Is Bio-Techne Corp (TECH) Modestly Undervalued? A Comprehensive Valuation Analysis

With a daily gain of 3.32%, a 3-month gain of 2.7%, and an Earnings Per Share (EPS) of 1.67, Bio-Techne Corp (NASDAQ:TECH) presents an interesting case for value investors. The question we aim to answer here is: Is the stock modestly undervalued? To do this, we'll delve into a comprehensive valuation analysis. Let's get started!

A Snapshot of Bio-Techne Corp (NASDAQ:TECH)

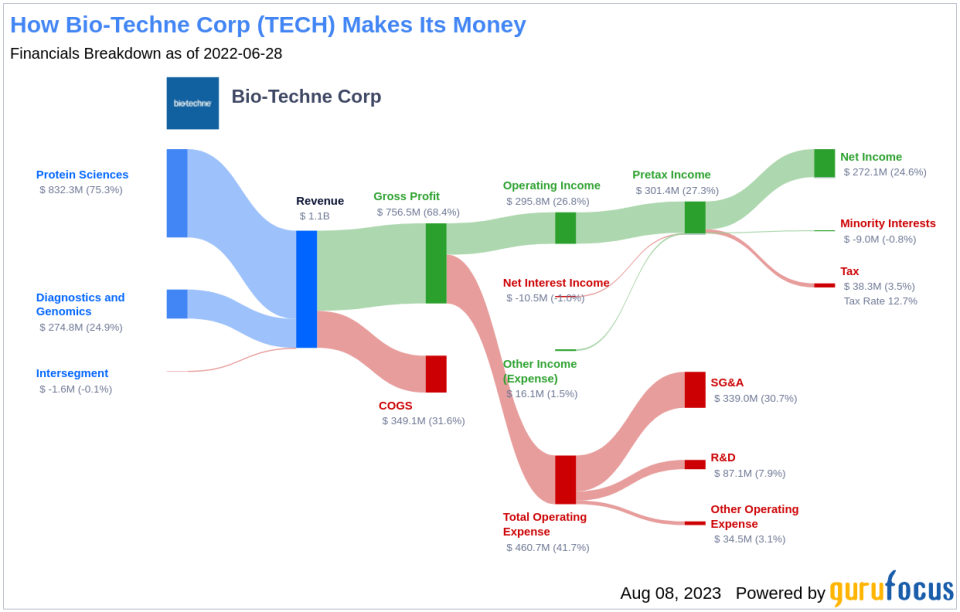

Based in Minnesota, Bio-Techne Corp (NASDAQ:TECH) is a life sciences manufacturer supplying consumables and instruments for the pharma, biotech, academic, and diagnostic markets. The company reports in two segments, protein sciences (75% of revenue), and diagnostics and genomics (25%). The United States accounts for about 55% of revenue, and the firm also has operations in EMEA (20% of sales), the U.K. (5%), and APAC (15%), with the rest of the world accounting for the remaining 5%.

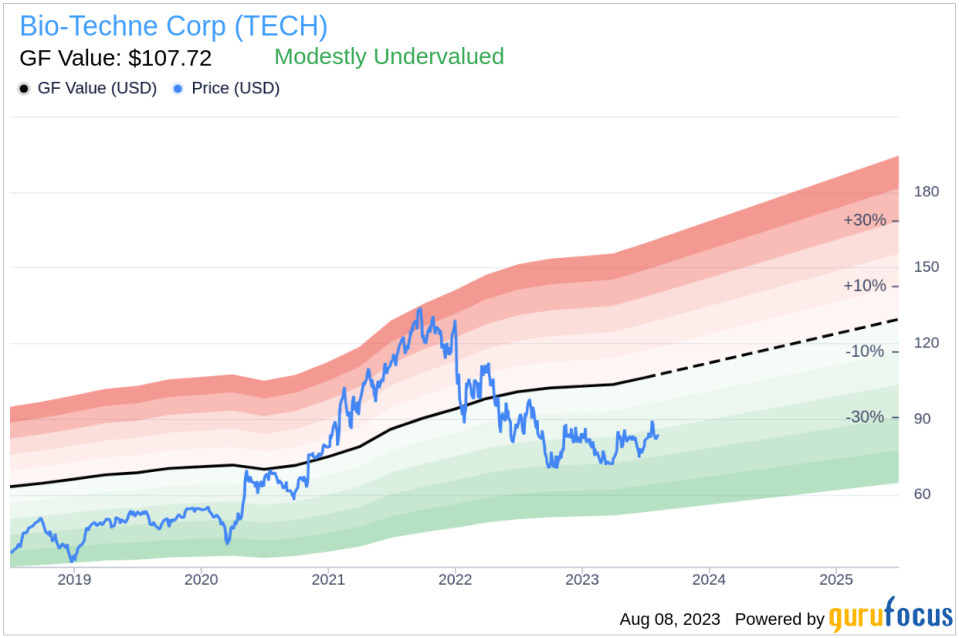

At a current price of $83.99 per share, it's crucial to compare this with the GF Value, an estimation of the company's fair value. This comparison will give us insights into whether the company is overvalued, undervalued, or fairly valued.

Understanding the GF Value of Bio-Techne (NASDAQ:TECH)

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

Based on our valuation method, Bio-Techne (NASDAQ:TECH) is estimated to be modestly undervalued. If the share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. On the other hand, if the share price is significantly below the GF Value calculation, the stock may be undervalued and have higher future returns.

Given that Bio-Techne is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength of Bio-Techne

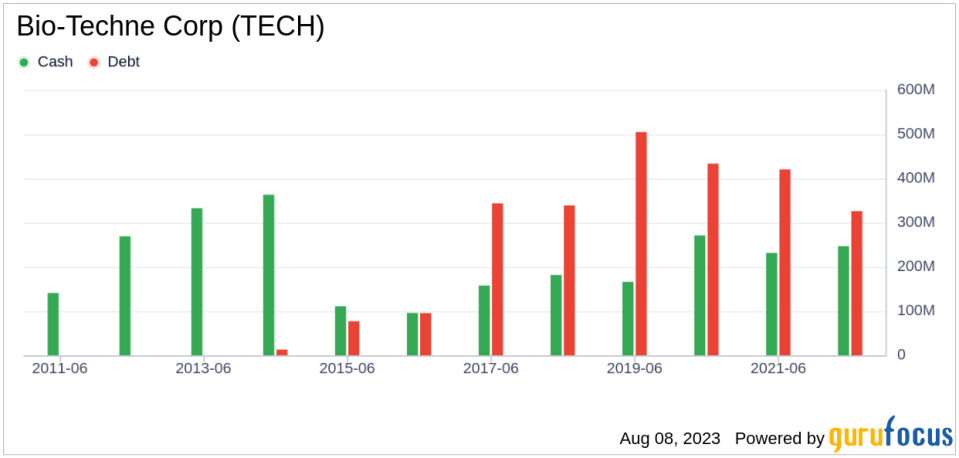

Investing in companies with strong financial strength is a safer approach as they pose less risk of permanent loss. Evaluating the financial strength of a company can be done by looking at its cash-to-debt ratio and interest coverage. Bio-Techne has a cash-to-debt ratio of 0.33, which is worse than 89.64% of companies in the Biotechnology industry. However, the overall financial strength of Bio-Techne is 8 out of 10, indicating strong financial health.

Profitability and Growth of Bio-Techne

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. Bio-Techne has been profitable 10 over the past 10 years. Over the past twelve months, the company had a revenue of $1.10 billion and Earnings Per Share (EPS) of $1.67. Its operating margin is 25.3%, which ranks better than 91.5% of companies in the Biotechnology industry. Overall, GuruFocus ranks the profitability of Bio-Techne at 9 out of 10, indicating strong profitability.

Growth is a crucial factor in the valuation of a company. A faster-growing company creates more value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth of Bio-Techne is 13.6%, which ranks better than 59.82% of companies in the Biotechnology industry. The 3-year average EBITDA growth rate is 22.8%, which ranks better than 70.43% of companies in the Biotechnology industry.

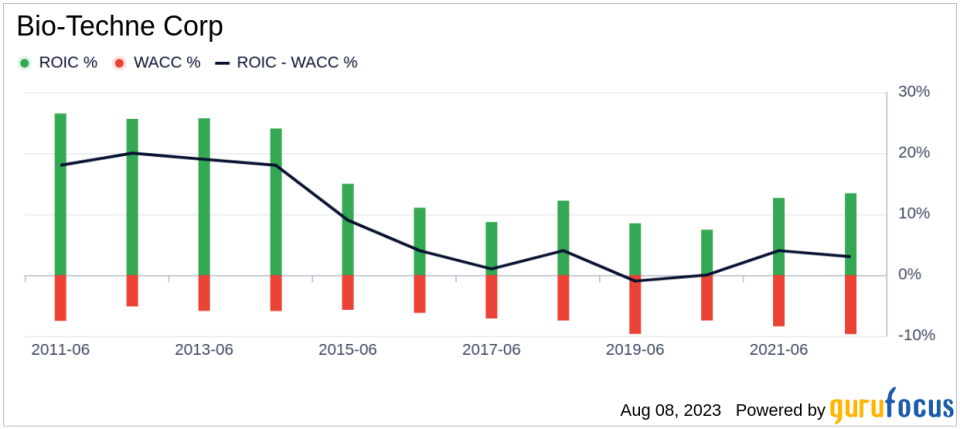

ROIC vs WACC: Evaluating Profitability

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is a good way to evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. During the past 12 months, Bio-Techne's ROIC is 11.36 while its WACC came in at 11.14.

Conclusion

In conclusion, the stock of Bio-Techne Corp (NASDAQ:TECH) is estimated to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. Its growth ranks better than 70.43% of companies in the Biotechnology industry. To learn more about Bio-Techne stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.