BioMarin Pharmaceutical: Pioneering Innovations Are Driving Future Growth

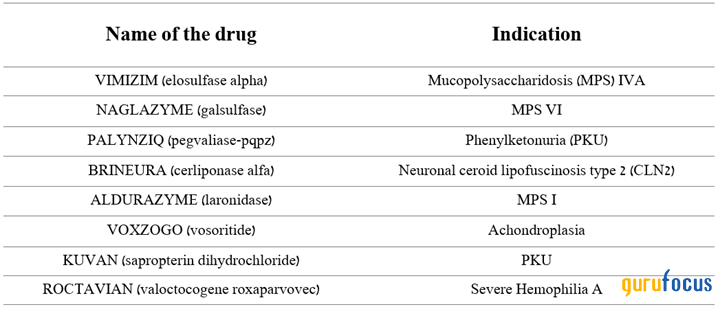

BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) is a fast-growing pharmaceutical company focused on the development and commercialization of next-generation medicines to combat various rare diseases, including hemophilia A, achondroplasia, phenylketonuria, neuronal ceroid lipofuscinosis type 2 and mucopolysaccharidosis type VI.

Investment thesis

Unlike many mid-market-cap companies in the pharmaceutical industry, BioMarin has a rich portfolio of Food and Drug Administration-approved drugs, allowing it to diversify its sources of free cash flow and minimize the risks associated with the loss of exclusivity of some of its products.

Source: Author's elaboration, based on 10-K filing.

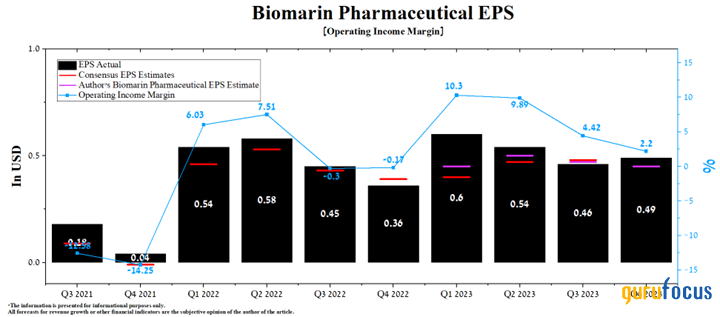

On Feb. 22, BioMarin released financial results for the fourth quarter of 2023 that significantly exceeded analysts' expectations, ultimately causing its share price to skyrocket by more than 8%.

Source: TradingView

The company's management expects its full-year 2024 revenue to be between $2.7 billion and $2.8 billion, representing double-digit growth from the prior year. Moreover, its forecasted non-GAAP diluted earnings per share will be in the range of $2.60 to $2.80, up 23% from 2023.

According to our estimates, the key contributors to BioMarin's high revenue and net income growth rates are Voxzogo, Palynziq, Aldurazyme and Vimizim.

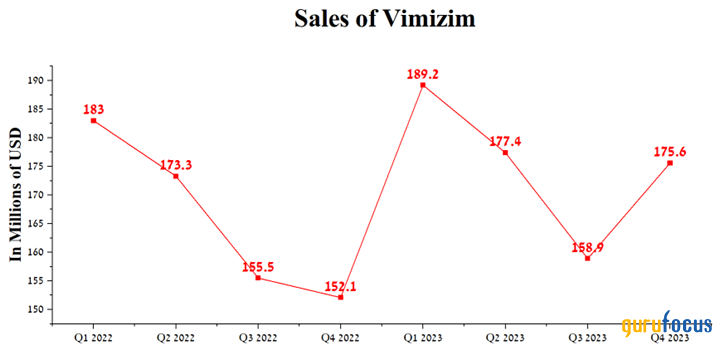

So the company's flagship product is Vimizim (elosulfase alfa), a medicine for treating patients with mucopolysaccharidosis type IVA, which is a rare disease primarily affecting the skeleton. Its sales were $175.6 million for the three months ended Dec. 31, 2023, an increase of 15.50% year over year, driven by a near-lack of competitors, an increase in new patients in the United States, the European Union and growth in government orders in the Middle East.

Source: Author's elaboration, based on quarterly securities reports.

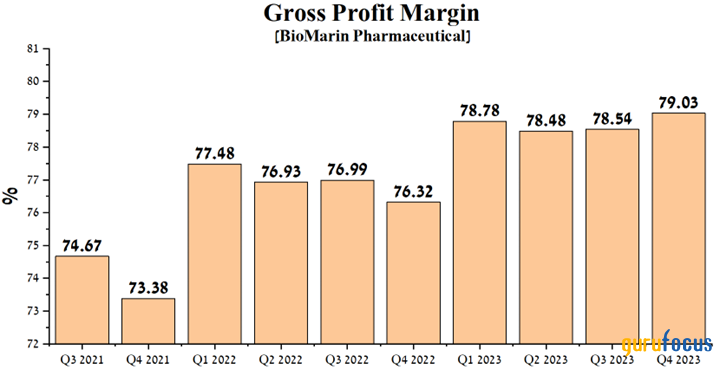

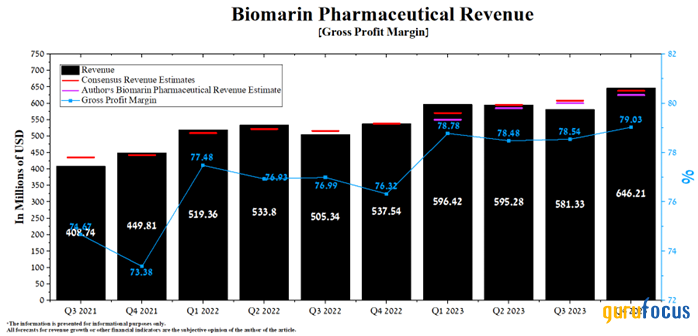

Another investment thesis is BioMarin's growing gross margin on both an annualized and quarterly basis. For the fourth quarter of 2023, it was 79.03%, an increase of 2.71% year over year despite higher manufacturing and general expenses due to the commercial launch of Roctavian, the first FDA-approved gene therapy for the treatment of severe hemophilia A.

Source: Author's elaboration, based on GuruFocus data.

We initiate our coverage of BioMarin Pharmaceutical with an outperform rating for the next 12 months.

The current financial position and outlook

BioMarin's revenue for the fourth quarter was $646.20 million, exceeding our expectations by about $21 million and, more importantly, rising 20.20% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates in seven of the 10 quarters by a significant margin, which is one factor indicating that financial market participants continue to underestimate the prospects for BioMarin's business as one of the leaders in the global rare disease treatment market.

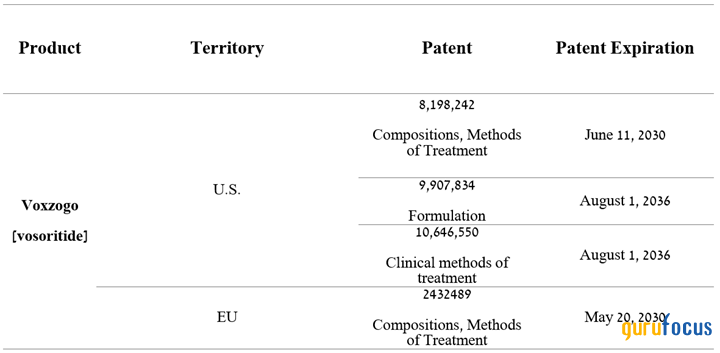

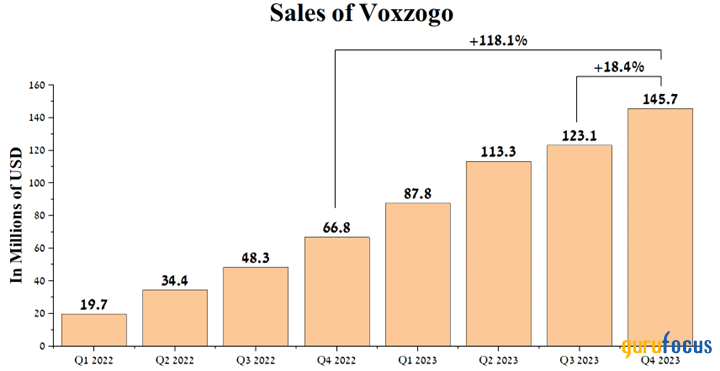

One of the key contributors to the company's revenue growth was Voxzogo (vosoritide), which is a medication used to raise linear growth in children with achondroplasia having open epiphyses. Achondroplasia is a bone growth disorder and is one of the most common causes of dwarfism, affecting approximately one in 15,000 to one in 40,000 people.

According to the 10-K, the drug's key U.S. patents expire in 2036, while in the European Union, it expires in 2030.

Source: Author's elaboration, based on 10-K filing.

Since Voxzogo is an analog of C-type natriuretic peptide, one of its mechanisms of action is based on binding to the NPR-B receptor, thereby inhibiting FGFR3 signaling and its downstream effects. Consequently, this leads to the restoration of normal bone formation, which ultimately accelerates the growth of patients with achondroplasia.

Its sales were $145.70 million for the three months ended Dec. 31, an increase of 118.10% year over year due to the expansion of its geographic use and the fact it remains the first and only FDA-approved drug to increase linear growth in children with achondroplasia.

Source: Author's elaboration, based on quarterly securities reports.

Due to Voxzogo's universal mechanism of action, the company began a Phase 3 clinical trial in the second half of 2023 to evaluate its efficacy in treating patients with hypochondroplasia. People with this genetic disease have extremely short stature, arms and broad hands and feet. According to MedlinePlus, the exact prevalence of hypochondroplasia is unknown at this time, but scientists estimate it occurs in one in 15,000 to 40,000 births.

As a result, we believe Voxzogo has the potential to become a blockbuster as early as 2025, thereby offsetting the decline in Kuvan (sapropterin dihydrochloride) sales due to the appearance of more and more generics on the market.

The American pharmaceutical company is anticipated to release its first-quarter financial results on April 26. BioMarin's revenue for the quarter is expected to range from $618.90 million to $675 million, up 9% from the first quarter of 2023.

Source: Author's elaboration, based on GuruFocus data.

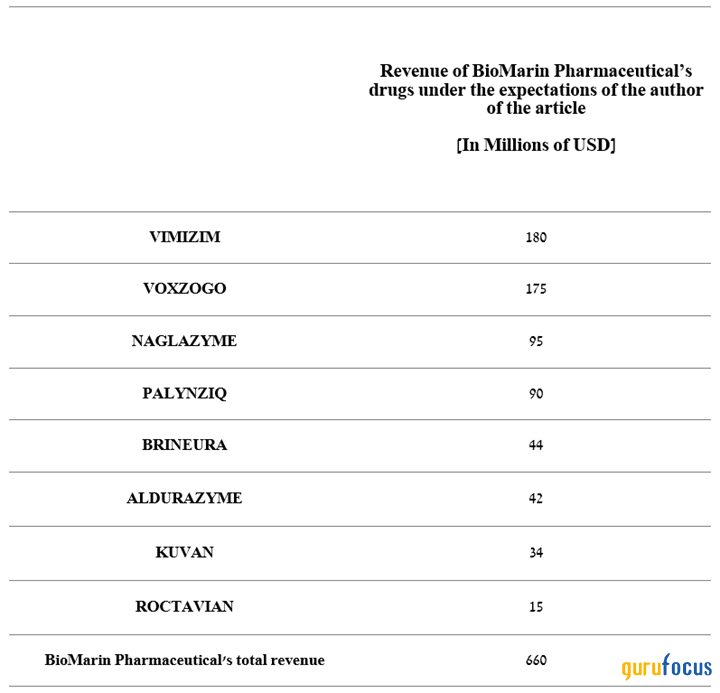

On the other hand, we expect the company's total revenue to reach $660 million in the first three months of 2024, about $10 million above the median of the above range, mainly due to higher demand for Roctavian (valoctocogene roxaparvovec-rvox), gene therapy for the treatment of patients with hemophilia A, as well as Vimizim (elosulfase alfa) approved for the fight against mucopolysaccharidosis type IVA.

Source: created by author.

The company's operating income margin was 2.20% for the fourth quarter of 2023, an increase of 2.37% year over year thanks to a significant increase in demand for Voxzogo. We estimate this financial metric will reach 5.20% in 2024 and increase to 8.10% by 2025, mainly due to increased sales of Palynziq, Aldurazyme and Roctavian, as well as lower costs of raw materials needed to synthesize its products.

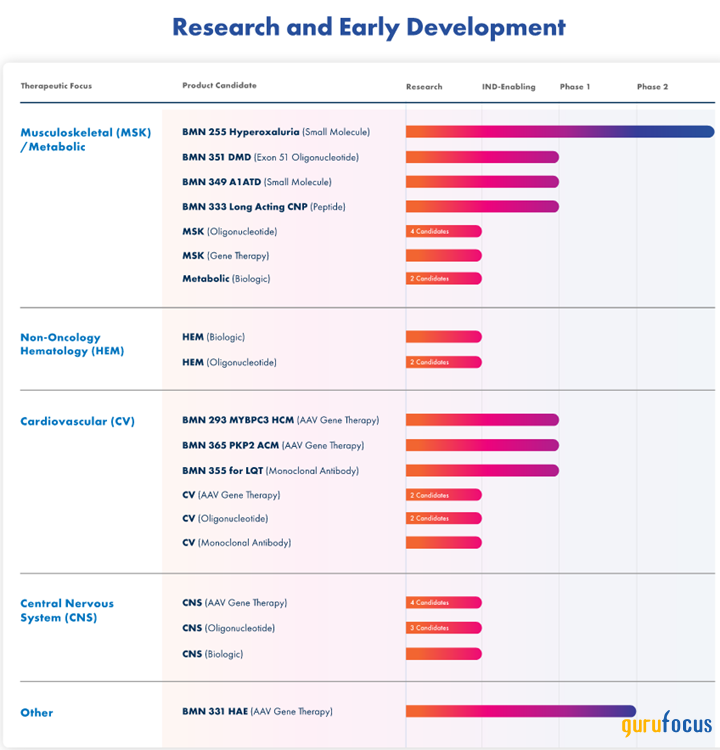

Nevertheless, these factors partially offset our expected continuation of the trend of growth in BioMarin's research and development spending due to the conduct of many clinical trials, the purpose of which, among other things, is to evaluate the efficacy and safety of BMN 255 for the treatment of primary hyperoxaluria type 1, BMN 293, BMN 365 and BMN 355 for combating various cardiovascular diseases.

Source: BioMarin Pharmaceutical presentation.

The company's first-quarter earnings per share are expected to be in the range of 47 cents to 93 cents, which is 17 cents higher than analysts' expectations for the previous quarter. In comparison, we expect earnings per share to be slightly below this range and reach 60 cents due to higher administrative and advertising expenses.

Source: Author's elaboration, based on GuruFocus data.

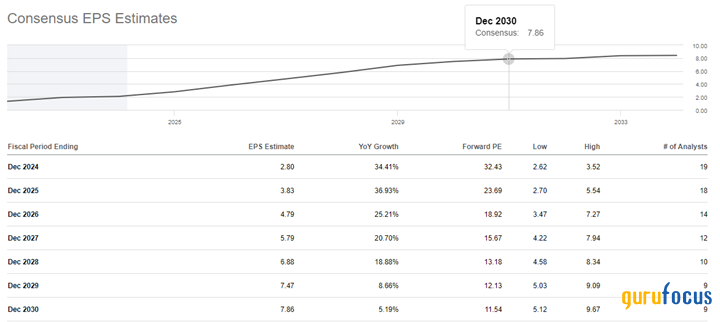

The company's trailing 12-month non-GAAP price-earnings ratio is 41.70, indicating it trades at a significant premium to the health care sector. However, BioMarin is a growth stock with solid revenue growth and continues to be one of the leaders in the global orphan drugs market. As a result, we believe it is justifiable that it continues to trade at high multiples.

More globally, driven by its strong operating income growth rate, its price-earnings ratio is expected to decline to 13.20 by 2028, which we estimate is an attractive value for long-term investors seeking undervalued assets with a rich pipeline of FDA-approved drugs.

Source: Author's elaboration, based on GuruFocus data.

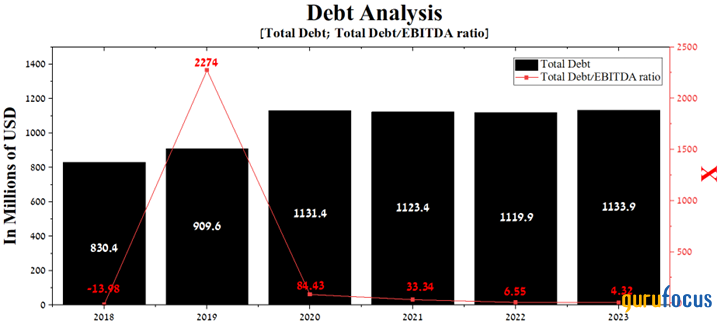

At the end of December, the company's total debt stood at about $1.13 billion, remaining roughly the same level as over the past four years.

Source: Author's elaboration, based on GuruFocus data.

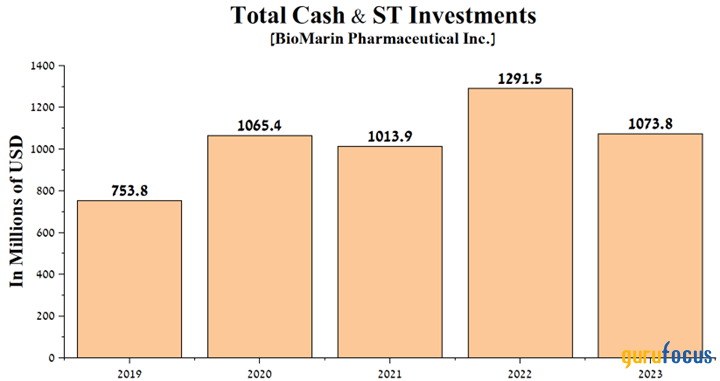

However, given BioMarin's growing Ebitda in recent years, its total debt/Ebitda ratio continues to decline at an extremely high rate, reaching 4.32 in 2023. Additionally, its total cash and short-term investments stood at $1.07 billion.

Source: Author's elaboration, based on GuruFocus data.

As a result, we believe the company does not have significant financial risks associated with either servicing its debt or repaying the convertible notes due in 2024 and 2027.

Conclusion

Key risks that could negatively impact BioMarin's investment attractiveness include a higher rate of decline in Kuvan sales due to the launch of more generic versions, continued uncertainty regarding Roctavian's commercial prospects and increased competition in the phenylketonuria treatment market.

On the other hand, the company continues to be a leader in the global enzyme replacement therapy market, which is reflected in the extremely high growth rates of Voxzogo sales and also allows it to resort to an aggressive R&D policy, with the ultimate goal of accelerating the development of numerous product candidates for the treatment of rare and ultra-rare diseases, for which there are no approved treatments.

In our assessment, these factors, coupled with the company's growing gross margin, its high cash and short-term investments and the potential label expansion of Voxzogo, are among the crucial investment thesis making BioMarin an attractive asset for long-term investors.

This article first appeared on GuruFocus.