Bill Ackman's Pershing Square Packs Into Agilent

Pershing Square Capital Management, the activist firm founded by Bill Ackman (Trades, Portfolio), disclosed this week it established a new holding in Agilent Technologies Inc. (NYSE:A).

Ackman's firm buys the stock of public companies at a discount and pushes for change so that the market recognizes its value.

Transaction details and company background

According to a filing with the Securities and Exchange Commission, Pershing Square purchased 2,916,103 shares of Agilent, giving the position 3.44% weight in the equity portfolio. Shares averaged $72.2 during the quarter.

Spun off of HP Inc. (NYSE:HPQ) in 1999, Agilent has evolved into a medical diagnostics and research company that delivers insight and innovation toward improving quality of life. The Santa Clara, California-based company operates three business segments: life science and applied equipment, cross lab and diagnostics and genomics.

For the three months ending Oct. 31, Agilent reported revenue of $1.37 billion, up 6% from the prior-year quarter. Revenues in the company's cross lab and diagnostics and genomics segments increased 10% and 7% on a core basis, driven by continued strength in the pharma, diagnostics and clinical, and environmental and forensics markets according to CEO Mike McMullen.

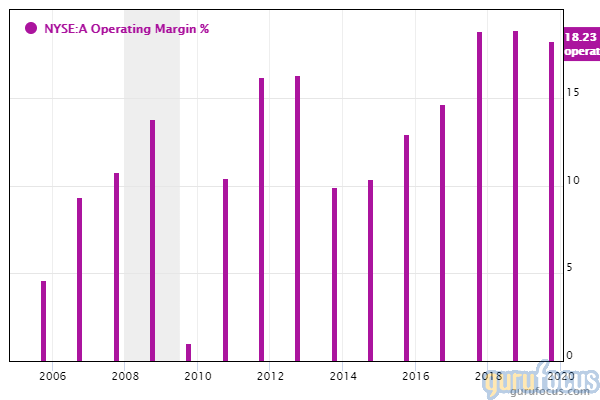

McMullen further said on the earnings call that the fourth quarter of fiscal 2019 represented the company's 19th consecutive quarter of adjusted operating margin expansion. Chief Financial Officer Bob McMahon said operating expense leverage and strong expense management drove margin growth, which is 12.80% per year on average over the past five years according to GuruFocus' loglinear regression model.

Company profitability overview

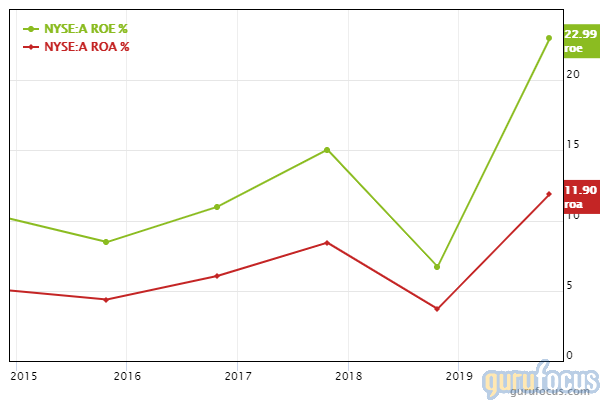

Agilent's expanding profit margins, which are outperforming over 85% of global competitors, contribute to a GuruFocus profitability rank of 8. Other strong indicators of high profitability include a solid Piotroski F-score of 6 and returns outperforming over 86% of global medical diagnostics and research companies.

Jerome Dodson (Trades, Portfolio), one of our speakers at next year's Value Conference, took a position in Agilent for his Parnassus Endeavor Fund (Trades, Portfolio) during the quarter. Other gurus riding Agilent's strong profitability include Pioneer Investments (Trades, Portfolio) and the Eaton Vance Worldwide Health Sciences Fund.

See also

Pershing Square's other buys for the quarter included Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

Disclosure: No positions.

Read more here:

Charles de Vaulx's Top 5 Buys of the 3rd Quarter

4 Health Care Stocks Gurus Broadly Own

Brandes Investments' Top 5 Buys in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.