BioMarin (BMRN) Posts Q4 Earnings Beat, Upbeat Voxzogo Sales

BioMarin Pharmaceutical BMRN reported fourth-quarter 2023 adjusted earnings per share of 49 cents, beating the Zacks Consensus Estimate of 44 cents. The reported earnings rose 48% year over year, driven by an increase in revenues that also offset the impact of rising R&D expenses.

Total revenues were $646.2 million in the reported quarter, up 20% year over year. The global uptake of Voxzogo and higher Vimizim revenues drove the upside. The top line beat the Zacks Consensus Estimate of $636.7 million.

Quarter in Detail

Product revenues (including Aldurazyme) totaled $633.1 million, up 20% year over year. The same from BioMarin's marketed brands (excluding Aldurazyme) increased 21% year over year to $590.4 million on higher revenues from Voxzogo. This offset lower sales from Kuvan. Royalty and other revenues totaled $13.1 million, up 8% year over year.

Voxzogo, approved for achondroplasia, generated sales of $145.7 million, up 118% year over year and 18% quarter over quarter. Higher sales of Voxzogo were fuelled by the U.S. label expansion to younger age groups (under five years). This label expansion was received last year in October.

Voxzogo sales beat the Zacks Consensus Estimate and our model estimates of $129 million and $127 million, respectively.

Shares of BioMarin rose 2.3% in pre-market trading on Feb 23, likely due to the better-than-expected Voxzogo sales.

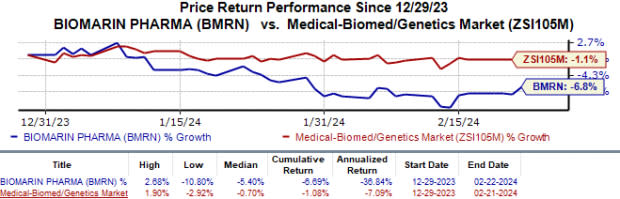

Year to date, the stock has lost 6.7% compared with the industry’s 1.1% fall.

Image Source: Zacks Investment Research

Vimizim sales rose 15% year over year to $175.6 million. The drug’s sales beat both the Zacks Consensus Estimate and our model estimates of $169 million and $172 million, respectively.

Palynziq injection sales grossed $87.8 million in the quarter, up 21% year over year. The drug’s sales beat the Zacks Consensus Estimate of $83 million and our model estimates of $85 million.

Naglazyme sales fell 2% year over year to $98.3 million,while Brineura generated sales of $43.6 million, up 2% over the year-ago quarter.

The recently approved Roctavian generated $2.7 million in sales during the fourth quarter compared with $0.7 million in the previous quarter. Roctavian is the first and only one-shot gene therapy approved for treating adults with severe hemophilia A in the United States and Europe.

In the phenylketonuria franchise, Kuvan revenues declined 32% to $36.7 million due to generic competition. The drug lost U.S. market exclusivity in late 2020.

Product revenues from Aldurazyme totaled $42.7 million, up 14% from that recorded in the prior-year quarter. The upside was likely due to the favorable timing of order fulfillment to Sanofi SNY.

BioMarin signed a collaboration agreement with Sanofi’s subsidiary, Genzyme, for Aldurazyme. Sanofi, through Genzyme, is BMRN’s sole customer for Aldurazyme. The Sanofi subsidiary is responsible for marketing and selling Aldurazyme to third parties.

Full-Year Results

BioMarin reported total revenues of $2.42 billion, up 15% year over year.

The company’s reported earnings for 2023 were $2.08 per share, up 36% from the year-ago period’s levels.

2024 Guidance

In 2024, BioMarin expects to record total revenues in the range of $2.7-$2.8 billion, implying an increase of around 14% year over year at the midpoint. The Zacks Consensus Estimate for full-year 2024 revenues stands at around $2.79 billion.

While management expects Voxzogo to be an important contributor to total revenues, it expects a modest contribution from Roctavian sales.

Non-GAAP operating margin is expected to be between 23% and 24%.

BioMarin expects adjusted earnings per share to be in the range of $2.60-$2.80, suggesting 30% growth over last year’s levels at the mid-point

Recent Updates

In fourth-quarter 2023, BioMarin started a pivotal registrational program on Voxzogo for a new potential second indication — hypochondroplasia, a condition characterized by impaired bone growth. Management is also preparing to initiate two additional clinical programs later this year evaluating Voxzogo in idiopathic short stature and genetic short stature conditions, respectively.

The company also announced that it has started a strategic portfolio review of all R&D programs to determine which pipeline programs should be selected and advanced for further development. A complete update on this review is expected at the company’s Investor’s Day event, which is scheduled to be held later this year.

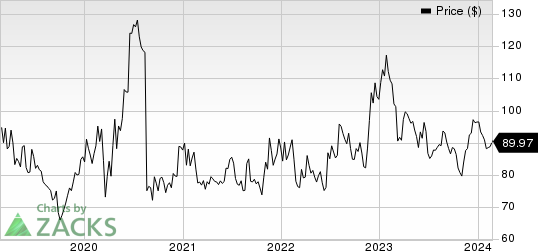

BioMarin Pharmaceutical Inc. Price

BioMarin Pharmaceutical Inc. price | BioMarin Pharmaceutical Inc. Quote

Zacks Rank & Key Picks

Currently, BioMarin has a Zacks Rank #3 (Hold). Some other top-ranked stocks in the overall healthcare sector include Adicet Bio ACET and Puma Biotechnology PBYI. While Puma Biotechnology sports a Zacks Rank #1 (Strong Buy) at present, Adicet carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Puma Biotechnology’s 2023 earnings per share have risen from 72 cents to 73 cents. Meanwhile, during the same period, earnings per share estimates for 2024 have improved from 64 cents to 71 cents. Year to date, shares of PBYI have rallied 36.5%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on one occasion. Puma delivered a four-quarter average earnings surprise of 76.55%.

In the past 60 days, estimates for Adicet Bio’s 2024 loss per share have improved from $2.11 to $1.81. Year to date, shares of ACET have surged 29.1%.

Earnings of Adicet Bio beat estimates in two of the trailing four quarters while missing the mark on the other two occasions. On average, Adicet came up with a four-quarter negative earnings surprise of 8.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report