Billionaire Mark Mobius Says Emerging Market Stocks Are the Place to Be Right Now; Here Are 2 Names That Analysts Like

Since the end of the Second World War, the US has been the 800-pound gorilla of the world economy – the largest in monetary terms, the largest producer, the largest innovator, the largest financial market. That dominance has been challenged in the last couple of decades, with the rise of China to become the world’s second-largest economy, the expansion of Taiwan’s semiconductor chip industry to global leadership, the ingenuity of South Korean tech firms – especially in AI, and the expansion of India’s economy as that country has become the world’s largest by population.

For billionaire hedge manager Mark Mobius, the emergence of new players among the world-leading economies opens up new opportunities for a more diversified portfolio – and the famously successful investor recently acknowledged that his own portfolio is completely divested from US-based companies. Mobius isn’t just boosting and promoting emerging economies and markets – he’s putting his money where his mouth is, and going all-in.

Mobius is particularly intrigued by the potential of Taiwan, South Korea, and India. In a recent interview, he emphasized, “We are seeking companies that have established international diversification, and we’ve come across numerous enterprises with remarkable technological prowess that enables them to broaden their investor outreach.” Mobius goes on to cite the booming high-tech in Taiwan and South Korea, and India’s fast GDP growth of 7% and population of 1.40 billion. Mobius sees all three of these countries as economic leaders for the coming decades.

Wall Street’s analysts are finding plenty to agree with in that assessment, and they’ve been picking out emerging market stocks that are poised to gain going forward from here. Using TipRanks’ database, we pinpointed two such names that are considered ‘Strong Buys.’ Not to mention considerable upside potential is on the table here. Let’s take a closer look.

Taiwan Semiconductor (TSM)

Taiwan has become the world’s leader in semiconductor chip output, providing some 60% of the global supply of these vital computer components, and Taiwan Semiconductor is one of the country’s largest chip makers. The company operates primarily as a foundry, an advanced production plant that takes third-party contracts to manufacture semiconductor chips in mass runs. The client firms handle the design work and prototypes, while TSM handles the regular production; the model has proven successful for the industry.

It’s proven successful for TSM, specifically, too. The company has approximately 58% market share of Taiwan’s chip foundry business, and a market cap of more than $514 billion.

Taiwan Semiconductor’s financial results showed several quarters of positive results, and consistent gains, coming out of the pandemic period and through the end of last year. The company found support in increased product demand post-COVID. This year, however, slowing chip demand – caused by a combination of continued supply chain disruptions, a slower-than-hoped reopening in China, higher interest rates causing a tighter credit environment, and increased inflation forcing consumers to pare back spending – has impacted the chip foundry’s top and bottom lines.

In the last reported quarter, 2Q23, TSM showed revenues of US$15.68 billion. While this was down 13.7% from 2Q22, it beat the analyst expectations by US$300 million. The bottom line figure, an EPS of $1.14 in US currency, also fell 26% year-over-year, but came in better than expected, by 6 cents per share.

Mehdi Hosseini, a 5-star analyst from Susquehanna, highlights TSM’s strong position in the industry and its adeptness in leveraging this advantage to drive further market share growth. These qualities lie at the core of his assessment of the stock, where he presents a compelling long-term outlook based on the following factors: “1) COWOS capacity is expected to roughly double contributing to margin and revenue accretion. 2) New product ramps such as AWS Graviton and eventually Meteor Lake, Grace, Genoa/Sapphire Rapids are driving growth into 2024. 3) Server AI processors (CPU, GPU, and AI accelerators for training and inference) account for ~6% of TSM’s revenue and are expected to grow to account for a low teens % of revenue. 4) N3e starts to scale in 2024 thanks to higher EUV throughput from ASML’s 3800E. 5) Earning power in the next up cycle is estimated in the $8-$10 range, or ~2x that of CY23 EPS estimate.”

Quantifying this stance, Hosseini gives TSM shares a Buy rating with a 36% one-year upside based on a $135 price target. (To watch Hosseini’s track record, click here)

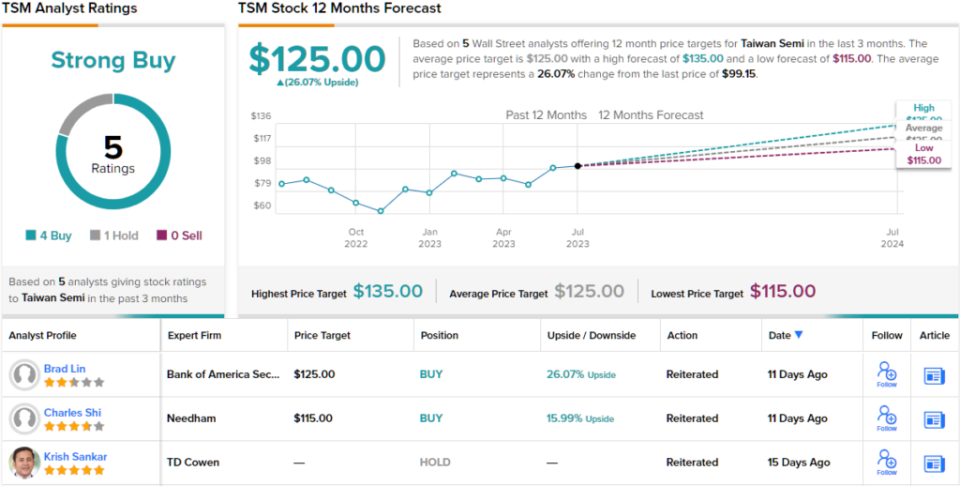

Overall, this major chip maker has picked up 5 recent analyst reviews, with a 4 to 1 breakdown favoring Buys over Holds for a Strong Buy consensus rating. The stock is trading for $99.15, and its $125 average price target implies a one-year upside potential of ~26%. (See TSM stock forecast)

WNS Limited (WNS)

WNS is a global business process management firm based in Mumbai, India. Strategically positioned in a country that has become an economic powerhouse over the last decade, WNS serves enterprise clients in 10 industries worldwide. With operations in 13 countries across 4 continents, the company’s success is fueled by a combination of technology and digital analytics, boasting over 400 clients and employing more than 59,000 people.

The general economic uncertainty of recent months – the combination of high interest rates and high inflation, the increased chances of a US recession, China’s slow reopening – have put a premium on business efficiency, exactly the sort of issue to which WNS promises solutions. The company has seen a modest upward trend in both revenues and earnings for the past several quarters.

The last quarterly report, for Q1 of fiscal year 2024, showed this trend continuing. The company had a revenue total of $317.5 million at the top line, for increases of 15.5% year-over-year – and beat the forecast by $12.9 million. At the bottom line, WNS’ $1.01 non-GAAP EPS beat expectations by 8 cents per share, and was up from 90 cents in the year-ago period.

The company’s solid growth in a difficult global environment caught the eye of Needham analyst Mayank Tandon, who wrote of WNS, “We remain bullish on WNS given the healthy operating environment and strong execution from management despite the uncertain macro conditions. We believe that WNS’ mission critical solutions become even more important during times of economic strain, and expect management to drive double-digit revenue and EPS growth despite the challenging macro. With the shares trading at an ex-cash P/E multiple of 15x our FY25 estimate, we view the risk-reward as compelling. WNS remains our top pick for 2023.”

Looking ahead, Tandon rates this ‘top pick’ as a Buy, and his $115 price target implies an upside potential of 66% for the year ahead. (To watch Tandon’s track record, click here)

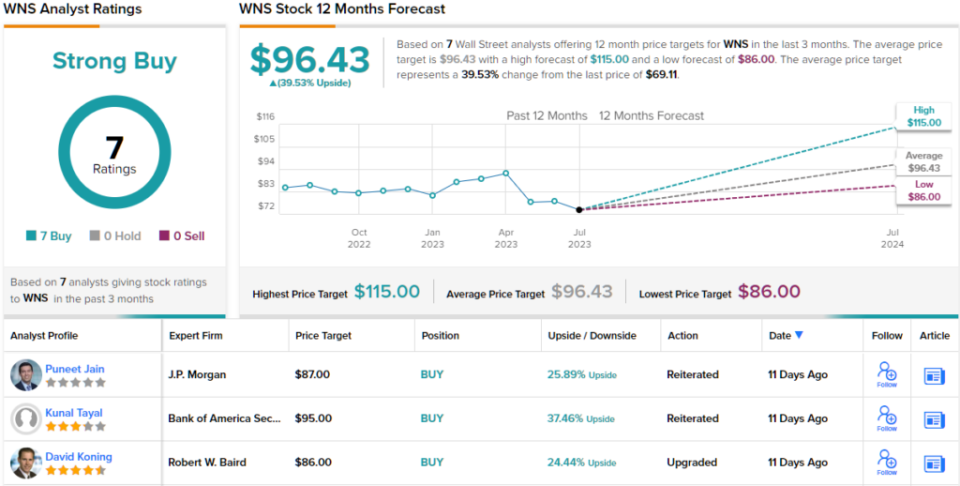

Overall, all 7 of the recent analyst reviews on WNS are positive, for a unanimous Strong Buy consensus rating on the stock. The average price target of $96.43 and trading price of $61.11 combine to suggest a 12-month upside potential of 39.5%. (See WNS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.