Biotech Stock Roundup: BIIB, Eisai's Drug Update, NVAX Gains on Deal Amendment

It was a busy week for the biotech sector, with many important regulatory and pipeline updates. Among these, key news was Biogen BIIB and Eisai’s drug Leqembi’s receipt of full FDA approval and Novavax’s NVAX stock price rally on deal amendment with Canada’s government.

Recap of the Week’s Most Important Stories:

BIIB’s/ Eisai’s Drug Approval: Biogen and partner Eisai announced that the FDA has approved the supplemental biologics license application (sBLA), supporting the traditional approval of their Alzheimer’s disease (AD) drug Leqembi. The drug was initially granted accelerated approval for a similar indication in January. The traditional approval is based on data from Eisai’s late-stage global Clarity AD clinical study, wherein Leqembi met its primary endpoint and all key secondary endpoints with statistically significant results and confirmed the clinical benefit of Leqembi.

Following the grant of full approval, Leqembi is the first and only approved anti-amyloid antibody treatment shown to reduce the rate of disease progression and slow cognitive impairment in the early and mild dementia stages of AD indication. Since Leqembi has received full/standard approval from the FDA, the Centers for Medicare and Medicaid Services will make the medication available for broader coverage under the United States government’s Medicare plan. However, Biogen’s stock was down despite the approval.

NVAX Surges on Canada Agreement: Shares of Novavax, Inc. NVAX surged after it announced that the company has amended its advanced purchase agreement with Canada’s government. Per the terms of the amendment, Canada renounced certain doses of Novavax’s Covid-19 vaccines that were previously scheduled for delivery and reduced the number of vaccine doses due for delivery. Canada’s government also revised the delivery schedule for the remaining vaccine doses that are yet to be delivered. Another clause was added to the agreement, which required Novavax to make use of the Biologics Manufacturing Centre (BMC) Inc. to produce bulk antigen for vaccine doses, which is scheduled for delivery in 2024 and 2025.

As compensation for the forfeited vaccine doses, NVAX reported that Canada’s government has agreed to pay it a total sum of $349.6 million. This amount is payable in two equal installments in 2023, the total value of which is equal to the remaining balance owed by the customer concerning such forfeited vaccine doses.

The first installment will be made upon execution of the amendment, but the second installment payment has a contingency. It states that the second installment payment will be made only after Novavax delivers the remaining vaccine doses in the second half of 2024. The agreement also grants the government the right to terminate the advanced purchase agreement if NVAX fails to gain regulatory approval for using BMC to produce vaccines on or before Dec 31, 2024.

Caribou Up on Pfizer Investment: Shares of leading CRISPR genome-editing biopharmaceutical company, Caribou Biosciences, Inc., CRBU, surged after it received an equity investment from pharma giant Pfizer. Per the terms, Pfizer has purchased 4,690,431 common shares of Caribou for $5.33 per share, resulting in a $25 million equity investment. The transaction, executed on Jun 30, 2023, is part of a Securities Purchase Agreement between the two companies on Jun 29, 2023. Alongside the investment, Pfizer's Sriram Krishnaswami has joined Caribou's Scientific Advisory Board.

Caribou is focused on advancing its allogeneic CAR-T cell therapy pipeline, and the infusion of funds from Pfizer's will accelerate these efforts. The company will use the funds to advance CB-011, an immune-cloaked allogeneic CAR-T cell therapy currently under evaluation in the phase 1 study, CaMMouflage, for patients with relapsed or refractory multiple myeloma (r/r MM).

This investment enables Caribou to maintain full ownership and control over its pipeline of allogeneic CAR-T and CAR-NK cell therapies, positioning the company to capitalize on future revenue opportunities. Through this partnership, Pfizer aims to contribute to the progress of Caribou's three programs - ANTLER phase I study for CB-010, the clinical program for CB-011 and submission of an investigational new drug application for CB-012.

Caribou currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prothena, Bristol Myers Advance Deal: Prothena PRTA announced that partner Bristol Myers Squibb BMY has exercised its option to obtain exclusive worldwide commercial rights to PRX005. The candidate is Prothena's groundbreaking anti-tau antibody designed for the potential treatment of Alzheimer's disease. In addition to the exclusive U.S. license optioned in June 2021, Bristol Myers Squibb will now be responsible for the development, manufacturing and commercialization of PRX005.

Under the terms of the deal, Bristol Myers Squibb will pay $55 million to Prothena for the worldwide license to PRX005. This payment will further strengthen Prothena's financial position and provide additional resources to advance its robust portfolio of product candidates for AD. The ongoing phase I clinical trial for PRX005 includes a multiple ascending dose (MAD) portion.

Bristol Myers Squibb will assume responsibility for reporting all program updates and future clinical study results. Prothena remains eligible for substantial additional payments, up to $160 million for U.S. rights, up to $110 million for global rights, and up to $1.7 billion for regulatory and commercial milestone payments for a total of up to $2.2 billion, which also includes amounts received to date.

Prothena's AD pipeline also includes PRX012, a next-generation antibody targeting amyloid beta, and PRX123, an amyloid beta/tau dual-targeting vaccine.

Performance

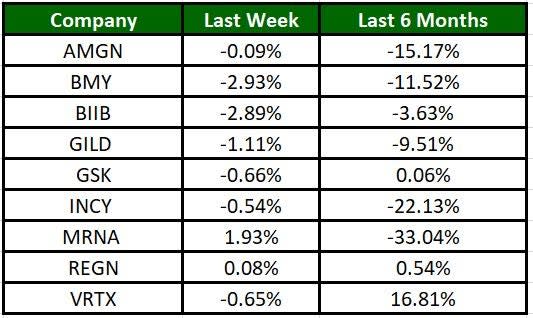

The Nasdaq Biotechnology Index has gained 0.57% in the past five trading sessions. Among the biotech giants, Moderna has gained 1.93% during the period. Over the past six months, shares of MRNA have lost 33.04%. (See the last biotech stock roundup here: Biotech Stock Roundup: BMRN’s Gene Therapy Gets Approval, SGTX Up on Buyout by LLY).

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

Prothena Corporation plc (PRTA) : Free Stock Analysis Report

Caribou Biosciences, Inc. (CRBU) : Free Stock Analysis Report