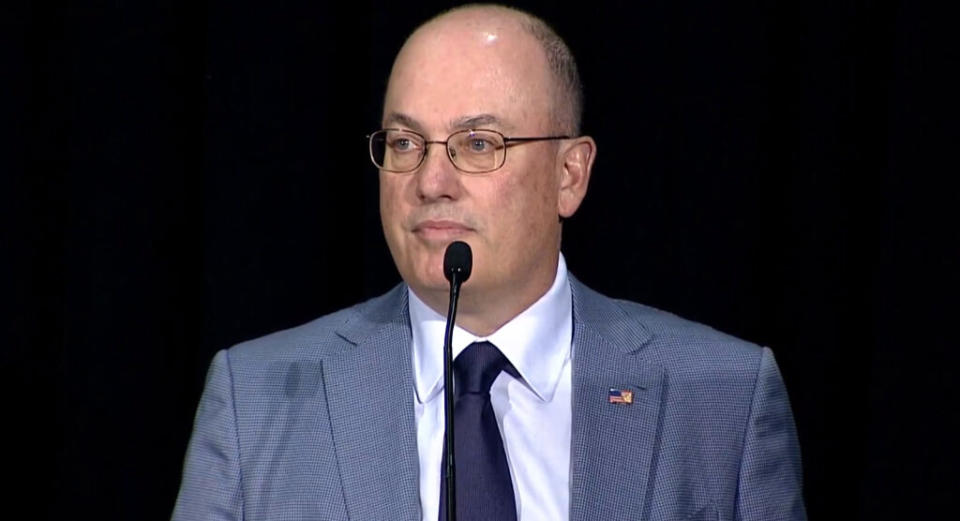

Billionaire Steve Cohen Loads Up on These 2 ‘Strong Buy’ Penny Stocks — Here’s Why Wall Street Sees Over 500% Upside Potential

There are two sides to every coin. For penny stocks, or tickers that trade for less than $5 per share, this rings especially true. As some of the most divisive names on the Street, they are either met with resounding praise or forceful discontent.

Going beyond the argument that you get more for your money, even minor price appreciation can result in massive percentage gains. However, some investors prefer to avoid these stocks entirely, as the fact that shares are trading at such depressed levels could signal insurmountable headwinds or weak fundamentals.

So, how are investors supposed to determine which penny stocks are poised to make it big? Following the activity of the investing titans is one strategy.

Billionaire Steve Cohen is among these Wall Street greats. Serving as Point72’s Chairman, CEO and President, Cohen has built his fortune – around $17.5 billion – using a high-risk/high-reward strategy. Throughout his career, Cohen has consistently delivered huge returns to clients, giving him guru-like status on the Street.

Turning to Cohen for inspiration, we took a closer look at two penny stocks Cohen’s Point72 made moves on recently. In fact, it’s not only Cohen who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Not to mention colossal upside potential is on the table. We’re talking about over 500% here.

Praxis Precision Medicines (PRAX)

We’ll start with Praxis Precision Medicines, a biopharmaceutical company focused on diseases of the central nervous system, or CNS. Specifically, the company is working on new treatments for movement disorders and epileptic seizure disorders, two sets of CNS conditions connected by neuronal imbalances. The company is following a dual-track research pipeline, using two proprietary platforms to develop new drug candidates: Cerebrum, a small molecule platform, and Solidus, an ASO (antisense oligonucleotide) platform.

The company’s research is based on the application of genetic insights and an understanding of the biological targets and circuits in the brain. Between the two platforms, Praxis has 4 active pipeline programs in the clinic.

The standout drug candidate here is ulixacaltamide. Earlier this month, Praxis announced positive data from the randomized withdrawal sub-study and long-term extension of the Essential1 study for this candidate in the treatment of essential tremors. The study showed that patients switched from ulixacaltanide to placebo experienced a worsening of symptoms. The sub-study execution also confirmed design features of the planned Phase 3 study, scheduled to begin during 4Q23. The company has already had a favorable end-of-phase-2 meeting with the FDA, in preparation for Phase 3 initiation.

Also of note is the company’s drug candidate PRAX-628, a potential treatment for focal epilepsy. This program has completed Phase 1 testing, and Praxis recently released positive results from the EEG analysis following that trial. PRAX-628 is currently undergoing Phase 2 testing, and the initial data readout from that study is expected in 2H23.

In another upcoming catalyst, Praxis expects to release data from the Phase 2 EMBOLD study of PRAX-562 in the treatment of pediatric patients with developmental and epileptic encephalopathies (DEEs) during the fourth quarter of this year.

These research tracks have caught the eye of Steve Cohen during Q2. In that quarter, Cohen bought 10,500,000 shares of PRAX, a massive increase from his previous holding of 50,000 – and a strong vote of confidence in the company. Cohen’s holding here is worth $11.39 million at current prices.

The billionaire investor is far from Praxis’ only bullish fan. Piper Sandler analyst Yasmeen Rahimi covers this stock and is impressed with what she sees – especially on the ulixacaltamide track.

“We are pleased to report that PRAX has been making significant progress across their four pipeline programs, especially highlighting that the Ph3 program in ET with ulixacaltamide is on track to start enrollment as soon as October 1 (4Q23) with topline in 2H24. We continue to have high conviction on a positive readout of the primary endpoint of mADL11, given that Essential1 showed a significant -1.81 delta difference (-2.69 vs -0.88 placebo; p=0.042), despite not being powered on that measure… Overall we remain bullish on the stock and see a buying opportunity for PRAX with ~1 year out from topline Ph3 data,” Rahimi wrote.

These comments underpin Rahimi’s Buy rating while her $18 price target makes room for 12-month returns of a whopping 1,598% from the current share price of $1.07. (To watch Rahimi’s track record, click here)

Overall, Wall Street tends to agree with the bull. The 4 recent analyst reviews include 3 Buys and 1 Hold, for a Strong Buy consensus rating. The $7.75 average price target is less aggressive than Rahimi’s, but it still leaves room for 624% upside potential. (See PRAX stock forecast)

Agenus, Inc. (AGEN)

The next penny stock we’re looking at is Agenus, a biotech company working on new immunotherapy drugs for the treatment of cancer. Immuno-oncology is an expanding field, based on using the patient’s own immune system to fight the cancer, aiming to control or cure the disease.

Agenus has a wide-ranging research pipeline of immuno-oncology programs, including antibody therapeutics, adoptive cell therapies, and adjuvants and vaccines. The company’s allogeneic cell therapies and adjuvant and vaccine programs are being undertaken by subsidiaries. In total, Agenus is working on more than a dozen clinical-stage programs and estimates that its leading program has a potential patient base of 200,000+ in the US.

Agenus’ pipeline includes fully-owned drug candidates, partner-directed programs, and clinical collaborations with other biotech companies. The company’s research is targeting a large number of cancers, including pancreatic cancer, cervical cancer, colorectal cancer, melanoma, and general solid tumors. Several of the drug candidates are undergoing multiple studies, as both monotherapies and combination treatments. Agenus’ partners include such big names as Merck, Briston Myers Squibb, and GSK.

In its most recent business update, for 2Q23, Agenus reported continuing progress on multiple research tracks. The most advanced of these is based on the drug candidate botensilimab, which is being clinically tested against several cancers. The primary trials are the two Phase 2 ACTIVATE studies. One of these studies assesses the drug as a monotherapy against melanoma, while the other examines it as a combination therapy with balstilimab against colorectal cancer. Both of these studies are expected to reach full enrollment by the end of this year, with data updates planned for 2024.

Standing firmly in the bullish corner, Cohen’s actions spoke volumes during the second quarter. Boosting its holding by 125%, his firm snapped up 9,776,083 shares in the company. This brought Point72’s total holding in the firm to 17,616,983 shares, a stake worth $22.2 million at current valuations.

The company’s active, wide-ranging, and catalyst-rich pipeline has also caught the eye of Baird analyst Colleen Kusy, who says of the company and its stock, “We expect multiple meaningful catalysts for Agenus over the coming 6-18 months, including additional lung cancer data (YE23, not currently in the stock), Phase 2 melanoma data in 2024, and Phase 2 data in MSS CRC without active liver mets, which are expected to support Agenus’ first BLA filing in 2024 (recently hired Chief Commercial Officer). Overall, we remain bullish on the profile of botensilimab across multiple tumor types.”

Kusy follows up her comments with an Outperform (i.e. Buy) rating, and a price target of $8 that indicates her confidence in a robust 537% one-year upside potential. (To watch Kusy’s track record, click here)

Overall, this stock holds a unanimous Strong Buy consensus rating, based on 5 positive reviews set in recent weeks. The shares are currently trading at $1.25 and have an average price target of $7.66, pointing toward a 510% gain on the one-year horizon. (See AGEN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.