Bill Ackman's Pershing Square Takes a Chip Off Chipotle Stake

Billionaire investor Bill Ackman (Trades, Portfolio) disclosed on Monday he trimmed Pershing Square's stake in restaurant operator Chipotle Mexican Grill Inc. (NYSE:CMG) by 12.5%.

The activist guru's New York-based hedge fund is known for taking large positions in underperforming companies and pushing for change in order to unlock value for shareholders.

According to Real-Time Picks, a Premium feature of GuruFocus, the guru sold 215,378 shares of the fast-casual restaurant chain, which was its best-performing holding in 2019, on Feb. 7. He now holds 1.5 million shares, which represent 20.69% of his firm's equity portfolio and 5.43% of the company's outstanding shares. The stock traded for an average price of $860.27 per share.

GuruFocus estimates Pershing Square has gained 83.14% on the investment since establishing it in the third quarter of 2016.

The popular Newport Beach, California-based company, which serves a variety of tacos and Mission-style burritos, has a $24 billion market cap; its shares were trading around $876.55 on Monday with a price-earnings ratio of 69.86, a price-book ratio of 14.25 and a price-sales ratio of 4.38.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced.

In Pershing Square's annual investor update presentation, Ackman noted that 2019 was "an outstanding year" for Chipotle shareholders as management successfully "reignited" sales and profit growth, recording 11% same-store sales growth. Restaurant margins expanded 1.8 percentage points to 20.5%. He noted management also has a clear plan for growth in 2020, which includes new menu items and the addition of drive-thru lanes.

Despite the progress made, Ackman cautioned that the firm still believes "Chipotle has significant unrealized growth potential, with average restaurant sales still 12% below peak levels and margins approximately 700 basis points below peak levels."

GuruFocus rated Chipotle's financial strength 4 out of 10 on the back of low debt ratios that underperform over half of its competitors. In contrast, the robust Altman Z-Score of 6.5 indicates the company is in good financial health.

The company's profitability fared better, scoring an 8 out of 10 rating. Although Chipotle's margins have declined over the past several years, they still outperform over half of its industry peers. In addition, it has strong returns, a moderate Piotroski F-Score of 6, which indicates operations are stable, and a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Chipotle as of the end of third-quarter 2019, Jim Simons (Trades, Portfolio)' Renaissance Technologies has the largest position with 6.89% of outstanding shares. Other guru shareholders are Spiros Segalas (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), John Hussman (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio).

Portfolio composition and performance

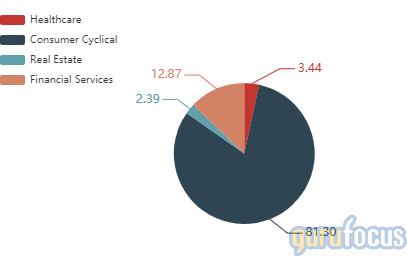

As of the end of the third quarter, Ackman's $6.49 billion equity portfolio, composed of eight stocks, was largely invested in the consumer cyclical sector, followed by much smaller holdings in the financial services, health care and real estate spaces.

The remaining stocks that make up his portfolio are Agilent Technologies Inc. (NYSE:A), Berkshire Hathaway Inc. (NYSE:BRK.B), Starbucks Corp. (NASDAQ:SBUX), The Howard Hughes Corp. (NYSE:HHC), Lowe's Companies Inc. (NYSE:LOW), Restaurant Brands International Inc. (NYSE:QSR) and Hilton Worldwide Holdings Inc. (NYSE:HLT).

After several years of underperformance, Pershing Square made a comeback in 2019 with a return of 58.1%. This was substantially above the S&P 500 Index's 30.43% return.

Disclosure: No positions.

This article first appeared on GuruFocus.