BIOAF: Second Quarter Update

OTC:BIOAF

READ THE FULL BIOAF RESEARCH REPORT

Second Quarter Fiscal Year 2022 Operational & Financial Results

Bioasis Technologies Inc. (OTC:BIOAF) filed second quarter fiscal year 2022 operational and financial reports with SEDAR on October 28, 2021 for the three-month period ending August 31, 2021.

During the reporting period and to-date, Bioasis:

➢ Published research validating the xB3 platform in the CNS - June 2021

➢ Entered into a funding agreement for CA$10 million and closed the initial CA$3 million - June 2021

➢ Entered into a research collaboration with Oxyrane UK Ltd. - June 2021

➢ Appointed Dave Jenkins as CFO - July 2021

➢ Announced results from rodent multiple sclerosis model - July 2021

➢ Entry into multiple Material Transfer Agreements with global pharma companies – July 2021

➢ Announced stock option grants - July 2021

➢ Appointed Jeffrey Sprouse as Preclinical Program Manager - July 2021

➢ Japanese patent application allowed - August 2021

➢ Appointment of Shadow Lake Group as business development advisor - August 2021

In the financial realm, Bioasis reported second quarter total operating expenses of CA$1.2 million1 for the quarter resulting in net loss of ($580,000) or ($0.01) per share.

For the three months ending August 31, 2021 and versus the three months ending August 31, 2020:

➢General and administrative expenses totaled $782,000, down 13% from $904,000 on decreases in salaries and consulting, legal, other professional and regulatory, and office, insurance and amortization expenses, partially offset by increases in share-based compensation and investor relations, marketing and travel;

➢Research and development expenses totaled $404,000, increasing 252% from $115,000 on increases in preclinical expenses, share-based compensation, salaries, consulting fees and benefits, and office, rent and amortization, partially offset by a decrease in patent maintenance, legal and filing fees;

➢Total other income was $605,000 vs a loss of ($1.1) million. Contributing factors were the forgiveness of the Paycheck Protection Program loan and the change in derivative value offset by interest expense, settlement of contract dispute and foreign exchange loss;

➢Net loss was ($580,000), or ($0.01) per share, compared to $1.9 million or $0.03 per share.

As of August 31, 2021, cash and equivalents on the balance sheet totaled $3.5 million. Cash burn for the quarter was approximately ($1.2) million. Cash flows from financing were a net $2.8 million from convertible debenture proceeds partially offset by debt issuance costs.

Research Collaboration With Oxyrane

On June 30, 2021, Bioasis announced a research collaboration with Oxyrane UK Ltd. Oxyrane is a UK-based developer of enhanced enzyme replacement therapies (ERT) for the treatment of lysosomal storage diseases, with a focus on the diseases of the central nervous system. The company is targeting Gaucher Disease, Parkinson’s Disease and Pompe Disease with plans to use the xB3 platform to deliver an undisclosed enhanced ERT into the brain.

Allowance of Japanese Patent Application

On August 9th, Bioasis announced that its patent application relating to an xB3-Iduronate-2-sulfatase (IDS) fusion protein had been allowed in Japan. The patent (2019-189551) was issued Notice of Allowance by the Japanese Patent Office, and the claims of this patent cover xB3-IDS fusion protein and treatment of lysosomal storage disease, namely at risk of developing central nervous system involvement including Hunter Syndrome (MPS II). The patent follows the June 18, 2020 Australian patent application (2015219339) granted by the Australian patent office, also relating to IDS.

Appointments

Dave Jenkins Appointed CFO

Announced in a July 1, 2021 press release, Dave Jenkins was appointed as Bioasis’ Chief Financial Officer. Jenkins brings more than 35 years of accounting and finance experience including 31 years at PricewaterhouseCoopers. At PwC, Jenkins supported multinational public clients as an audit partner. He also served private equity portfolio companies and venture backed growth companies. Sectors included bioscience, software and healthcare. Jenkins’ expertise includes raising capital, acquisitions and international expansion. He holds a bachelor’s in business administration and accounting from Muhlenberg College.

Jeffrey Sprouse, Ph.D. Appointed Preclinical Program Manager

On July 20, 2021, Bioasis announced the appointment of Jeffrey Sprouse, Ph.D. as its Preclinical Program Manager. Sprouse brings over 20 years of drug discovery experience. He is a trained neuropharmacologist who has held leadership positions in top tier pharma and served as project lead for drug discovery programs at Pfizer, where he and his team were responsible for proof of concept for a number of clinical candidates, and as committee chair for early project development at Lundbeck where his group focused on the generation of new pipeline assets. Sprouse has operated as a consultant, evaluating biological targets in the CNS space for potential investment, refining product profile messaging for key decision makers, supporting NCEs by developing mechanistic stories, and determining fit for clinical indications. Sprouse earned his doctorate at Cornell University Medical College with postdoctoral training in the Department of Psychiatry at Yale. He has authored/co-invented over 60 scientific papers, book chapters and patents.

Shadow Lake Group

On August 18th, Bioasis announced that it had appointed Shadow Lake Group Inc and its affiliate SLG Europe BV as its business development advisor. The team at SLG has previous knowledge of Bioasis’ xB3 platform and will be able to leverage this knowledge as well as their transaction experience in neuroscience and oncology to establish strategic partnerships for Bioasis. The xB3 technology platform has broad applicability and strategic partnerships will support commercialization efforts.

In the Financial Sphere

On July 20, 2021, Bioasis announced that it had granted stock options corresponding to a total of 1,367,606 common shares at $0.38 per share. Options were granted to directors and officers of Bioasis and an investor relations consultant. The options are granted as compensation in lieu of cash as Bioasis prioritizes partnership-enhancing R&D.

On June 22, 2021, the company entered into a convertible security funding agreement with Lind Global Macro Fund where the fund will issue up to $10 million in convertible securities. The initial investment of $3 million was closed on June 29, which included a closing fee of $90,000 and the issuance of 4.8 million 30-month warrants exercisable at $0.41 per share. 180 days after closing, Bioasis will begin repaying the note in $125,000 installments. Prepaid interest will accrue at $20,000 per month, and every 90 days, Lind retains the option to convert accrued interest into common shares at 90% of the market closing price on the day prior to the conversion. Converted shares will be locked up for four months + 1 day and short selling by Lind is prohibited. Principal value may also be converted to shares at a value of $0.31 per share.

Publications

Positive Results from Efficacy Study of xB3-IL-1RA in Multiple Sclerosis Model

Previous work by Thom et al.2 demonstrated that xB3 could deliver an interleukin-1 receptor antagonist to the brain, eliciting analgesia in a neuropathic pain animal model where systemic administration alone did not. IL-1 cytokines have been implicated in many autoimmune and neuroinflammatory diseases, creating an opportunity to attempt delivery of IL-1RA into the brain using the xB3 platform. A rodent allergic encephalomyelitis model of multiple sclerosis was administered with multiple doses of xB3-IL-1RA. Results, announced July 7, 2021, showed both delayed onset and reduced clinical symptom score in the treated animals versus control (p < 0.016). The data further evidenced the utility of xB3 to deliver large payloads across the blood-brain barrier and supports the potential application of Bioasis’ technology to treatment of neuroinflammatory diseases such as multiple sclerosis.

Bioasis’ long term goal is to advance into areas where activation of the inflammasome is critical to neuroinflammation. Neurodegeneration, lysosomal function and activation of the inflammasome are all linked and addressing the dysfunction at the level of the lysosome by using a replacement approach may yield further benefits. The research has implications for Parkinson’s Disease, Lewy Body dementia and frontotemporal dementia.

xB3 in the CNS

Over the previous several months, Bioasis has published both proof of concept of xB3 delivery of siRNA across the blood-brain barrier and the ability for the xB3 peptide chain to enter organelles within neurons, glia and microglia in the brain.

Announced on March 29, 2021, Frontiers in Molecular Biosciences published an article validating the ability of Bioasis’ xB3 platform to deliver an siRNA payload across the blood-brain barrier to the CNS in therapeutically relevant doses. Dr. Wilfred A. Jefferies joined Bioasis scientists to evaluate xB3 in siRNA applications to ischemic stroke. The results showed that the platform can translocate a siRNA payload across the blood-brain barrier and the siRNA can execute knockdown therapy, as evidenced by reduced stroke damage in the brain and improved neurological function. The paper was titled “A Nanomule Peptide Carrier Delivers siRNA Across the Intact Blood-Brain Barrier to Attenuate Ischemic Stroke” and can be found in its entirety at the address in the hyperlink.

Months later, Bioasis announced a publication in Frontiers in Neuroscience, “Discovery of a Highly Conserved Peptide in the Iron Transporter Melanotransferrin that Traverses an Intact Blood Brain Barrier and Localized in Neural Cells,” on June 3, 2021. Again, Dr. Wilfred Jefferies worked with Bioasis scientists, this time demonstrating that xB3 could not only cross the blood-brain barrier but also enter organelles, including endosomes and lysosomes, within many cell types in the CNS including neurons, glia and microglia in the brain.

Upcoming Milestones

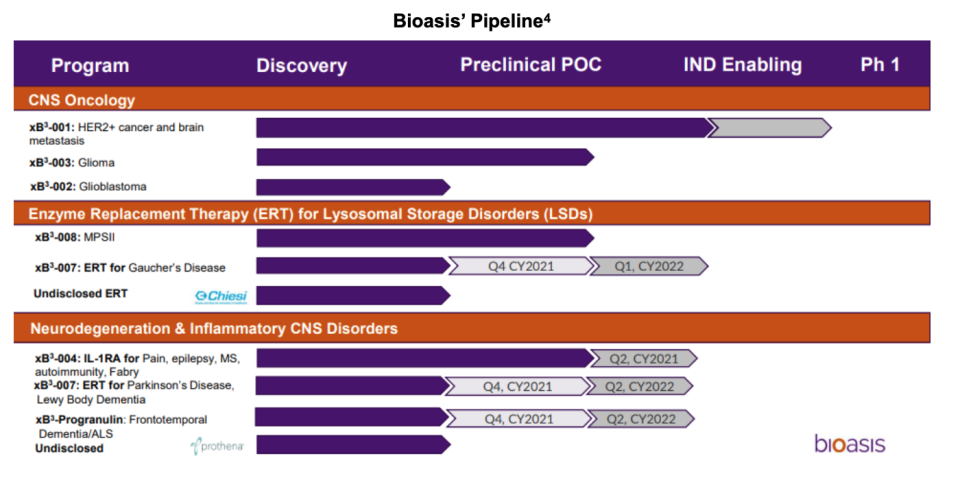

Below we have provided the anticipated timeline for events related to portfolio candidates (calendar quarters):

➢ xB3-007 glucocerebrosidase enzyme replacement therapy (ERT), BBB data – 1Q:22

➢ xB3-Progranulin (xB3-009) BBB data – 2022

➢ IND preparation for xB3-007 – 2022

➢ IND preparation for xB3-003 – 2022

➢ Additional research agreements with partners related to signed MTA - 2022

Summary

Bioasis offers a broad portfolio built on its xB3 technology platform that can be developed both internally and with partners for many therapies demonstrating brain activity. Bioasis has continued its efforts to expand its stable of partners, adding thoroughbreds Aposense and Oxyrane to its string. Continued publications continue to show evidence of xB3’s ability to ferry multiple compounds across the BBB and localize in neural cells, expanding potential indications for the neurodegeneration and inflammatory CNS program. While transportation, COVID and material availability related issues have delayed work, we anticipate only a minor slowdown to the company’s timeline. We anticipate parallel development of several xB3 compounds that will enter the clinic over the next several years. Two MTA’s that were signed earlier in 2021 may yield additional agreements (likely with associated upfront payments) to add to Bioasis’ pipeline. Our valuation work assumes candidates will achieve median drug revenue for each of the programs underway and applies a discount related to the anticipated 8% weighted probability of success. Please refer to our initiation here for detail on the company and a thorough discussion of our thesis.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

1. Subsequent financial results and comparison in Canadian Dollars (CA$)

2. Thom G, Tian MM, Hatcher JP, et al. A peptide derived from melanotransferrin delivers a protein-based interleukin 1 receptor antagonist across the BBB and ameliorates neuropathic pain in a preclinical model. J Cereb Blood Flow Metab. 2019;39(10):2074-2088. doi:10.1177/0271678X18772998

3. Source: Bioasis March 2021 Corporate Presentation

4. Source: September 2021 Corporate Slide Deck