BioMarin (BMRN) Q2 Earnings Top, Sales Show Coronavirus Impact

BioMarin Pharmaceutical Inc.’s BMRN adjusted earnings of 32 cents per share beat the Zacks Consensus Estimate of 16 cents. Earnings were significantly better than the year-ago earnings of 10 cents per share due to higher revenues and lower R&D expense.

Total revenues were $429.5 million in the reported quarter, up 11.5% from the year-ago period, driven by higher product revenues. Sales beat the Zacks Consensus Estimate of $418 million.

As expected, in the quarter, the company experienced significant impact due to disruptions of day-to-day operations of clinics and hospitals due to COVID-19. The pandemic caused demand interruptions such as missed patient infusions and disruption in new patient starts for some of its products.

BioMarin’s shares have risen 41.7% this year so far compared with the industry’s increase of 6.6%.

Quarterly Details

Product revenues (including Aldurazyme) were $419.0 million in the quarter, reflecting a 10.5% increase year over year. Product revenues from BioMarin's marketed brands (excluding Aldurazyme) grew 4% year over year to $386.8 million. Royalty and other revenues were $10.5 million in the quarter, higher than $8.7 million a year ago.

Kuvan revenues rose 8% to $122.6 million driven by U.S. price increase.

Palynziq injection sales grossed $40.7 million in the quarter compared with $34.6 million in the previous quarter, driven by new patients initiating therapy as well as the growing number of U.S. patients who have now achieved maintenance dosing. The majority of Palynziq sales came from the United States from patients who started Palynziq therapy before COVID-19 environment set in. However, COVID-19 had a material impact on new patient starts for Palynziq, especially in the months of March and April, with some improvement in May and June. In Europe, patient starts in Germany were slow due to COVID-19.

Naglazyme sales declined 18% to $81.0 million. Vimizim contributed $116.7 million to total revenues, down 5% year over year. Sales of both Naglazyme and Vimizim were hurt by unfavorable timing of orders. Naglazyme and Vimzim revenues vary on a quarterly basis, primarily due to the timing of central government orders from some countries, mainly Brazil. Meanwhile, missed patient infusions due to COVID-19 also hurt sales of the drugs in the second quarter.

Brineura generated sales of $25.8 million in the quarter, compared with $24.0 million in the previous quarter

Product revenues from Aldurazyme totaled $32.3 million, up 457% year over year due to higher sales volume to Sanofi’s SNY subsidiary Genzyme. Genzyme is BioMarin's sole customer for Aldurazyme and is responsible for marketing and selling Aldurazyme to third parties.

R&D expenses declined 17.3% year over year to $135.2 million due to lower costs for development of Roctavian. Marketing expenses associated with Palynziq commercial efforts and launch preparations for Roctavian resulted in a 9% increase in SG&A expenses to $146.1 million.

2020 Guidance

BioMarin maintained its financial guidance for the year on the assumption that the demand patterns will return to normal levels in late 2020.

Total revenues are expected in the range of $1.85-$1.95 billion.

Vimizim sales are expected in the range of $530-$570 million. Kuvan sales guidance was maintained in the range of $430-$480 million. Naglazyme sales are predicted in the band of $360-$400 million. Brineura sales are expected within $85-$115 million. Palynziq sales are forecast in the $160-$190 million range.

The guidance for costs was maintained. R&D costs are expected to be within $675-$725 million. SG&A expenses are anticipated in the range of $780-$830 million.

The company still expects adjusted net income in the range of $260-$310 million, the midpoint of which indicates growth of more than 70%.

Pipeline Update

BioMarin’s regulatory applications for Roctavian (valoctocogene roxaparvovec/valrox), a gene therapy for severe hemophilia A, are under review in the United States (PDUFA Date: Aug 21) and Europe with potential approval and launch in the United States in the second half of 2020. Per the company, if the BLA is approved, Roctavian will be the first gene therapy in the United States to be approved to treat any type of hemophilia. Meanwhile, in Europe, the marketing application remains under accelerated assessment. However, as communicated on the first-quarter conference call, the review process in EU has been extended by at least three months due to the COVID-19 related delays. Therefore, an opinion from the CHMP is expected in late 2020/early 2021.

Another important candidate in its pipeline is vosoritide, which has been developed to treat achondroplasia, the most common form of dwarfism. The company filed a regulatory application for vosoritide in the EU in July and expects to file the same in the United States in the third quarter.

Zacks Rank and Other Stocks to Consider

BioMarin currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are Emergent Biosolutions EBS and Horizon Therapeutics Public Limited Company HZNP, both with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

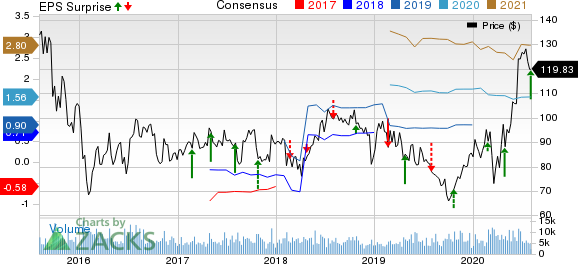

BioMarin Pharmaceutical Inc. Price, Consensus and EPS Surprise

BioMarin Pharmaceutical Inc. price-consensus-eps-surprise-chart | BioMarin Pharmaceutical Inc. Quote

Emergent Biosolutions’ earnings per share estimates have moved up 25.6% for 2020 and 40.6% for 2021 over the past 60 days. Share price of the company has increased 127.3% this year.

Horizon Therapeutics’ earnings per share estimates for 2020 have risen by 13% while those for 2021 have gone up by 12.1%, over the past 60 days. The stock has risen 70.7% this year so far.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research