Biotech Stock Roundup: ALDX, EVLO Down on Setback, SRRK Offers Updates & More

It was a busy week for the biotech sector before the third-quarter earnings kicked in. While nothing important came from bigwigs, pipeline and regulatory updates from quite a few other biotechs were in focus.

Recap of the Week’s Most Important Stories:

Aldeyra Plummets on Setback: Shares of Aldeyra Therapeutics, Inc. ALDX plummeted after the company received a setback in its new drug application (NDA) for reproxalap for the treatment of the signs and symptoms of dry eye disease. Aldeyrat received minutes from a late-cycle review meeting with the FDA, which identified substantive review issues in connection with the NDA for reproxalap. In the meeting, the regulatory body stated that the NDA lacks data to support reproxalap’s efficacy for the sought indication. The FDA has also requested certain chemistry, manufacturing and controls (CMC) details.

Aldeyra then submitted its responses to the FDA, which it believed was sufficient to mitigate the identified review issues and CMC requests. However, the FDA has not directly given an opinion on the sufficiency of the information submitted and has indicated Aldeyra to conduct an additional clinical study to satisfy efficacy requirements. Aldeyra submitted its NDA for reproxalap for treating the signs and symptoms of dry eye disease in December 2022. In February 2023, the FDA accepted the reproxalap NDA for filing and set a target action date of Nov 23, 2023.

Given the details of the minutes released by Aldeyra, it is unlikely that the FDA will be able to approve the NDA for reproxalap on or about the target action date or even afterward. The regulatory body might issue a Complete Response Letter (CRL) instead and ask Aldeyra to conduct additional CMC studies or clinical studies and submit the results before the application is reconsidered. An additional study equals extra capital outlay and a delay in approval, significantly denting Aldeyra's growth prospects.

Annovis Up on Study Updates: Annovis Bio, Inc. ANVS announced a positive interim independent analysis from its Alzheimer’s Disease (AD) study on buntanetap, an experimental, oral translational inhibitor of neurotoxic aggregating proteins. This phase II/III AD study has been designed to enroll a total of 320 mild to moderate AD patients. These patients are randomly assigned to receive either 7.5, 15, or 30 mg of buntanetap or placebo once per day. Shares were up on the news.

The co-primary endpoints of the study are the change from baseline to the end of treatment of Alzheimer’s Disease Assessment Scale-Cognitive Subscale 11 (ADAS-Cog11) and Alzheimer’s Disease Cooperative Study Clinician’s Global Impression of Change (ADCS-CGIC), which assess cognition and activities of daily living. The interim analysis was based on 107 patients at six weeks from all cohorts collectively. Results conducted by an independent data analytics provider indicated that the AD trial should continue as planned with the same trial size to maintain the statistical power for both co-primary endpoints. Recruitment of additional patients is not required.

Per management, since sample size re-estimation for the study is unnecessary, it signals that treatment effects in patients receiving buntanetap are positive vis-à-vis those receiving placebo after just six weeks of treatment.

Updates From Scholar Rock: Scholar Rock Holding Corporation SRRK gained after the company announced plans to expand into the cardiometabolic disorders space and pricing of its public offering. The company will leverage its experience in myostatin inhibition to advance SRK-439, a novel investigational myostatin inhibitor for treating cardiometabolic disorders, with an initial focus on obesity. An investigational new drug application (IND) submission is targeted in 2025.

Preclinical data support advancing SRK-439 for the treatment of obesity. Studies in diet-induced obese mice showed that SRK-439, in combination with GLP-1 receptor agonist (GLP-1 RA), achieved a dose-dependent reversal of lean mass loss during GLP-1 RA-mediated weight loss and an increase in fat mass loss mediated by GLP-1 RA treatment.

Scholar Rock Holding has also announced plans to initiate a phase II proof-of-concept study with apitegromab in combination with a GLP-1 RA in 2024, subject to IND acceptance. Data from the clinical trial are expected in mid-2025 and will be used to advance further clinical development of SRK-439.

Concurrently, Scholar Rock announced the pricing of an upsized underwritten public offering of 12,408,760 shares of its common stock at a public offering price of $6.85 per share. Gross proceeds from the offering are expected to be approximately $85.0 million before deducting underwriting discounts, commissions and other offering expenses.

Evelo Down on Study Failure: Shares of Evelo Biosciences, Inc. EVLO declined after the company announced that its mid-stage study on the experimental candidate, EDP2939, for treating moderate psoriasis, did not achieve its main goal. The primary endpoint of the study was the difference in the proportion of patients who achieved an outcome of a 50% improvement from baseline in Psoriasis Area and Severity Index (PASI) score (a PASI-50 response) between EDP2939 and placebo after 16 weeks of daily treatment. The study failed to achieve this endpoint, and consequently, Evelo will cease the development of EDP2939.

The company is exploring strategic alternatives and partnering opportunities for its other candidate, EDP1815, and its small intestinal axis platform.

Evelo currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Setback for Amylyx: Amylyx Pharmaceuticals, Inc. AMLX announced that the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency confirmed its initial negative opinion on the Marketing Authorisation Application (MAA) seeking approval of AMX0035 for the treatment of amyotrophic lateral sclerosis (ALS) in the European Union (“EU”). Amylyx received a negative opinion from the CHMP for the same in June and requested a formal re-examination of the MAA in July.

AMX0035 (sodium phenylbutyrate and ursodoxicoltaurine) is approved under the trade name Relyvrio in the United States and Albrioza in Canada. Amylyx now plans to focus on the completion of the phase III PHOENIX study, which was initiated prior to its MAA submission. The study is expected to provide additional data on the efficacy and safety profile of AMX0035. Amylyx plans to seek approval in the EU if the results of the PHOENIX study are positive. Top-line results are expected in mid-2024.

Performance

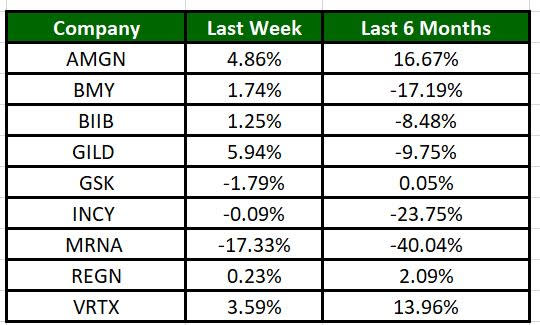

The Nasdaq Biotechnology Index has lost 0.35% in the past five trading sessions. Among the biotech giants, Gilead has gained 5.94% during the period. Over the past six months, shares of Moderna have plunged 40.04%. (See the last biotech stock roundup here: Biotech Stock Roundup: BMY Grabs MRTX, AKRO Down on Study Data, ALNY Faces Setback).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aldeyra Therapeutics, Inc. (ALDX) : Free Stock Analysis Report

Amylyx Pharmaceuticals, Inc. (AMLX) : Free Stock Analysis Report

Evelo Biosciences, Inc. (EVLO) : Free Stock Analysis Report

Scholar Rock Holding Corporation (SRRK) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report