BioMarin Pharmaceutical's (NASDAQ:BMRN) investors will be pleased with their 13% return over the last three years

Investors can buy low cost index fund if they want to receive the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. For example, the BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) share price return of 13% over three years lags the market return in the same period. Disappointingly, the share price is down 9.6% in the last year.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for BioMarin Pharmaceutical

While BioMarin Pharmaceutical made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

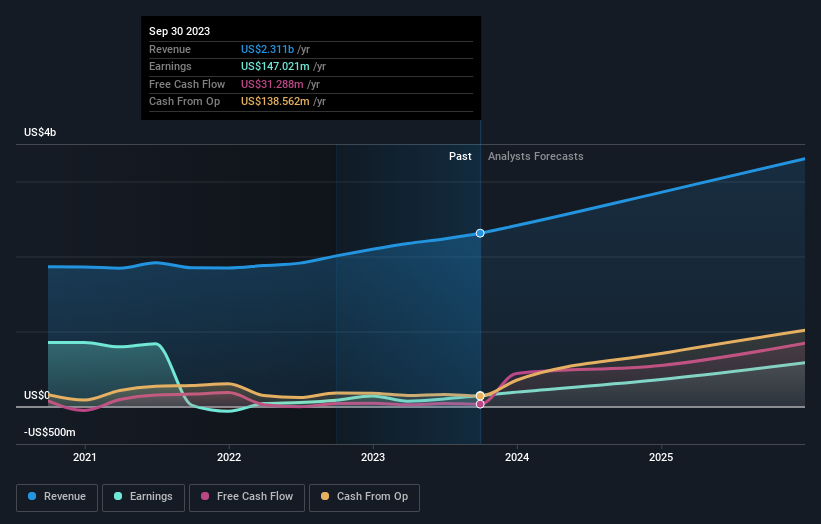

In the last 3 years BioMarin Pharmaceutical saw its revenue grow at 7.5% per year. That's not a very high growth rate considering it doesn't make profits. The market doesn't seem too pleased with the revenue growth rate, given the modest 4% annual share price gain over three years. A closer look at the revenue and profit trends could uncover help us understand if the company will be profitable in the future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

BioMarin Pharmaceutical is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for BioMarin Pharmaceutical in this interactive graph of future profit estimates.

A Different Perspective

BioMarin Pharmaceutical shareholders are down 9.6% for the year, but the market itself is up 14%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research BioMarin Pharmaceutical in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.