BioMarin Pharmaceutical Inc. (BMRN) Announces Record Financial Results for 2023

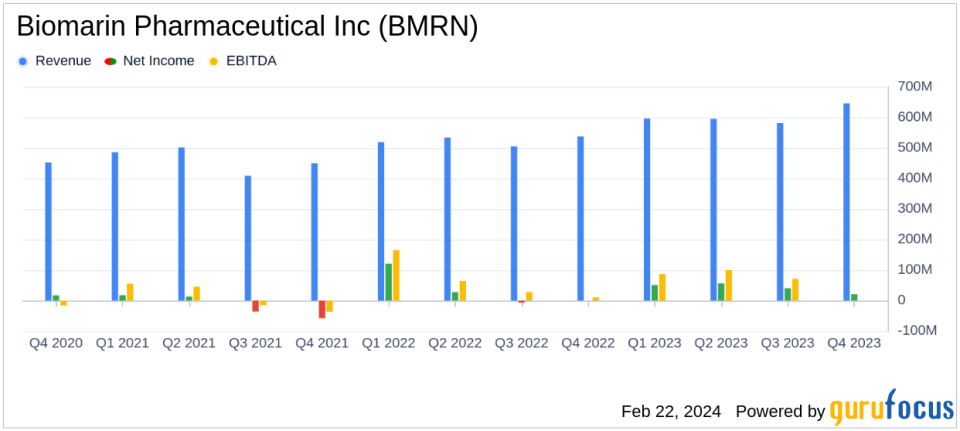

Total Revenues: $2.42 billion in FY'23, marking a 15% increase year-over-year (20% at constant currency).

GAAP Diluted EPS: Grew by 16% year-over-year to $0.87 in FY'23.

Non-GAAP Diluted EPS: Increased by 36% year-over-year to $2.08 in FY'23.

VOXZOGO Net Revenues: Soared to $470 million in FY'23, a 178% increase year-over-year.

2024 Financial Outlook: Anticipates double-digit total revenue growth, significant non-GAAP operating margin expansion, and non-GAAP EPS growing faster than revenues.

On February 22, 2024, BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) released its 8-K filing, detailing a record-setting financial performance for the fourth quarter and full year of 2023. The company, known for its focus on rare-disease therapies, including the recently approved ROCTAVIAN for hemophilia A and VOXZOGO for achondroplasia, has reported significant growth across key financial metrics.

BioMarin's success is largely attributed to the global demand for VOXZOGO, the only approved treatment for children with achondroplasia, which saw a remarkable increase in prescriptions, especially following the FDA's approval for use in children under the age of 5. The company's established enzyme products also contributed to the strong financial results, with VOXZOGO revenues growing 118% over the prior quarter.

Financial Performance and Strategic Priorities

BioMarin's total revenues for the fourth quarter of 2023 were $646.2 million, a 20% increase from the same period in 2022. This growth was driven by higher VOXZOGO sales volume and VIMIZIM product revenues, which were partially offset by lower KUVAN product revenues due to generic competition. GAAP net income saw a significant increase to $20.4 million in the fourth quarter, compared to a marginal loss in the same period of 2022. This improvement reflects higher gross profit and reduced severance costs, despite increased R&D and SG&A expenses.

Non-GAAP income also rose by $31.8 million to $94.9 million in the fourth quarter, thanks to higher gross profit and despite higher R&D and SG&A expenses. Looking ahead, BioMarin's 2024 financial outlook is optimistic, with the company expecting double-digit total revenue growth, a focus on operational excellence, and cost optimization to drive profitability.

Key Financial Metrics and Importance

Key financial achievements such as the growth in VOXZOGO net revenues, which reached $470 million for FY'23, are critical for BioMarin as they underscore the company's ability to successfully launch and scale treatments for rare diseasesa niche but vital segment in the biotechnology industry. The company's non-GAAP diluted EPS of $2.08, a 36% increase year-over-year, is particularly important as it reflects the company's operational efficiency and profitability, excluding non-recurring or non-cash expenses.

These financial metrics are essential for investors as they provide insights into the company's financial health and its potential for sustained growth. BioMarin's focus on strategic priorities, including maximizing VOXZOGO opportunities and establishing ROCTAVIAN, positions the company to capitalize on its unique offerings in the rare disease market.

Analysis and Outlook

With a robust pipeline and strategic focus on high-impact R&D candidates, BioMarin is poised for continued success. The company's emphasis on expanding margins and accelerating EPS growth indicates a commitment to delivering shareholder value. BioMarin's financial guidance for 2024, with projected revenues between $2.7 billion to $2.8 billion and a non-GAAP operating margin percentage of 23% to 24%, reflects confidence in its ability to maintain momentum and achieve sustainable growth.

Investors and potential members of GuruFocus.com should note that BioMarin's strong financial performance, coupled with its strategic initiatives, presents a compelling case for the company's future prospects. The company's focus on rare genetic disorders and its track record of bringing innovative treatments to market make it a noteworthy player in the biotechnology space.

For a deeper dive into BioMarin Pharmaceutical Inc.'s financial details and strategic initiatives, interested parties can access the full earnings release and join the conference call and webcast scheduled for today at 4:30 p.m. ET.

Explore the complete 8-K earnings release (here) from Biomarin Pharmaceutical Inc for further details.

This article first appeared on GuruFocus.