcies over the past few years, which has led the company to buy back the stores, as well as close low-volume locations.

Restaurant Brands carries a fair amount of leverage, which stood at 4.80 times at the end of 2023. About half its debt is variable, which has led to higher interest expenses, which have also eaten into cash flow while it is embarking on its remodeling and digitalization efforts.

Economic conditions, both in the U.S. and internationally, can also impact sales. Quick-service restaurants have generally been enjoying strong sales growth on the back of rising prices, but consumers have started to push back, so this catalyst should begin to wane. In China, meanwhile, Restaurant Brands has pulled back on some new store growth due to current conditions in the country.

Valuation

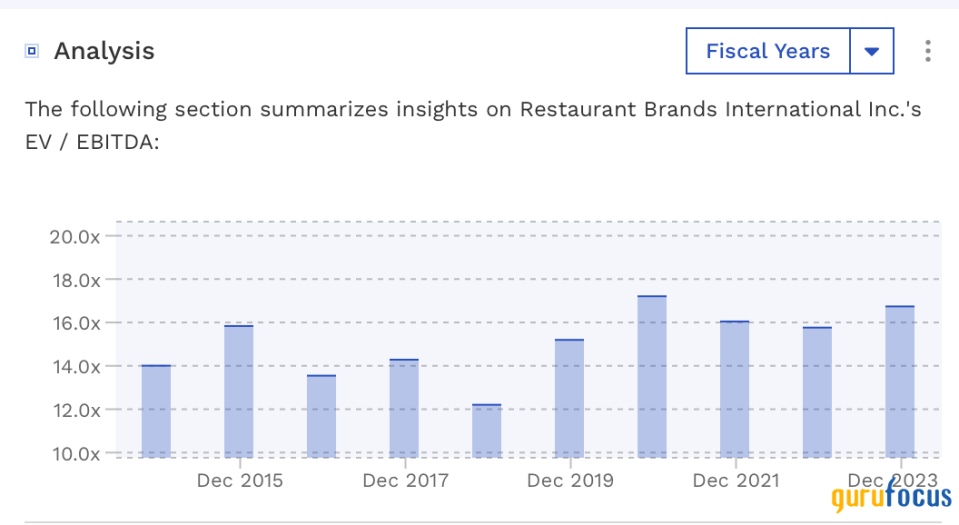

The stock currently trades around 14 times the 2024 consensus Ebitda of $2.77 billion and 13 times the 2025 consensus of $2.99 billion.

Revenue growth is expected to grow 6.20% this year and over 5.30% next year.

The company trades at a discount to rival McDonald's, which trades at nealry 18 times 2024 Ebitda, and close to Wendy's (NASDAQ:WEN), which trades at just under 14 times 2024 Ebitda.

Before the pandemic, Restaurant Brands traded between 12 and 16 times Ebitda. That would value the company between $71 and $104 based on 2025 Ebitda, with a midpoint of $87.50.

Conclusion

Restaurant Brands is in the midst of turning around its Burger King brand through remodels, digitalization and increased marketing. At the same time, the company is looking to expand all its concepts, especially in international markets.

Its franchise model helps reduce risks, although it has had to deal with some franchisee issues at Burger King in recent years. If the company's turnaround continues, the stock should have some nice upside potential. Burger King posted solid 6.30% same-store sales in the fourth quarter, but the most notable sign of progress was the chain saw its first same-store traffic increase in the U.S. since the second quarter of 2021. The company needs to build on this momenturm, but it is a good step in the right direction.

This article first appeared on GuruFocus.