Bio-Rad Laboratories Inc (BIO) Faces Headwinds in Q4, Yet Shows Resilience in Diagnostics Segment

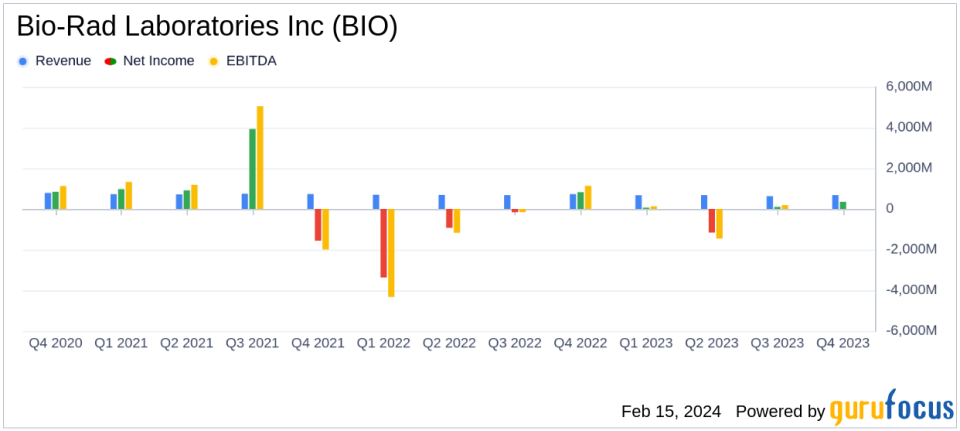

Revenue: Q4 net sales decreased by 6.7% to $681.2 million; full-year sales down 4.7% to $2,671.3 million.

Net Income: Q4 net income dropped to $349.7 million from $827.7 million in the prior year; full-year net loss reported at $637.3 million.

Earnings Per Share: Q4 diluted EPS at $12.14, down from $27.78; full-year loss per share at $21.82.

Gross Margin: Q4 gross margin slightly decreased to 53.8%; full-year gross margin at 53.4%.

Operational Highlights: Clinical Diagnostics segment grew, while Life Science faced declines; non-GAAP measures provided.

2024 Outlook: Non-GAAP, currency-neutral revenue growth expected between 1.0 to 2.5% with an operating margin of approximately 13.5 to 14.0%.

Bio-Rad Laboratories Inc (NYSE:BIO) released its 8-K filing on February 15, 2024, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a global provider of life science research and clinical diagnostics products, faced a challenging year with a notable decrease in net sales and net income, particularly impacted by the biopharma market's ongoing weakness.

For the fourth quarter, Bio-Rad reported net sales of $681.2 million, a 6.7% decrease from the $730.3 million reported in the fourth quarter of 2022. The Life Science segment experienced a significant decline of 19.1%, primarily due to lower sales of ddPCR, qPCR, and Western blotting products. Conversely, the Clinical Diagnostics segment saw a 5.3% increase, driven by strong demand for diabetes and quality control related products.

The company's net income for the fourth quarter was $349.7 million, or $12.14 per share on a diluted basis, a substantial decline from the $827.7 million, or $27.78 per share, reported in the same period of 2022. This decrease was primarily due to changes in the fair market value of equity securities related to the company's investment in Sartorius AG.

For the full year, Bio-Rad's net sales decreased by 4.7% to $2,671.3 million, with the Life Science segment down 12.0% on a currency-neutral basis. The Clinical Diagnostics segment, however, grew by 3.2% on a currency-neutral basis. The full-year gross margin was 53.4%, compared to 55.9% in 2022. The company reported a net loss of $637.3 million for the year, a significant contrast to the net loss of $3,627.5 million in 2022.

Strategic Initiatives and Future Outlook

Bio-Rad's President and CEO, Norman Schwartz, commented on the results, stating,

The ongoing weakness in biopharma markets continued to impact our fourth-quarter 2023 results, which were largely in line with expectations. Shifting focus to 2024, our full-year outlook reflects ongoing execution of our corporate transformation initiatives, effective expense management, and a cautiously optimistic view of a gradual biopharma sector recovery in the second half of the year."

The company's 2024 financial outlook anticipates non-GAAP, currency-neutral revenue growth of approximately 1.0 to 2.5 percent and an estimated non-GAAP operating margin of approximately 13.5 to 14.0 percent. This outlook is set against the backdrop of strategic initiatives aimed at navigating the current market challenges and positioning the company for future growth.

Bio-Rad's performance in 2023 reflects the resilience of its Clinical Diagnostics segment and the impact of broader market challenges on its Life Science segment. The company's strategic focus and cautious optimism for the latter half of 2024 suggest a commitment to navigating through the current headwinds with an eye on long-term growth.

For detailed financial statements and the reconciliation of GAAP to non-GAAP financial measures, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Bio-Rad Laboratories Inc for further details.

This article first appeared on GuruFocus.