Biogen's (BIIB) Stock Outperforms Industry YTD: Here's Why

Biogen BIIB holds a strong position in the MS market with a wide range of products, including Avonex, Tysabri, Tecfidera and Plegridy. Biogen is also gradually diversifying its pipeline across neuroscience and the adjacent therapeutic areas.

Biogen’s spinal muscular atrophy (SMA) treatment, Spinraza (nusinersen), has consolidated its position in the neurological disease market, with the drug being the first treatment to be approved in the United States for SMA. Biogen also has an industry-leading portfolio in Alzheimer’s disease, addressing both amyloid and tau pathologies.

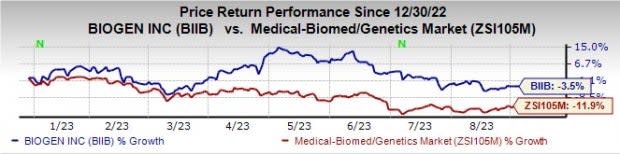

Its stock has outperformed the industry so far this year. The stock has lost 3.5% year to date compared with a decline of 11.9% for the industry.

Image Source: Zacks Investment Research

The main reason for the stock’s outperformance was the FDA’s traditional approval of Leqembi, Biogen and Eisai’s anti-amyloid beta protofibril antibody drug, for the treatment of Alzheimer’s disease. It was a huge milestone for Biogen as Leqembi was the first Alzheimer’s drug to get traditional approval from the FDA. The FDA had granted accelerated approval to Leqembi in January. However, the drug was not expected to contribute much to revenues until the Centers for Medicare & Medicaid Services (CMS) granted reimbursement for it under Medicare plans.

Once Leqembi received traditional approval, the CMS also announced broader Medicare coverage for the drug for early Alzheimer’s disease in the United States in July. A broad range of patients can now get access to Leqembi following the CMS decision. Leqembi has the potential to generate blockbuster sales. Regulatory applications seeking approval of Leqembi are under review in Japan, China, Europe and some other regions. Regulatory filings seeking approval for a subcutaneous formulation and a maintenance dosing version of Leqembi are expected in 2024

After Biogen’s focus shifted to Leqembi, it announced a new restructuring program, which is expected to result in a headcount reduction of approximately 1,000 employees. The program is expected to generate approximately $1 billion in gross cost savings. Out of these savings, around $300 million is expected to be re-invested in new products and R&D activities, which should further save costs of $700 million by 2025.

While most of Biogen’s key drugs are facing declining sales due to intense competitive pressure, Biogen’s new products, such as Leqembi, Qalsody (tofersen) and zuranolone, could help revive growth. Qalsody was approved to treat amyotrophic lateral sclerosis with SOD1 mutations in the United States in April 2023

Zuranolone was added to Biogen’s portfolio with the November 2020 collaboration with Sage Therapeutics SAGE. The FDA approved Biogen and Sage Therapeutics’ zuranolone, to be marketed as Zurzuvae, for women with postpartum depression (PPD) in August. However, the FDA issued a complete response letter for the new drug application seeking approval of zuranolone for the major depressive disorder indication, asking for an additional study to be conducted. ZURZUVAE is expected to be launched and commercially available for the PPD indication in the fourth quarter of 2022.

Zacks Rank & Stocks to Consider

Biogen currently has a Zacks Rank #3 (Hold).

Biogen Inc. Price and Consensus

Biogen Inc. price-consensus-chart | Biogen Inc. Quote

Some better-ranked biotech companies are Exelixis EXEL and Dynavax Technologies Corporation DVAX, both with a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Exelixis’ 2023 earnings per share have risen from 89 cents to 98 cents per share. During the same period, earnings per share estimates for 2024 have risen from $1.31 to $1.36. Year to date, shares of Exelixis have risen 41.8%.

Earnings of Exelixis beat estimates in three of the last four quarters, witnessing an earnings surprise of 18.62%, on average.

In the past 60 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 56 cents to 24 cents, while those for 2024 have improved from a loss of 24 cents to earnings of 2 cents. Shares of Dynavax Technologies have risen 36.7% YTD.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters and missed the mark on two occasions. On average, the company witnessed an earnings surprise of 25.78% over the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report