Bill Nygren's Top 6 Trades in the 3rd Quarter

- By James Li

Bill Nygren (Trades, Portfolio), manager of the Oakmark Fund, disclosed this week that the fund's top six trades during the third quarter included new buys in Keurig Dr Pepper Inc. (NASDAQ:KDP) and CBRE Group Inc. (NYSE:CBRE). Despite this, the top sells included the closure of its Pinterest Inc. (NYSE:PINS) holding and position reductions in Citigroup Inc. (NYSE:C), Apache Corp. (NYSE:APC) and EOG Resources Inc. (NYSE:EOG).

The Chicago-based fund seeks long-term capital appreciation by investing in companies the fund managers believe trade at a discount to the fair business value. Nygren and his partners also look at free cash flows and level of management ownership.

Nygren said in his quarterly commentary letter that the Oakmark Fund returned 6.2% during the quarter, underperforming the Standard & Poor's 500 Index benchmark return of 8.9%. Despite this, the fund manager said its disciplined investment strategy and long-term focus helped the fund outperform the stock market since the fund's inception in August 1991.

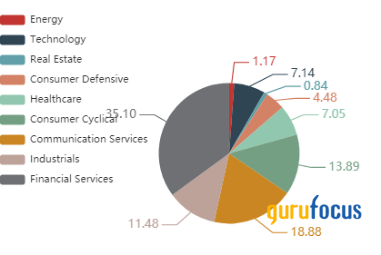

As of third quarter-end, the fund's $10.6 billion equity portfolio contains 49 stocks, with three new positions and a turnover ratio of 3%. The top three sectors in terms of weight are financial services, communication services and consumer cyclical, representing 35.10%, 18.88% and 13.89% of the equity portfolio.

Keurig Dr Pepper

The Oakmark Fund purchased 5.97 million shares of Keurig Dr Pepper, giving the stake 1.56% weight in the equity portfolio. Shares averaged $29.29 during the third quarter; the stock is fairly valued based on its current price-to-GF Value ratio of 1.05.

The Burlington, Massachusetts-based company manufactures nonalcoholic beverages through brands like Dr. Pepper, Snapple, 7UP, Canada Dry and Mott's. GuruFocus ranks the company's profitability 6 out of 10: Even though revenues have declined over 10% per year on average over the past five years, Keurig Dr Pepper's operating margin is near a 10-year high of 22.25% and outperforms 89.58% of global competitors.

Nygren said in his commentary that he and his partners believe that single-serve coffee pods like Keurig's K-Cups have growth potential due to convenience, quality and variety of products tailored to at-home coffee consumption.

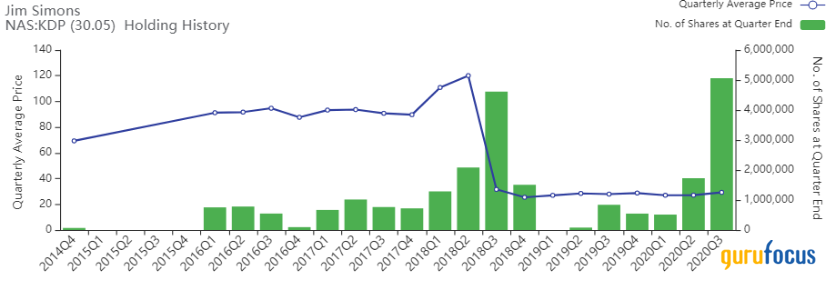

Other gurus with holdings in Keurig Dr Pepper include Jim Simons (Trades, Portfolio)' Renaissance Technologies and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management.

CBRE

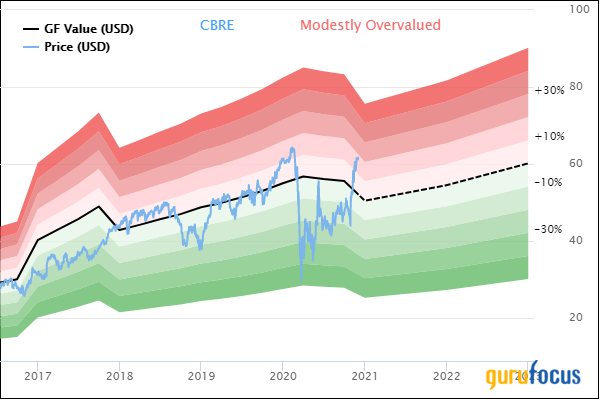

The fund purchased 1.894 million shares of CBRE, giving the position 0.84% weight in the equity portfolio. Although shares averaged $45.67 during the third quarter, the stock is modestly overvalued as of Wednesday with a price-to-GF Value ratio of 1.19.

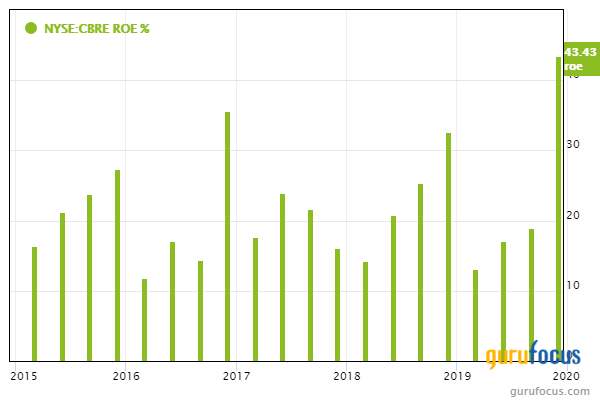

GuruFocus ranks the Los Angeles-based real estate company's profitability 8 out of 10 on the back of a four-star business predictability rank and a return on equity that outperforms 89% of global competitors despite operating margins being near a 10-year low of 4.33% and underperforming over 69% of global real estate companies.

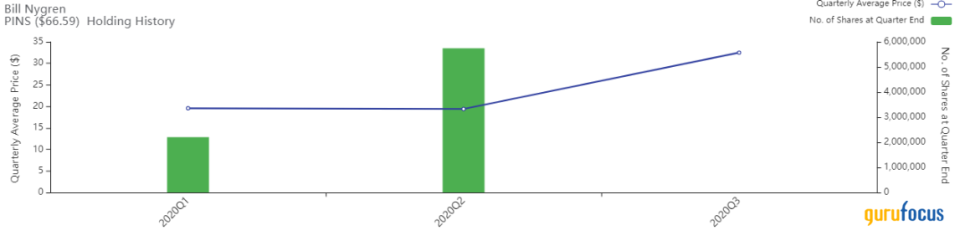

The fund sold 5.739 million shares of Pinterest, trimming the equity portfolio 1.16%. Shares averaged $32.50 during the third quarter; the fund gained over 60% on the stock since initially buying shares during the first quarter.

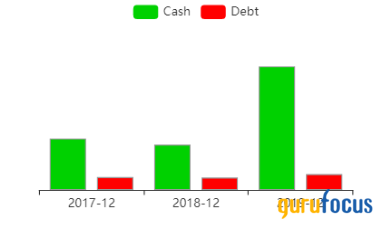

The San Francisco-based company provides a platform that helps users discover ideas for apparel, cooking and travel. GuruFocus ranks the company's financial strength 7 out of 10 on the back of equity-to-asset and debt-to-equity ratios outperforming over 62% of global competitors.

Nygren said in his letter that the fund established holdings in Pinterest and Match Group Inc. (NASDAQ:MTCH) during the market's "heightened volatility" over the first three months of the year: The companies traded down despite attractive long-term prospects, increased user engagement and strong balance sheets. The fund sold the holdings when the market agreed with the fund's thesis and the stock approached the fund's estimate of intrinsic value.

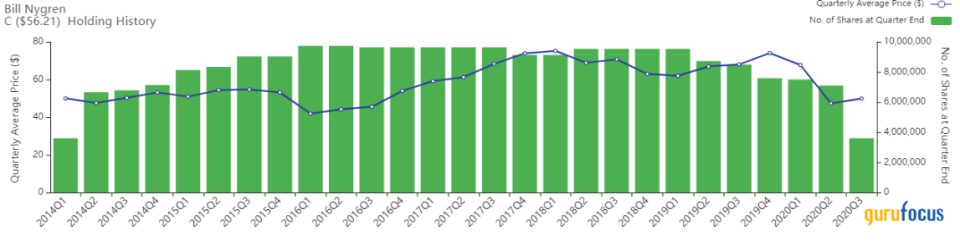

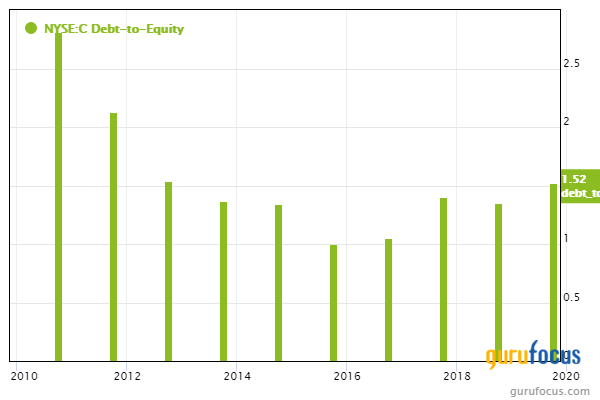

Citigroup

The fund sold 3.49 million shares of Citigroup, trimming the position 49.2% and the equity portfolio 1.63%. Shares averaged $49.87 during the third quarter.

GuruFocus ranks the New York-based bank's financial strength 3 out of 10 on the back of debt ratios underperforming over 75% of global competitors, suggesting high use of leverage compared to stocks from other industries.

Apache and EOG Resources

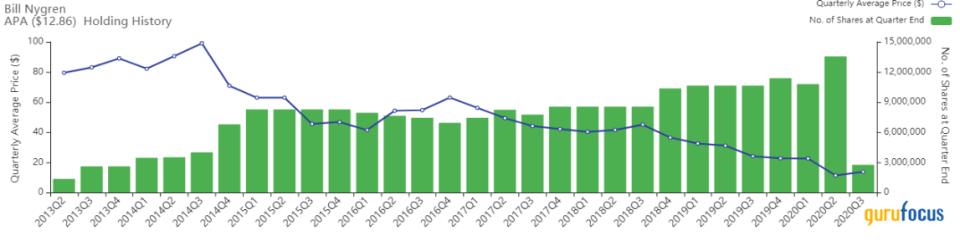

The fund sold 10.795 million shares of Apache, trimming the position 79.73% and the equity portfolio 1.33%. Shares averaged $13.70 during the third quarter.

The fund also sold 2.014 million shares of EOG Resources, trimming the position 42.73% and the equity portfolio 0.93%. Shares averaged $44.93 during the third quarter.

Apache and EOG Resources both explore for and produce oil around the globe, with headquarters in Houston.

Disclosure: No positions.

Read more here:

David Herro's Top 4 Trades in the 3rd Quarter

3 Scandinavian Companies With Strong Margin Growth

3 Margin-Growing UK Stocks as Lockdown Measures Ease Up

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.