Bio-Techne Corp (TECH) Reports Mixed Q2 Fiscal 2024 Results Amid Industry Headwinds

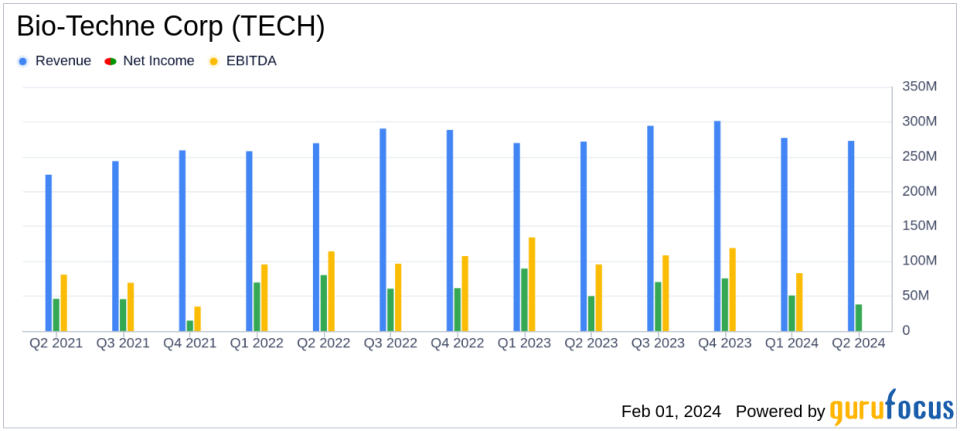

Revenue: Reported flat at $272.6 million with a 2% organic decline.

GAAP EPS: Decreased to $0.17 from $0.31 in the previous year.

Adjusted EPS: Dropped to $0.40 compared to $0.47 year-over-year.

Cash Flow: Operations generated $142.5 million, an 18% increase.

Operating Margin: GAAP operating margin declined to 13.9% from 25.0%.

Segment Performance: Protein Sciences down 3%, Diagnostics and Genomics up 11%.

On February 1, 2024, Bio-Techne Corp (NASDAQ:TECH) released its 8-K filing, detailing the financial outcomes for the second quarter ended December 31, 2023. The Minnesota-based life sciences manufacturer, known for its contributions to the pharma, biotech, academic, and diagnostic markets, faced a challenging quarter with a 2% organic revenue decline, though overall revenue remained flat at $272.6 million. The company's GAAP earnings per share (EPS) also saw a decrease to $0.17 from $0.31 in the prior year, with adjusted EPS falling to $0.40 from $0.47.

Bio-Techne's performance reflects the broader BioPharma industry's macroeconomic conditions, which have intensified in the fiscal second quarter. Despite these challenges, the company reported a 20% growth in instrument consumables and a strong commercial execution in the academic end market with high single-digit growth. Additionally, cash flow from operations saw a healthy 18% increase to $142.5 million.

The company's financial strength and strategic appointments, such as Dr. Matthew F. McManus as President of the Diagnostics and Genomics segment, signal Bio-Techne's commitment to navigating the current environment and positioning for future growth. CEO Kim Kelderman expressed confidence in the company's ability to create value for stakeholders and highlighted the initial signs of stabilization in China, a key market for Bio-Techne.

Financial Performance Analysis

The Protein Sciences segment, which accounts for the majority of the company's revenue, experienced a 3% decrease in net sales, while the Diagnostics and Genomics segment saw an 11% increase. The GAAP operating margin for the quarter was significantly impacted, dropping to 13.9% from 25.0% in the previous year, primarily due to asset impairments, restructuring charges, and the acquisition of Lunaphore.

Non-GAAP measures, which exclude certain items such as stock-based compensation and acquisition-related expenses, provide a different perspective on the company's performance. Adjusted operating margin decreased to 30.1% from 35.5%, and adjusted EBITDA also saw a decline, reflecting the impact of the current economic landscape on Bio-Techne's operations.

"I am pleased with the teams continued execution in this dynamic operating environment, as we navigated a challenging China landscape and conservatism from a subset of biotech customers, which was partially offset by continued strength in our academic end market, said Kim Kelderman, President and Chief Executive Officer of Bio-Techne.

As Bio-Techne continues to adapt to market conditions and leverage its diverse portfolio, investors and stakeholders will be watching closely to see how the company's strategic initiatives unfold in the coming quarters.

For a more detailed analysis of Bio-Techne Corp's financial results and to listen to the earnings conference call, please visit the company's investor relations website.

For further information and inquiries, contact David.Clair@bio-techne.com or call 612-656-4416.

Explore the complete 8-K earnings release (here) from Bio-Techne Corp for further details.

This article first appeared on GuruFocus.